Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. KuCoin Token (KCS)

KCS is the native token of KuCoin, launched in 2017 as a profit-sharing token that allows traders to draw value from the exchange. It was issued as an ERC-20 token running on the Ethereum network and was supported by most Ethereum wallets. The total supply of KCS was set at 200 million, and there is a planned buyback and burn until just 100 million KCS remain. Sooner or later, as the KuCoin decentralised trading solution goes live, KCS will be the native asset of KuCoin’s decentralised financial services as well as the governance token of the KuCoin community in the future.

KCS Price Analysis

At the time of writing, KCS is ranked the 46th cryptocurrency globally and the current price is US$10.53. Let’s take a look at the chart below for price analysis:

KCS has been trading through a massive range during Q2, with the price showing mild bullishness from last week.

Bulls bought near $9.50. The weekly level and daily gap near $10.23 could prompt buyers to step in again as the price challenges the swing high and resistance around $13.50. A strong move and acceptance above this level may reach for the swing highs at $14.75 and $15.66, which mark another area of resistance.

However, rejection from the current area may send the price down to retest support near $10.00. Relatively equal lows around $9.78 provide a rich target for a stop run. Sustained bearishness may reach the low near $8.90 and possibly as low as $7.14 into higher-timeframe support.

2. Near Protocol (NEAR)

NEAR Protocol is a decentralised application platform designed to make apps usable on the web. The network runs on a Proof-of-Stake (PoS) consensus mechanism called Nightshade, which aims to offer scalability and stable fees. NEAR uses human-readable account names, unlike the cryptographic wallet addresses common to Ethereum. NEAR also introduces unique solutions to scaling problems and has its own consensus mechanism, called “Doomslug”.

NEAR Price Analysis

At the time of writing, NEAR is ranked the 25th cryptocurrency globally and the current price is US$3.36. Let’s take a look at the chart below for price analysis:

During Q2, NEAR has retraced 70% from its highs to support at the retracement of around $3.10.

The price shifted market structure to run to the consolidation lows near $3.40, just under the monthly open. A continued bearish trend in the market may create support just below, between $3.00 and $2.70.

On the other hand, if the current resistance breaks, the price might find resistance near $4.83 and $5.14, whereas mid-Q2 buyers may still be trapped in longs.

3. Compound (COMP)

Compound COMP is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pools supported by the platform. When a user deposits tokens to a Compound pool, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and can be used to redeem the underlying cryptocurrency initially deposited into the pool at any time. These COMP tokens can be bought from third-party exchanges or can be earned by interacting with the Compound protocol, such as by depositing assets or taking out a loan.

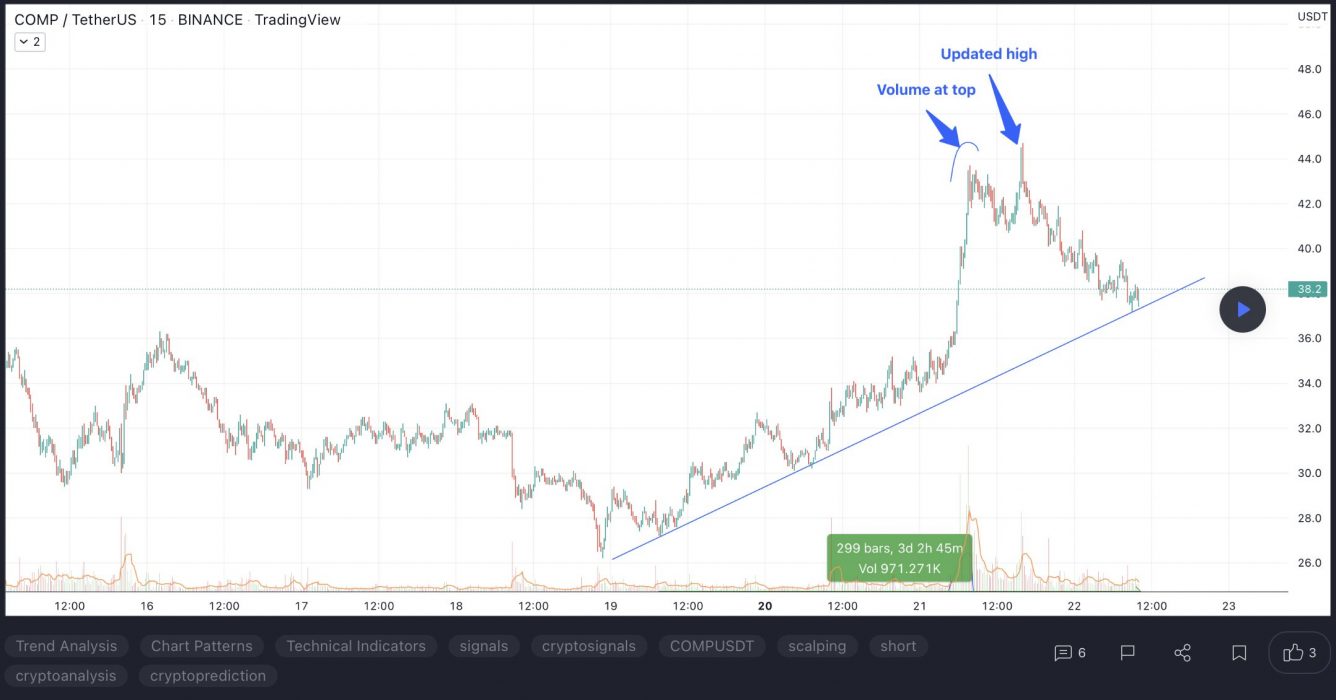

COMP Price Analysis

At the time of writing, COMP is ranked the 99th cryptocurrency globally and the current price is US$39.29. Let’s take a look at the chart below for price analysis:

After rallying over 55% from its Q1 low, COMP is encountering resistance near $57.43.

This resistance and the monthly open at $40.13 currently have the price trapped. The swing high and resistance near $49.27 provide a likely target before any major bearish market shift, with continuation through this resistance possibly reaching for short stops and resistance near $62.55.

The daily gap at $35.12 could provide support, while the area beginning near $30.49 could see more substantial interest from the bulls. A longer-term bearish shift in the marketplace will likely reach the relatively equal lows near $28.48, possibly finding a floor at possible support beginning near $24.71.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.