Ethereum-based, decentralised blockchain platform Stratis has witnessed its native token STRAX rocket 103 percent in one 24-hour period this week, cooling off from a rally that at one point reached 160 percent.

STRAX took off minutes after the project announced a series of updates, including a new ticketing system via which NFTs will be used to validate entry to venues and distribute rewards at events.

Stratis has also foreshadowed several new blockchain-powered video games set to hit its mainnet later this year, along with issuing an update on its launch of a stablecoin pegged to the British pound called Great British Pound Token (GBPT).

PwC to Provide Audit Services for New Stablecoin

The platform is currently working with Price Waterhouse Coopers (PwC) to complete regulatory registration and expects the partnership to be ongoing with PwC providing auditing services for the GBPT stablecoin’s implementation.

According to the Stratis announcement, “With entities like Visa increasingly willing to accept stablecoin payments, there’s a huge opportunity to simplify cross-border and wholesale payments using blockchain technology.”

Prior to this week’s STRAX price rally, the team behind the protocol teased the upcoming launch of Sky Dream Mall, a new metaverse project powered by the Stratis blockchain:

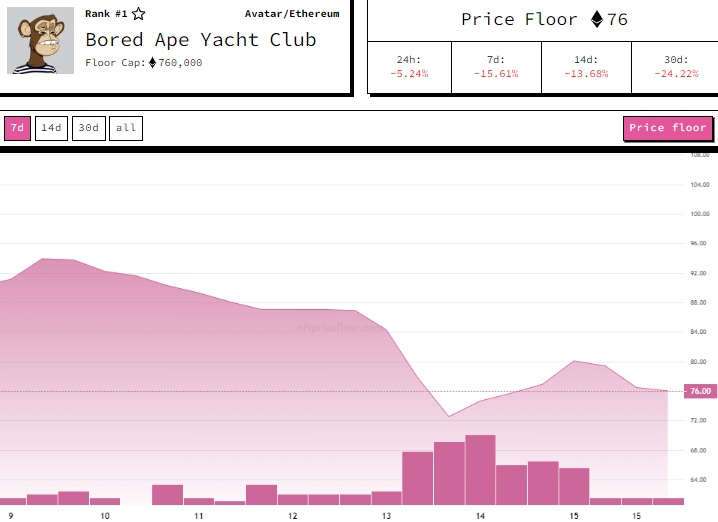

STRAX Defies Market Conditions

All of which is in clear defiance of the current bear market and the onset of the so-called ‘crypto winter’. These are arguably the most positive developments in the sector since April, when blockchain-based music platform Opulous saw the price of its token, OPUL, rally 175 percent after it announced DeFi staking, CEX listings and S-NFT sales.

You’d have to go back even further to find another one-day performance to rival that of STRAX this week. In February this year, the utility and governance token for the DEX Injective Protocol rallied more than 100 percent in a single day following the listing of Cosmos (ATOM) perpetual futures on the platform.