Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

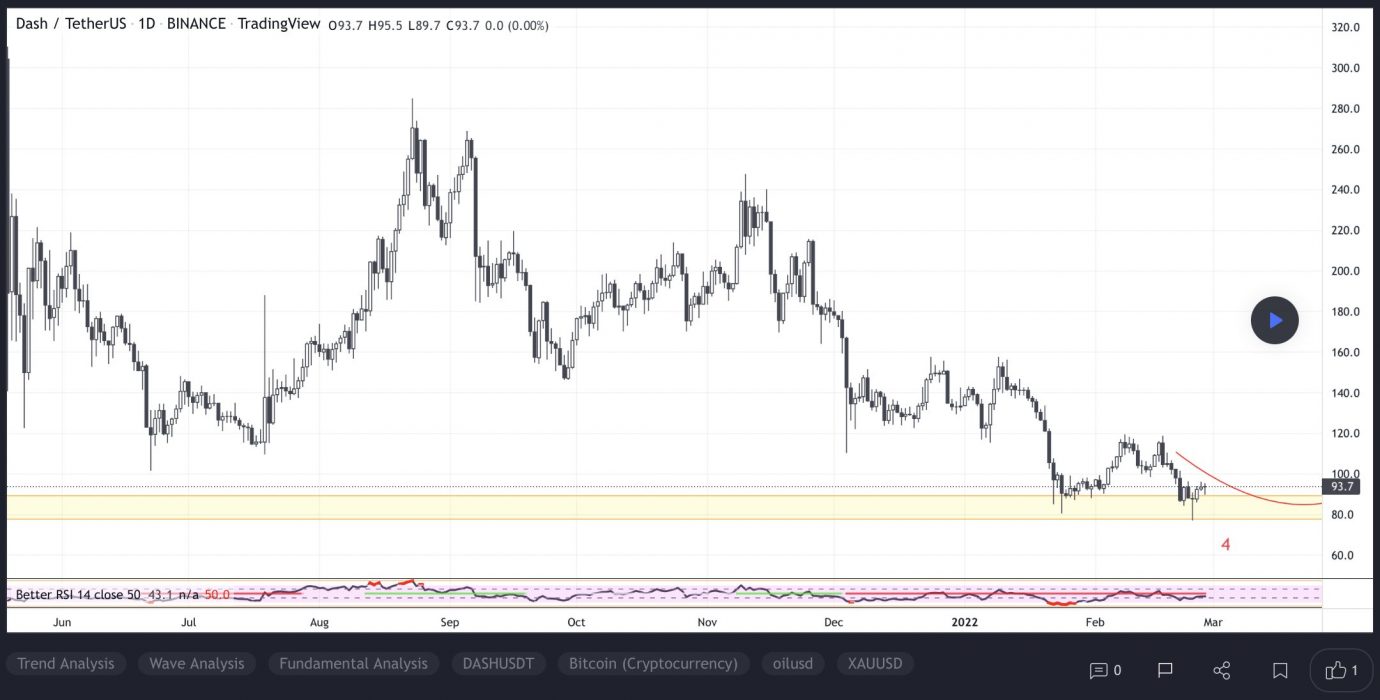

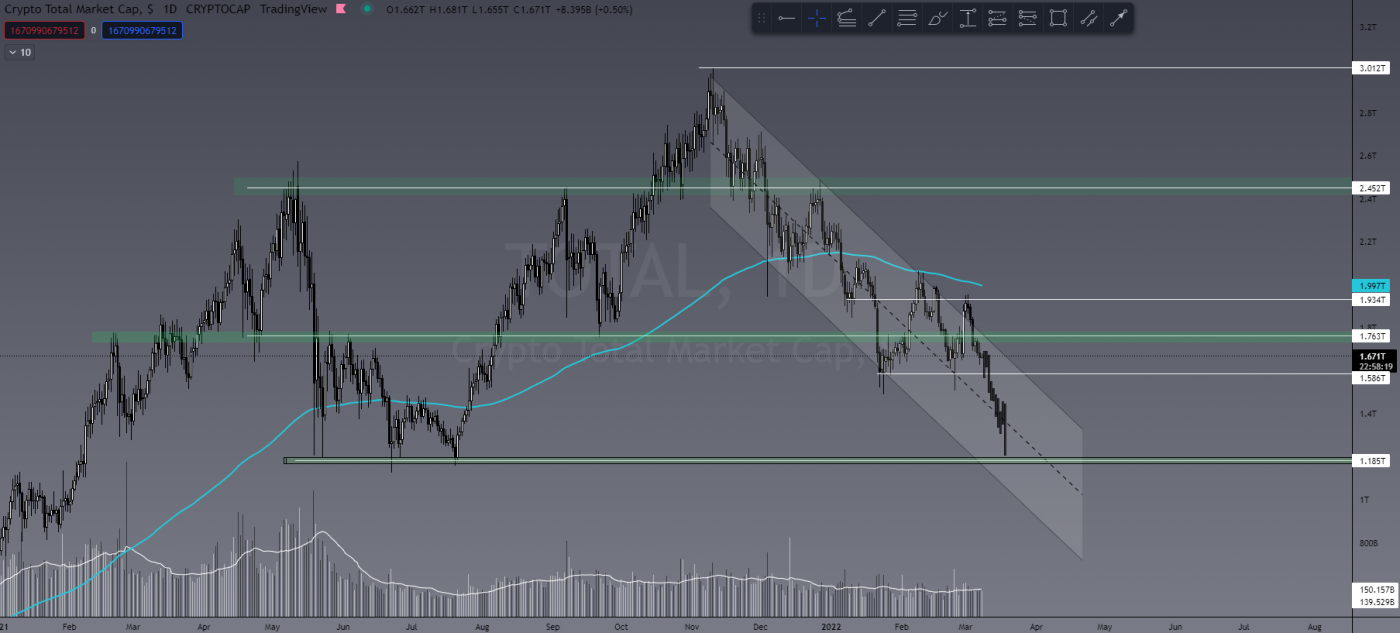

The TOTAL cryptocurrency marketcap has been ranging between US$1.9 trillion and US$1.6 trillion for over a month now and still producing lower market structure. As I’ve been saying for a while, I still expect to see further downside in the crypto markets. Once the US$1.58 trillion support level is broken, I see the market losing over US$400 billion.

BTC.D (bitcoin market dominance in %) is sitting at 43.3% and looks to be turning. If this happens with ALT coins still dropping, it tells me money flow is going into USD/USDT etc as profit-taking is occurring. That, coupled with the DXY (US Dollar Currency Index) pumping, gives me confidence in this scenario.

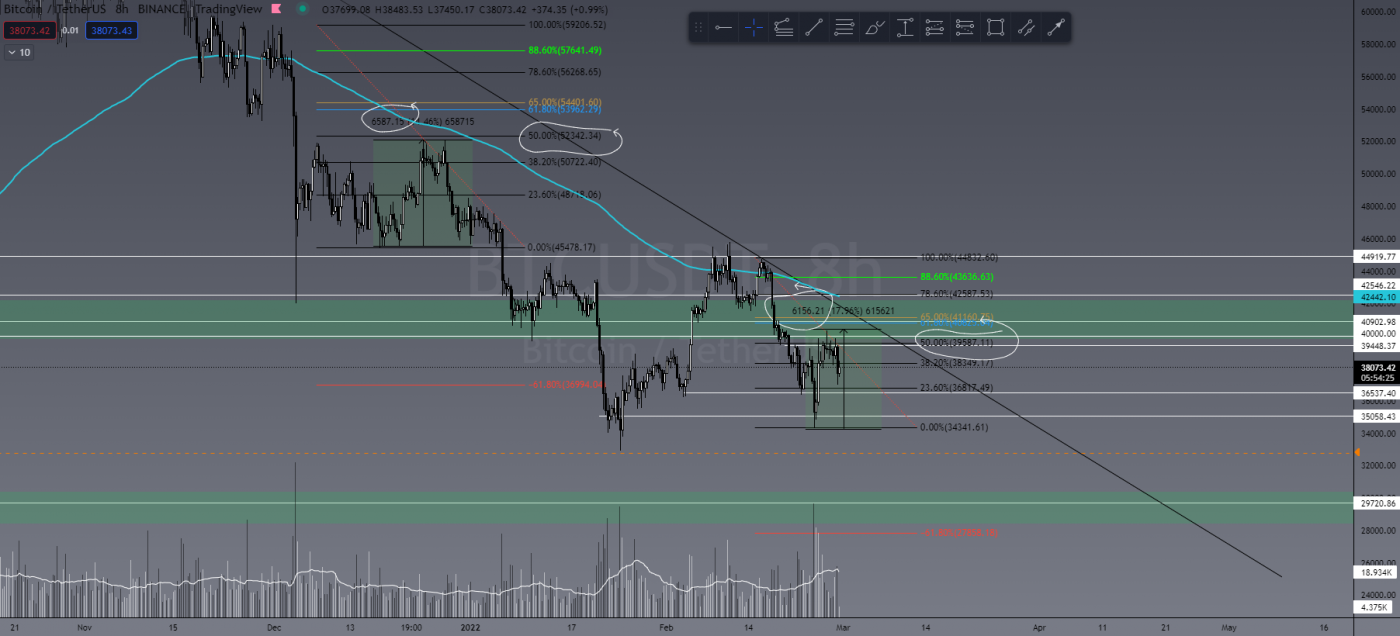

As for BTC itself, nothing has changed for me. Despite seeing a little pump in price action from US$38,000 to US$45,000 last week, there really wasn’t huge volume behind it to give me buyer confidence. My point still stands, in that breaking the daily 200 EMA is when I can start getting comfortable into a bullish bias. I know some say I go against the grain a little with a bearish outlook, but I’m trying to prepare people for that scenario. The last thing I want to see is another 2018 situation where people lose 90% of their capital due to “hopium” and bullish influencers. I still like the US$29,000 target.

Last Week’s Performance

WAVES/USDT

I think it’s important to share both winning and losing trades. Last week I shared a potential trade on WAVES and this one was definitely a losing trade! I entered my short at key resistance and was stopped out for a 2% loss. This is why we use stop losses! Not every trade we enter will be a winner, and it’s important to mitigate that risk with correct risk management strategies.

ETH/USDT

One of the most consistently profitable traders I know, and a leader within The Crypto Den community TradeRoom, Cassie, who shared this beautiful 20% (200% on 10x) ETH short trade. Cass is also highly active in our TCD Facebook group for those who would like to follow her trades.

This Week’s Trades

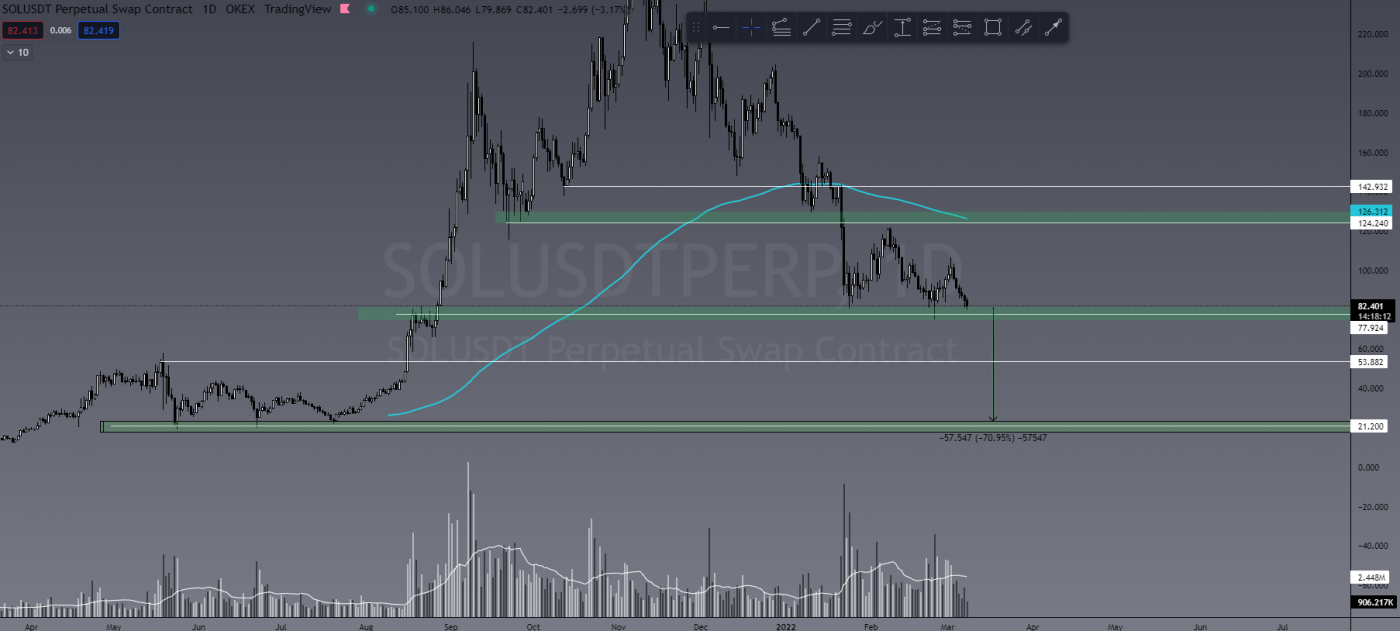

SOL/USDT

I’m going to have to go with SOL again as my pick of the week (should it play out) for a potential short here. If BTC does see further downside with profits moving into USD instead of ALTs, I see SOL as one of the biggest losers – a potential 70% drop from its current price. It may see some sideways support at US$53.00, though my target is US$21.00.

ADA/USDT

Yes, I know you’re probably sick of seeing me write this but again, for the same reasons as above with SOL, I still see ADA dropping a good 70%. Hardcore ADA fans give me hell over this but I see absolutely nothing bullish in the charts for ADA!

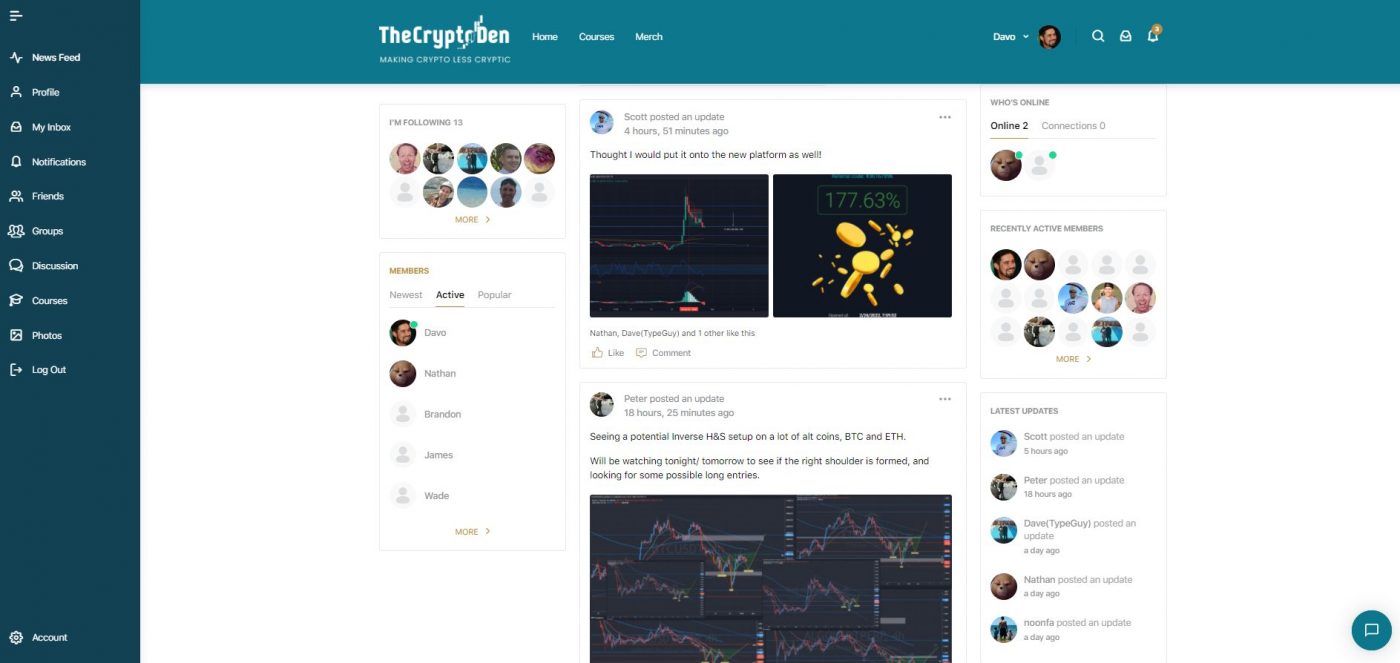

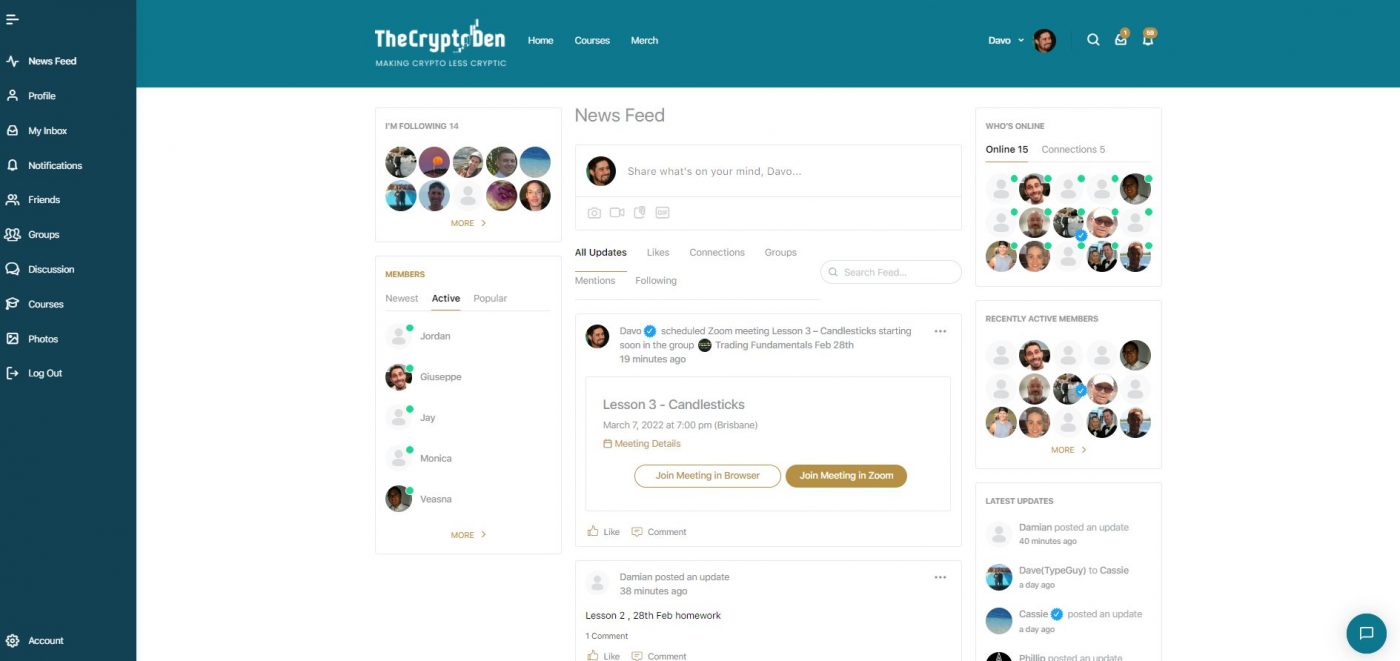

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trading chat, connect to like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the Crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!