The Australian Border Force (ABF) and Infocomm Media Development Authority (IMDA) of Singapore have successfully completed a trial of blockchain technology to increase the effectiveness of trade flow between Australia and the island city-state.

According to the joint media release from the ABF, IMDA Singapore and Singapore Customs, the three institutions have been able to demonstrate trade documents can be issued and verified digitally across two independent systems.

As part of the Australia-Singapore Digital Economy Agreement, announced in November 2020, the project aimed to simplify cross-border trade. The trial successfully tested the interoperability of two digital verification systems – the ABF’s Intergovernmental Ledger (IGL) and IMDA’s TradeTrust reference implementation.

ABF is proud to pioneer cutting-edge digital verification projects in Australia. We understand this collaboration is among the first to involve multiple government agencies from two countries to achieve cross-border document interoperability.

Michael Outram, ABF commissioner

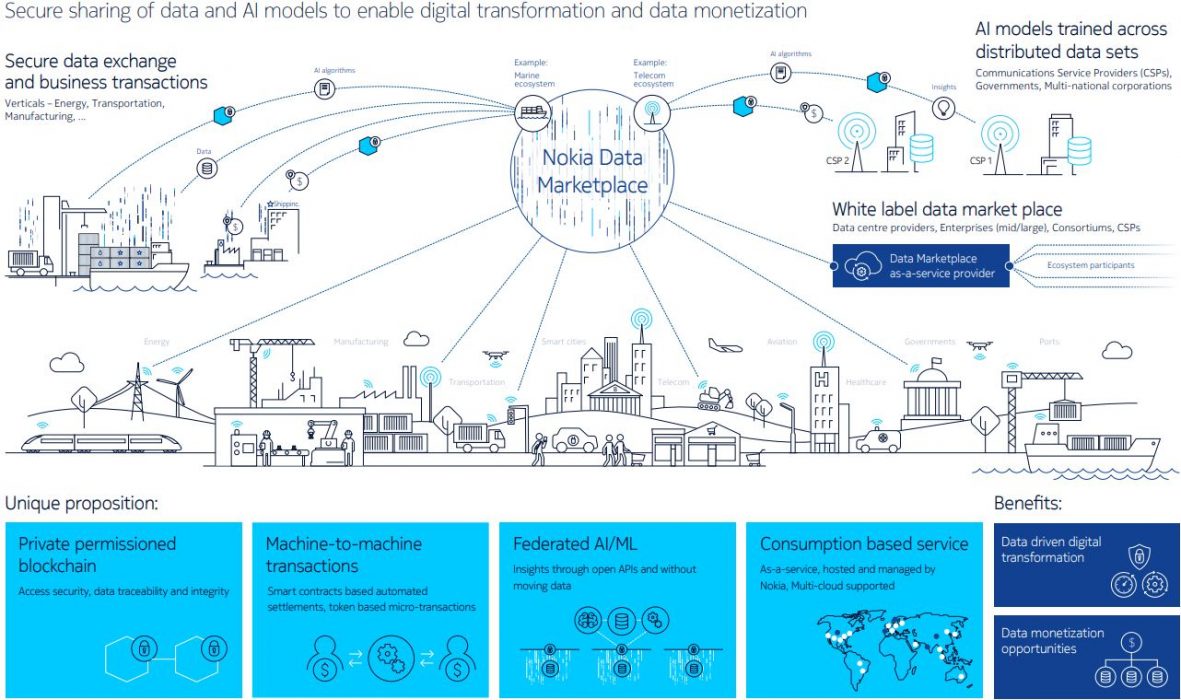

By using the blockchain-based, decentralised approach, transactions can become more cost-effective and offer scalability without the need for expensive data exchange infrastructure, lowering barriers to the adoption of paperless cross-border trade.

Digital Verification and Verifiable Documents Show Promise as a ‘Circuit-Breaker’

The goal of the IGL platform is to progressively remove the need for paper documents and reduce cross-border transaction costs for Australian business, as mentioned in the Simplified Trade System reform agenda.

“Digital verification and verifiable documents show promise as a ‘circuit-breaker’ to disrupt persistent paper-based evidence required by authorities,” Outram said.

A Successful First Test Case

The first test case for the project was issuing certificates of origin (COOs), which contained QR codes with unique blockchain-based proofs that verified the authenticity and integrity of the documents.

Certificates of origin are usually issued on paper and businesses usually wait days to receive the hard-copy document via courier before dispatching it to multiple parties, including customs agencies, brokers and banks. Paper trade documents are generally required by authorities to prove authenticity and integrity.

Ho Chee Pong, director-general of Singapore Customs, stated that the Covid-19 pandemic had accelerated trade digitalisation and demonstrated the importance of cross-border paperless trade.

With these systems in place, documents can be verified much faster, allowing for seamless administration and an improved flow of information.