Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Near Protocol (NEAR)

NEAR Protocol is a decentralised application platform designed to make apps usable on the web. The network runs on a Proof-of-Stake (PoS) consensus mechanism called Nightshade, which aims to offer scalability and stable fees. NEAR uses human-readable account names, unlike the cryptographic wallet addresses common to Ethereum. NEAR also introduces unique solutions to scaling problems and has its own consensus mechanism, called “Doomslug”.

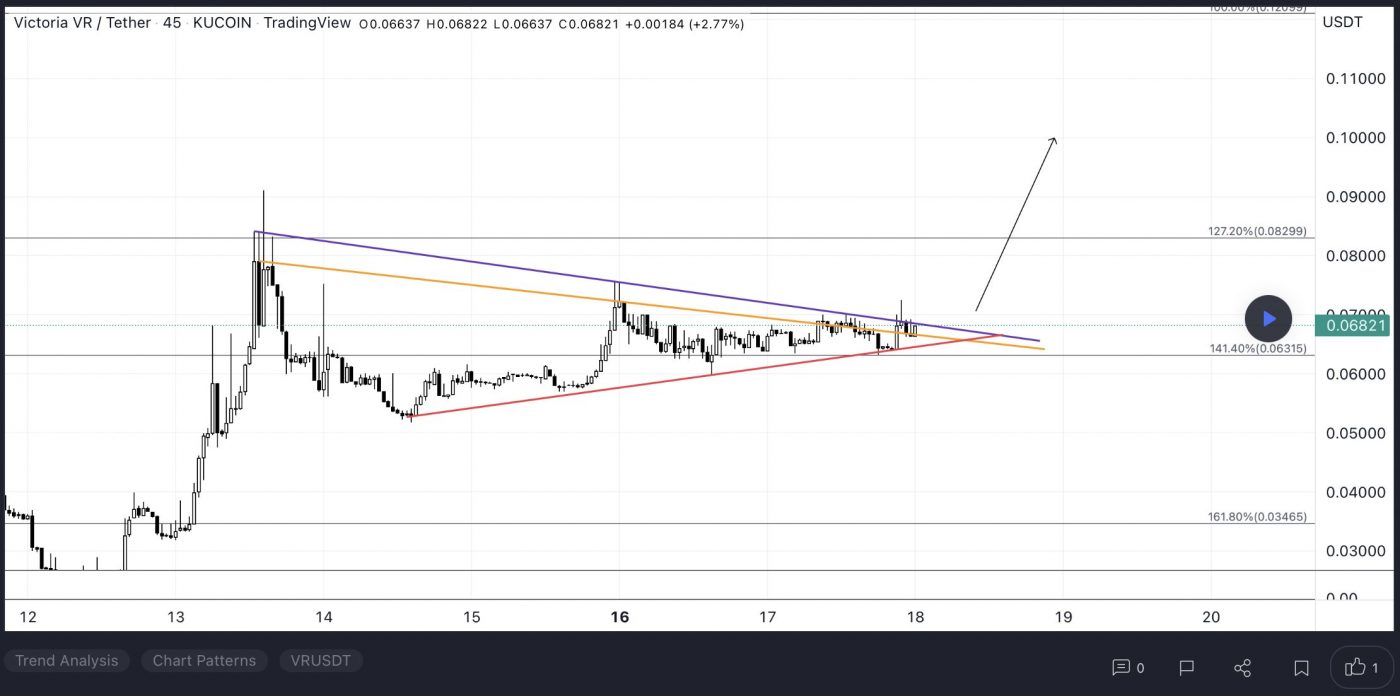

NEAR Price Analysis

At the time of writing, NEAR is ranked the 20th cryptocurrency globally and the current price is US$6.08. Let’s take a look at the chart below for price analysis:

After its uptrend during Q1, NEAR has retraced 70% from its highs to support at the retracement of around $5.80.

The price shifted market structure to run to the consolidation lows near $6.40, just under the monthly open. A continued bearish trend in the market may create support just below, between $6.00 and $5.20.

On the other hand, if the current resistance breaks, the price might find resistance near $8.33, whereas mid-Q1 buyers may still be trapped in longs.

2. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management. The platform uses two in-house tokens, VET and VTHO, to manage and create value based on its VeChainThor public blockchain. The idea is to boost the efficiency, traceability, and transparency of supply chains while reducing costs and placing more control in the hands of individual users.

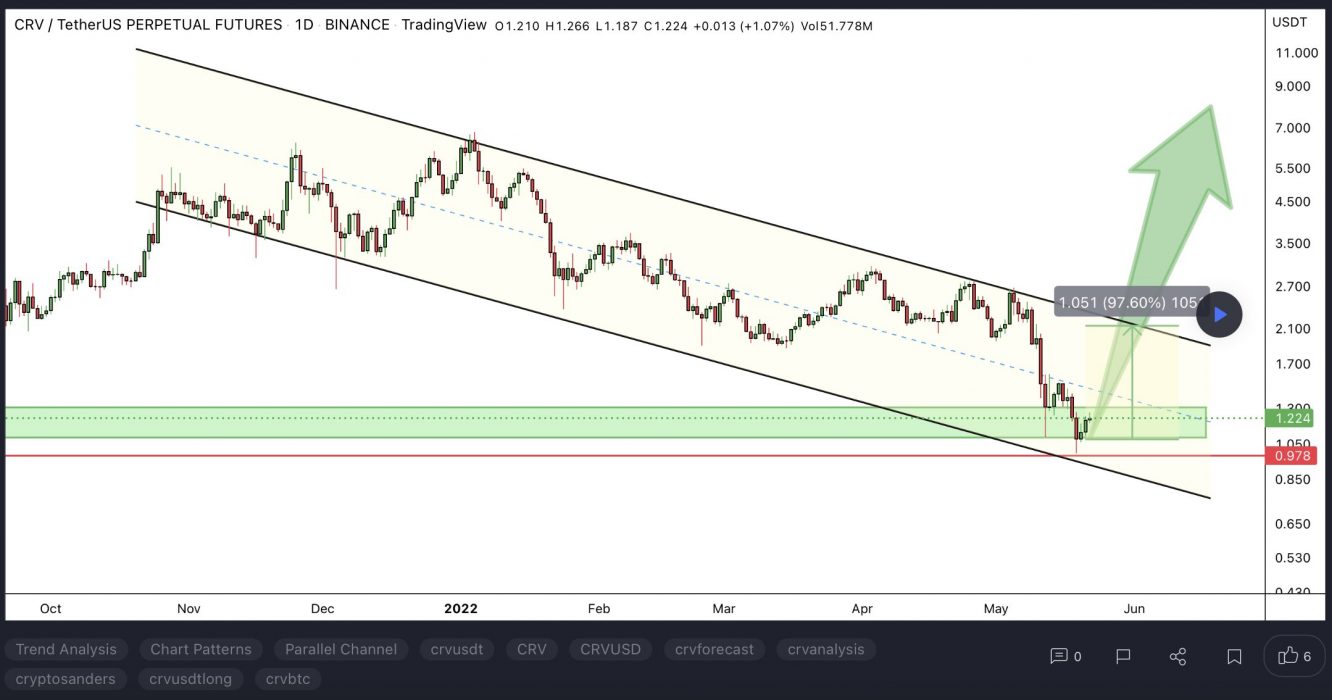

VET Price Analysis

At the time of writing, VET is ranked the 32nd cryptocurrency globally and the current price is US$0.03286. Let’s take a look at the chart below for price analysis:

VET‘s 68% move during late March ran into resistance near $0.08420, at the 30% extension of the Q1 swing.

An old high and the 18 EMA have provided support near $0.03083 and may give support again on a retest. This area also has confluence with the 51% and 63.8% retracements of November’s swing.

Just below, near $0.02943, the 56.8% retracement of the current Q1 swing might also mark an area of support.

If the market turns bearish, $0.02572 is unlikely to be revisited but could see interest from bulls during any deeper retracement.

An area near $0.03948, at the 50% extension of the last week swing, could see some profit-taking if bulls break the current resistance near $0.04478. Above, old consolidations near $0.04825 and $0.05072 may also provide some resistance before another round of price discovery.

3. Waves (WAVES)

WAVES is a multi-purpose blockchain platform that supports various use cases, including decentralised applications (DApps) and smart contracts. The platform has undergone various changes and added new spin-off features to build on its original design. Waves’ native token is WAVES, an uncapped supply token used for standard payments such as block rewards. Waves initially set out to improve on the first blockchain platforms by increasing speed, utility, and user-friendliness.

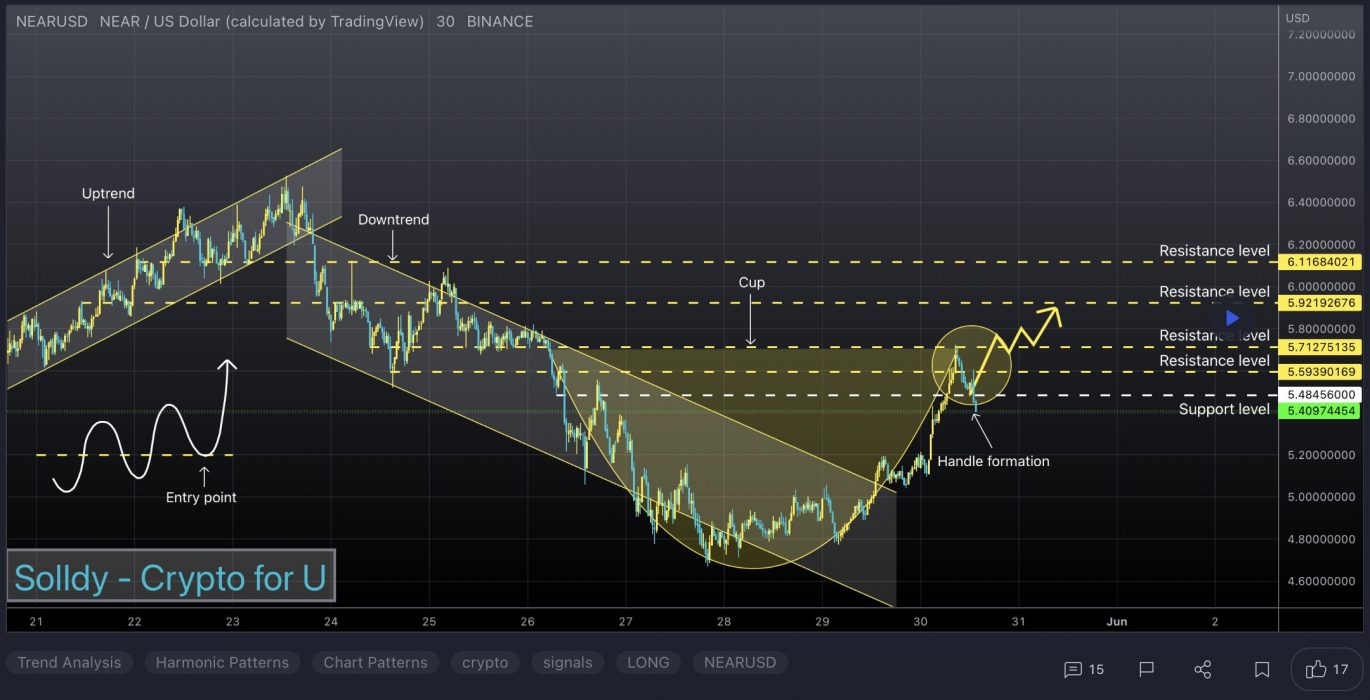

WAVES Price Analysis

At the time of writing, WAVES is ranked the 60th cryptocurrency globally and the current price is US$8.67. Let’s take a look at the chart below for price analysis:

During April’s high, WAVES‘ slight drop marks the current range as a reasonable area to expect accumulation.

The recent bearish flip of the 9, 18 and 40 EMAs might cause bulls to be less aggressive in bidding. However, possible support near $7.12 and $6.35 – between the 41.8% and 50.6% retracements – could see at least a short-term bounce.

Long-term consolidation suggests that the areas near $11.45 and $13.61 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $12.77, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $15.42, the start of the bearish move.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.