CRO, the native token of the crypto exchange Crypto.com, has surged by more than 1000 percent in 2021 and is now worth almost US$1, with a current price of $0.89 at time of writing.

What’s Driving the CRO Price?

Data from Messari shows the token has been on the green this year, with three-month returns exceeding 533 percent gains. Its total market cap is now above US$23 billion, with 24hr trading volumes nearing US$300 million.

Crypto.com has been doing a lot for the crypto space lately in terms of partnerships, appearances, deals with high-profile companies in traditional finance, even jumping into the sports industry.

Sports Partnerships and Naming Rights

The main drivers of this rally are Crypto.com numerous sports partnerships this year and becoming the first crypto exchange to pass the SOC 2 test, which is an internationally recognised standard in traditional finance.

The Staples Center – home of the iconic NBA team Los Angeles Lakers – will be renamed Crypto.com Arena after the exchange bought the naming rights. This in itself caused the CRO token to surge over 91 percent in later hours.

Moreover, Crypto.com announced yesterday that it has become the first crypto trading firm to comply with SOC 2 standards. This, the firm says, reassures its position as a trustworthy company for its users.

The SOC (Security Organisation Control) 2 is an internal report that attests to the trustworthiness of a company’s information practices, security, procedures and integrity.

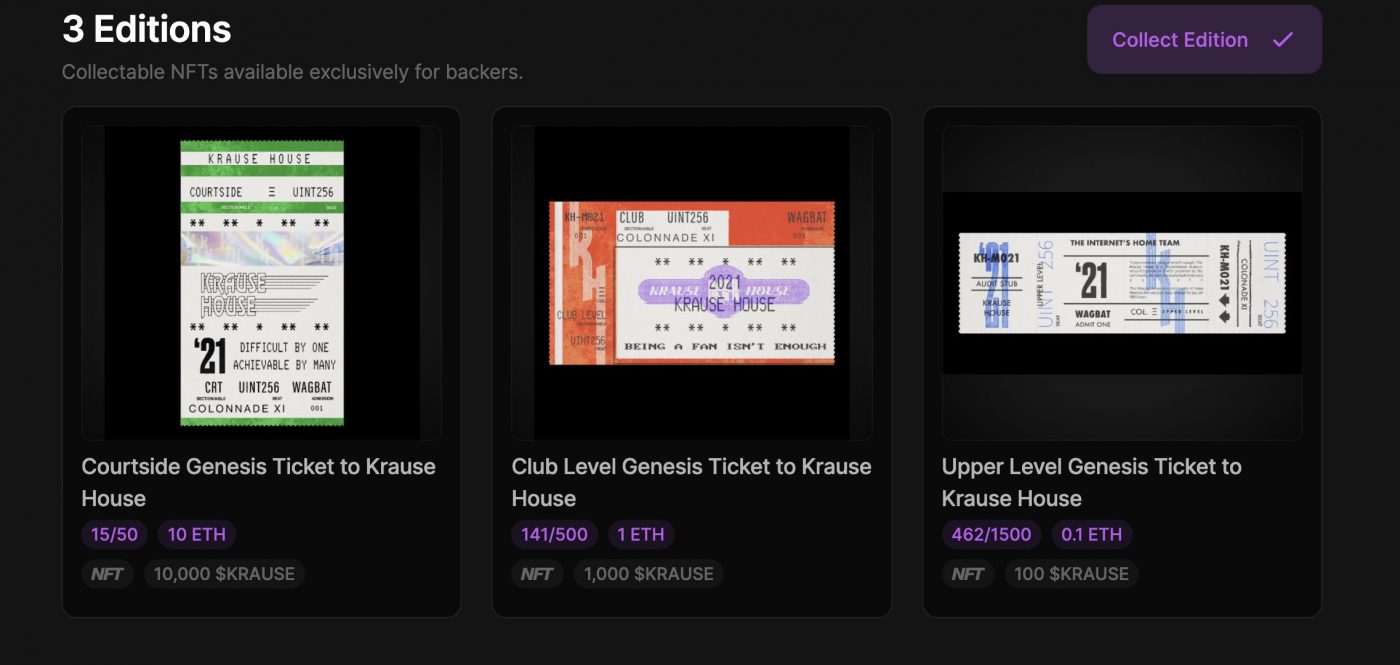

NFT Marketplace Assembles Big Names

In early 2021, Crypto.com hooked up with important names from several industries, collaborating with the likes of Lionel Richie, Snoop Dogg, the Aston Martin Formula 1 team, and more. The resulting NFT platform is now one of the top marketplaces for NFT collectors and content creators.

Launch of Free Crypto Tax Software in Australia

The crypto exchange has also been helping Aussies with their crypto tax obligations. Three months ago, Crypto.com launched a crypto tax software package in the country backed by professional tax advisers to facilitate the filing of crypto taxes at no cost.