Tokenised real estate is now a reality thanks to NFTs. The global real estate store Propy offers a faster, simpler and more secure process for buying and selling property through smart contracts.

On January 14, Coinbase announced it would list Propy (PRO) on its website’s blog. Coinbase is the largest cryptocurrency exchange in the US and the second-largest cryptocurrency exchange by volume globally.

Propy is a project focused on expanding the functionality of NFTs beyond the digital art world. The Ethereum-based protocol integrates blockchain technology with the real estate sector and offers an automated closing process for international real estate transactions.

The PRO token is used to pay for platform fees to process tasks such as modifying and creating title and deed contracts. Read the whitepaper here.

First Real Estate NFT in the US

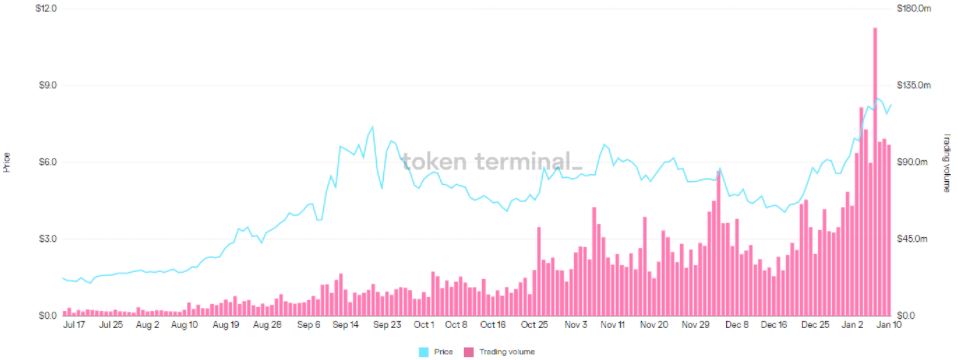

Along with the recent Coinbase listing, Propy has an upcoming sale in Tampa, Florida, which will be the first real estate NFT sale in the US. These two factors appear to have boosted the price of the PRO token:

PRO was worth US$1.12 on January 12 before news of the Coinbase listing. The price moved 227 percent to hit a daily high at US$3.67 on January 14 and has since continued to climb beyond US$4.00. The token has ballooned by an impressive 5192.6 percent in just one year and is still climbing the ranks, currently sitting at #257.

Meanwhile, HeroX announced the tokenisation of the first property in Australia last September. As house prices remain out of reach for many new investors, NFTs seek to disrupt the global real estate market by offering the tokenisation of property around the world.