The first global state of crypto report from cryptocurrency exchange Gemini has found that over 80 percent of Australian crypto investors opt to hold their assets long-term.

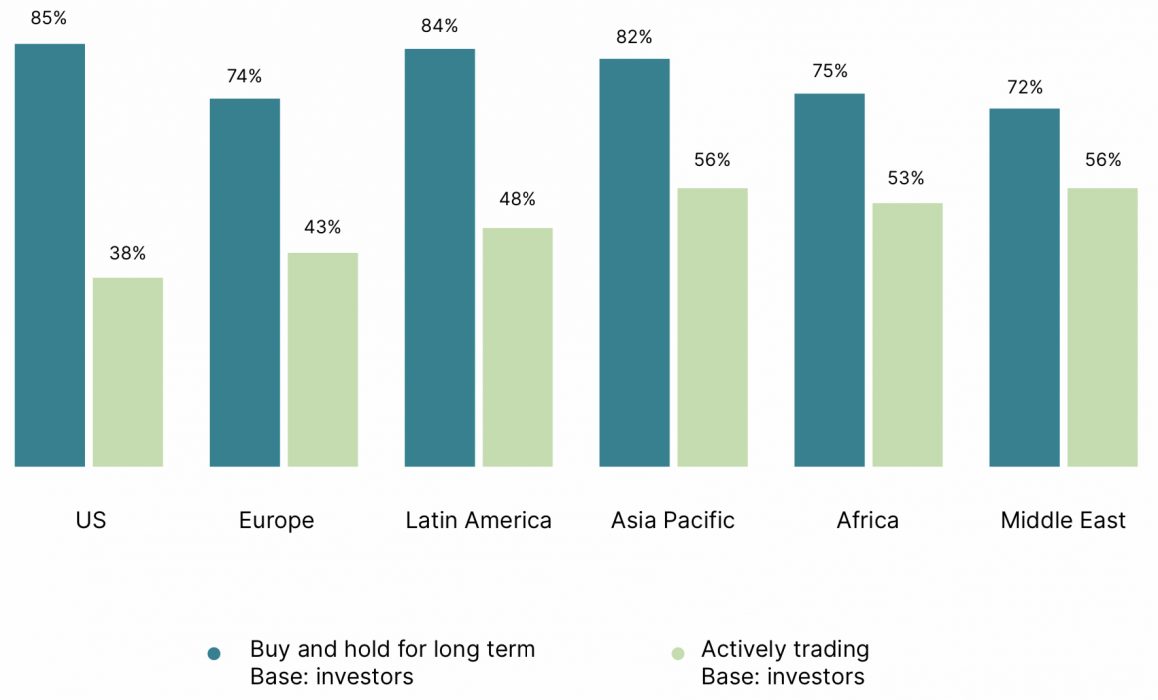

The high percentage of committed HODLers in Australia is similar to figures found in other parts of the world – from 72 percent in the Middle East to 85 percent in the US.

The survey, which was conducted online between November 23, 2021, and February 4, 2022, asked 30,000 people from 20 countries about their attitudes and behaviour relating to cryptocurrency investments in an effort to uncover trends and characterise the current state of the market.

2021 a Huge Year for Adoption in Australia and Globally

Another of the major takeaways from the report was just how big a year it was for crypto adoption – 43 percent of Australians surveyed said they first invested in crypto in 2021. Curiously, this finding contrasts sharply with a survey from Saxo Markets released late last year that found only one in 10 Australians had any idea what crypto is.

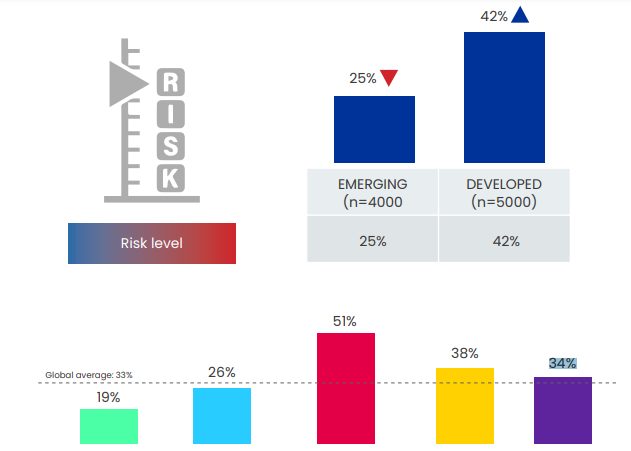

Globally, the Gemini survey found the 2021 adoption numbers were even higher – 44 percent of Americans surveyed said 2021 was the year they got into crypto, and over half of all respondents from Brazil (51%), Hong Kong (51%) and India (54%) said 2021 was the first time they’d bought crypto.

Future Looks Bright

Based on the findings from its survey, the Gemini report is bullish about the future of crypto, stating:

In 2021, cryptocurrency reached a tipping point, evolving from what many considered a niche investment into a global, established asset class.

2022 Gemini Global State of Crypto report

The report also points out that the overall crypto market capitalisation topped out at almost US$3 trillion in 2021, making crypto the best performing asset class of the past decade.

Another report released late last year by digital asset management firm Mawson was similarly positive, finding that the crypto market in Australia could grow to over A$68 billion by 2030.