Following the country’s annual budget speech, India’s finance minister Nirmala Sitharaman announced a 30 percent taxation rate on any income stemming from the transfer of virtual digital assets. She added that the country is likely to issue the digital rupee in the 2022-2023 financial year.

News Welcomed by Indian Crypto Investors

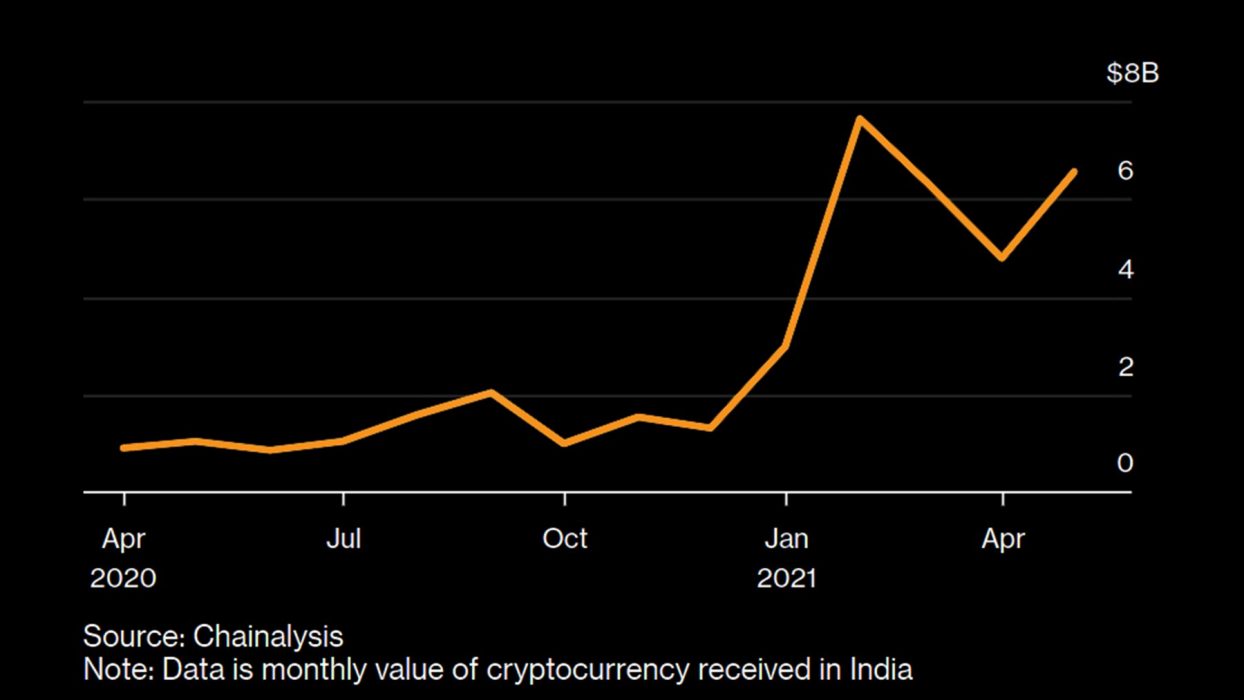

In a country where crypto investment has shot up by 19,000 percent in a year, and the younger cohort is opting to invest their assets in crypto rather than traditional options such as gold, the news has been welcomed.

“There has been a phenomenal increase in transactions in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime,” the minister said in the budget speech delivered on February 1.

Clarity regarding taxation suggests that crypto would not be banned as some had feared. Apart from the high tax rate, India will not provide any deductions on crypto income except the cost of acquisition. Further, losses incurred by transferring crypto cannot be offset against any other income, unlike losses from stocks.

According to the speech, tax deductions at source will also be imposed on payments for the transfer of crypto assets at a rate of 1 percent for transactions over a certain threshold. Any gifts of crypto assets will also be taxed in the hands of the recipient.

Although the words “crypto” and “cryptocurrency” were not used during the speech, the minister used the phrase “virtual digital asset”, which the industry takes as a term for cryptocurrencies and NFTs.

India to Launch ‘Digital Rupee’ CBDC in Fiscal Year 2023

The budget speech also gave a specific timeline for the launch of India’s central bank digital currency (CBDC). Minister Sitharaman has said that a “digital rupee using blockchain and other technologies” is set to be issued by the Reserve Bank of India starting in the fiscal year 2022-2023. According to the minister, “digital currency will lead to a more efficient and cheaper currency management system”.

Although the clarity given regarding taxation is a step in the right direction, the country still awaits regulatory clarity. The government was scheduled to introduce a crypto bill for discussion in parliament but has not done so yet. The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, when presented, will provide specific details on whether India is going to embrace cryptos officially or not.

Will Taxation Deter Retail Investors?

The news from India is significant, seeing as it will affect over one billion people and is likely to set a trend. But the question remains whether imposing a 30 percent tax on virtual digital assets will deter retail investors. While some have argued that 30 percent is too much, others disagree, saying it is in line with taxation on personal income.