Cryptocurrency exchange and wallet service CoinJar, today announced the launch of “CoinJar Bundles“, designed to simplify the creation and management of diversified cryptocurrency portfolios, especially for new investors into the sector.

CoinJar Bundles allow CoinJar customers to seamlessly purchase multiple cryptocurrencies in one transaction. CoinJar has curated a collection of bundles, including the largest cryptocurrencies by market cap, bundles that centre around stablecoins, ERC-20 tokens, and more.

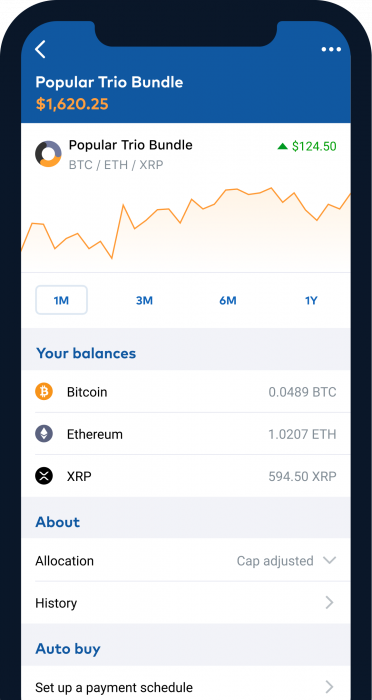

Among them, CoinJar’s ‘Popular Trio Bundle’ provides weighted allocations in BTC, ETH and XRP, while the ‘Universe Bundle’ allows customers to easily invest across the company’s entire digital currency inventory.

Each Bundle will clearly break down asset allocations between ‘proportional’ and ‘cap adjusted’. Funds added to each Bundle may be automatically allocated in fixed proportions or allocated to reflect the ratio of basket content and quantity of cryptocurrencies set according to a Bundle’s settings.

“Diversity is king. But building a healthy, diversified crypto portfolio can be intimidating, not to mention time consuming.” said Asher Tan, CEO of CoinJar.

“We’re a big believer in simplifying access to the cryptocurrency space, which is why we’ve launched CoinJar Bundles – a single-click way to invest in multiple cryptocurrencies at once”, said Asher.

Beyond bundles and after a successful launch in the UK, CoinJar is expanding to a number of European countries, and is quickly becoming the simplest way to buy a diversified cryptocurrency portfolio on iPhone and Android devices.

About CoinJar

Established in 2013, CoinJar is the easiest way to buy, sell, store and spend cryptocurrencies in the UK and Australia. CoinJar’s iOS and Android apps allow users to trade cryptocurrencies on the go, while CoinJar Exchange and CoinJar OTC Trading Desk cater for professional traders, as well as individuals and institutions looking to make larger transactions.