Investments into institutional-focused crypto custody firms have skyrocketed in 2021 – over US$3 billion has been raised this year, a rate three times higher than 2020.

The amount of capital flowing to institutional-focused crypto custody companies is now worth a total of almost US$3.5 billion, 4.8 times the amount raised in 2018.

NYDIG Leads the Chart

In mid-December, bitcoin holding company NYDIG announced the closing of US$1 billion in investment funding, giving the company an estimated value of more than $7 billion.

A day later, Anchorage, a San Francisco-based crypto custody company for institutional investors, announced a US$350 million funding round.

The top companies leading investment rounds so far are:

- NYDIG: $1 billion raised;

- Ledger: $380 million raised;

- Anchorage: $350 million;

- Fireblock: $310 million; and

- Copper: $50 million

More Institutions Replace Gold with Bitcoin

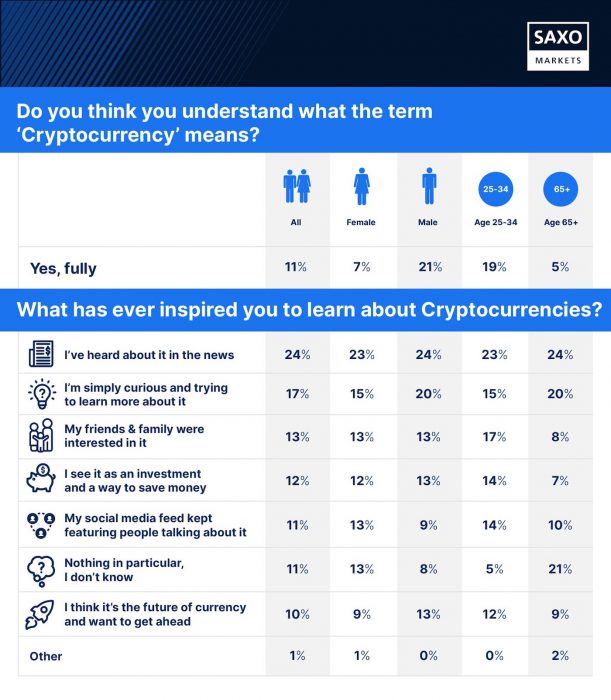

Institutions have been heavily hoarding some of the top cryptocurrencies in the market, and institutional interest in the crypto market has surged to the point that 84 percent of institutions are interested in a crypto ETF.

So far, the idea remains the same: institutions want to escape inflation, and gold was the preferred option by most industries. However, with the rise of Bitcoin and other decentralised currencies, more institutions – including investment firms and banks – are replacing gold with bitcoin.

Crypto News Australia has kept track of the latest Bitcoin purchases made by institutional players in the crypto market this year. You can check our list here.