Bitcoin (BTC) has seen some impressive gains this year, rising by a massive 25 percent in just the first week of January alone. However, nothing quite compares to the massive pump seemingly instigated by Elon Musk this morning when he changed his Twitter profile to the simple hashtag #Bitcoin, sending a strong endorsement of the world’s leading cryptocurrency to his 43.7 million followers.

The effect of the update by the world’s richest man saw Bitcoin rocket from $32,000 to near $38,000 in a matter of minutes. That’s an almost 20 percent price rise in less than an hour, driven by an incredible $20 billion increase in trading volume. While the price corrected soon after to below $36,000, Bitcoin’s trading volume continues to grow, reaching around $88 billion as more traders across the US begin waking up.

“It was inevitable.”

After changing his Twitter status to Bitcoin, Musk tweeting the phrase “In retrospect, it was inevitable.” The tweet is widely understood to signal that Elon has now bought some Bitcoin, although it may also signal his feelings about the recent GameStop (GME) and Robinhood debacle that exposed the true level of fraud on Wall Street.

Musk has been following the GameStop events as they unfolded this week, Tweeting on Tuesday this week “Gamestonk!”, with a link to the r/WallStreetBets Reddit channel that’s been driving these massive stock market short squeezes.

Documenting Bitcoin, a Twitter account dedicated to keeping a record of Bitcoin events, noted that somebody had embedded Musk’s tweet into the Bitcoin blockchain for eternity. According to this tweet, the entry was inserted by Coin Corner tech lead @zakkdev.

Bitcoin longs and shorts liquidated

As a result of Musk’s tweet, nearly $420 million worth of Bitcoin shorts were liquidated in less than an hour, followed by $120 million in longs liquidated soon after as the price rapidly corrected. On Binance alone, $57 million worth of shorts were liquidated in just the first 10 minutes of Musk’s endorsement.

Not only did Musk’s tweet help pump Bitcoin but potentially saved it from an extended bear market due to options expiring. Billions of dollars worth of Bitcoin futures options expired today, an event which could have otherwise pushed Bitcoin below $30,000 and into an even deeper rut.

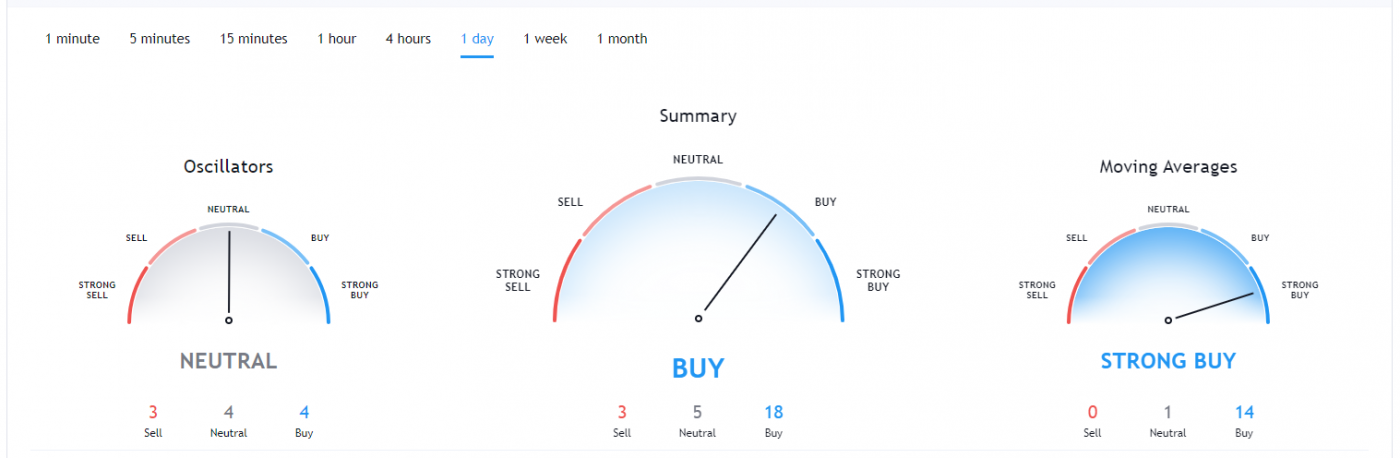

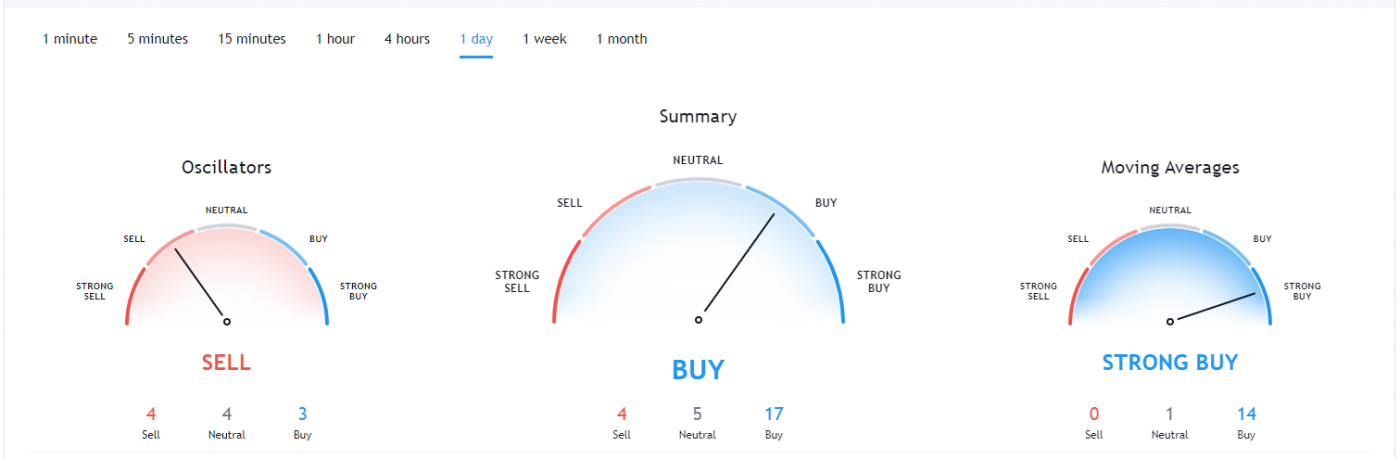

Overbought Territory

While the move is undoubtedly good for the crypto market, it does mean Bitcoin has moved into overbought territory, signaling the potential for a trend reversal to the downside. However, as is common in the cryptocurrency market, the current revolutionary sentiment could continue to drive the price to the moon.