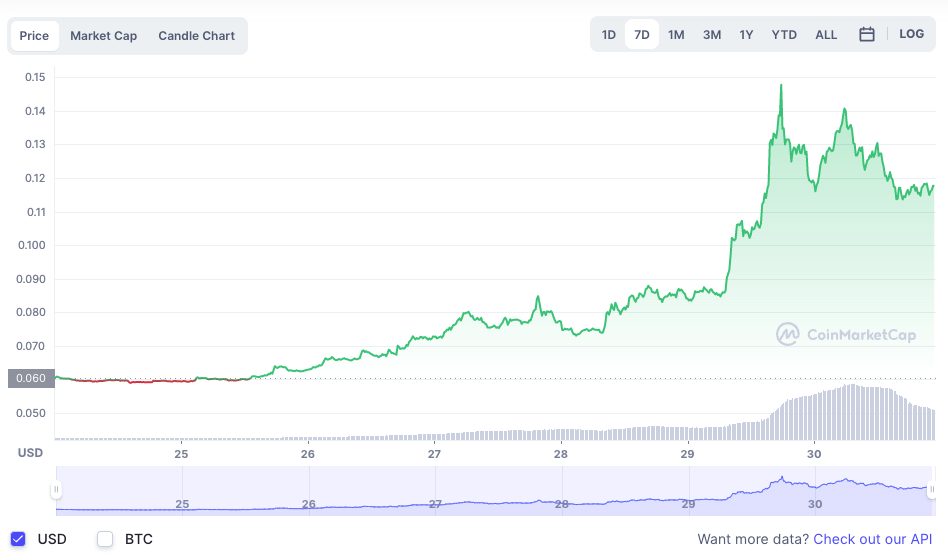

A court ruling in favour of the US Securities and Exchange Commission (SEC) that upholds allegations that LBC tokens were illegally sold as securities has caused the token’s value to plummet by over 36 percent.

US District Judge Paul J. Barbadoro said in his ruling that the evidence shows “LBRY promoted LBC as an investment that would grow in value over time through the company’s development of the LBRY network.”

Following its loss, LBRY tweeted it would not give up, and warned that the ruling had set “an extraordinarily dangerous precedent that makes every cryptocurrency in the US a security, including Ethereum.”

Upon news that LBRY had been found to have violated the law by offering its LBC tokens as unregistered securities, LBC’s value dropped sharply and was trading at just US$0.012636 at the time of writing.

Precedent Applied Could Cripple US Crypto

Founder and CEO of the LBRY network, Jeremy Kauffman vented his frustration on Twitter:

Kauffman also tweeted his belief that the ruling “threatens the entire US cryptocurrency industry.”

The blockchain-based LBRY network is a protocol for building apps that enable creators and users to publish and purchase digital content including videos, music and ebooks.

Judge Barbadoro said he was not persuaded by LBRY’s argument that it hadn’t received fair notice that its offering was subject to securities laws, particularly given the network did not issue an Initial Coin Offering (ICO).

He said the SEC’s case was backed by a Supreme Court precedent that had been applied in hundreds of cases for more than 70 years. “While this may be the first time it has been used against an issuer of digital tokens that did not conduct an ICO, LBRY is in no position to claim that it did not receive fair notice that its conduct was unlawful,” Barbadoro said.

“Because no reasonable trier of fact could reject the SEC’s contention that LBRY offered LBC as a security, and LBRY does not have a triable defense that it lacked notice, the SEC is entitled to judgment.”

US District Judge Paul J. Barbadoro