Gary Vaynerchuk, affectionately known as Gary Vee, anticipates a bear market ahead for non-fungible tokens (NFTs) but still believes that “NFTs are going to be here for the rest of everybody’s life”.

Too Much Short-Term Greed Will Cause a Bear Market

In an interview with Decrypt, Vee said he believed that “winter is coming” for NFTs. While the creator of Ethereum-based VeeFriends, and a collector of CryptoPunks and other NFTs, remains very bullish on the future of NFTs, he still believes a significant pullback in valuation is coming.

When discussing why he believed people were investing in the market boom, Vee said:

The conversation is about to get very interesting when we hit an NFT winter, because there’s way too much short-term greed, and supply and demand issues.

Gary Vee, crypto entrepreneur

Vee has pocketed a pretty penny during the NFT craze with his hand-drawn doodles netting US$1.2 million, outselling similar works by Andy Warhol and Jackson Pollock.

In early 2021, the NFT market exploded and generated US$2.5 billion during the first half of the year but seemed to fade in the second half, leading some to suggest the NFT market frenzy was just a short-term fad. However, the market surged to new heights in August and DappRadar reported a trading volume of US$10.67 billion for Q3 alone – a 700 percent increase over Q2 2021.

Vee did not say he thinks a pullback per se is coming, but rather believes that a potential drop in the valuation of NFTs might occur in the future. He has previously predicted that the majority of NFT projects would lose significant value over time, but that blue-chip projects might come out even higher at the other end.

Vaynerchuk made specific reference to NFT projects such as CryptoPunks and Bored Ape Yacht Club, as well as certain pieces from the XCOPY collection, which have seen numerous sales above the million-dollar mark. He added: “XCOPY shows all the nuances of potentially becoming a Warhol, a Banksy, or a Pollock.”

NFTs Will Be Here for the Foreseeable

I do believe firmly that 90 percent of the NFT projects right now, [their] values will be less than that when it’s all said and done … The problem is the 2 percent that are going to be so much more extraordinarily high … that one is required to do the homework to see the opportunity.

Gary Vee

On the current state of NFTs, Vaynerchuk has said that many people are spending money they cannot afford on things they do not understand:

Regardless of his views on the current state of NFTs, Vee predicts: “NFTs are going to be here for the rest of everybody’s life – and [they are] going to get more meaningful, not less.”

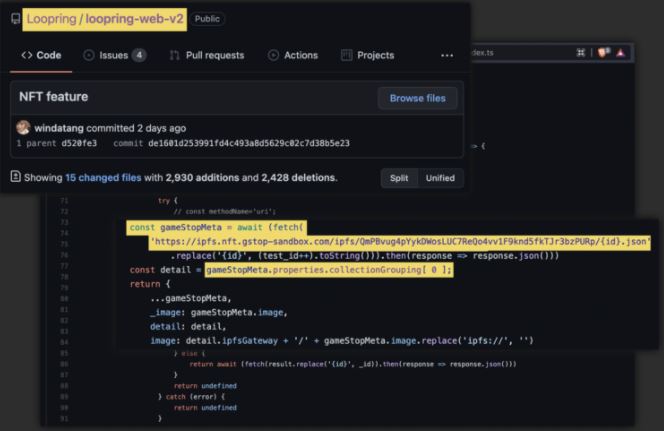

Agree with Vee? You Can Now Short the NFT Market

If you agree with Vee that the NFT market is currently overheated, SynFutures is launching NFTures, a product that will allow users to short the future prices of NFTs. As many continue to question the value of NFTs, and with many tokens serving no purpose other than being able to be bought or sold, SynFutures is looking to change the way we derive profit from NFTs.