Australian cryptocurrency entrepreneur Craig Sproule has been charged by the US Securities and Exchange Commission (SEC) for defrauding investors by diverting millions from a digital coin offering into South African gold mining interests.

Sproule, currently a resident of California, faces additional charges of making false and misleading statements when selling digital asset securities. Jointly named on the SEC charge sheet are two companies founded by the Lismore-born entrepreneur – Crowd Machine Inc and Metavine Pty Ltd.

‘The Man Behind the Machine’

Self-proclaimed on social media as “the Man behind the Machine”, Sproule has been ordered to pay a US$200,000 (A$280,000) civil penalty while Crowd Machine’s digital tokens will be banned from crypto trading platforms.

Crowd Machine was intended to replace Amazon Web Services, the cloud-based computer infrastructure, with a distributed system. To achieve this, Sproule claimed to have raised US$40.7 million through an initial coin offering of Crowd Machine Compute Tokens (CMCT) in early 2018 that was to fund a decentralised computer network.

Almost $6 Million Siphoned into South African Gold Mines

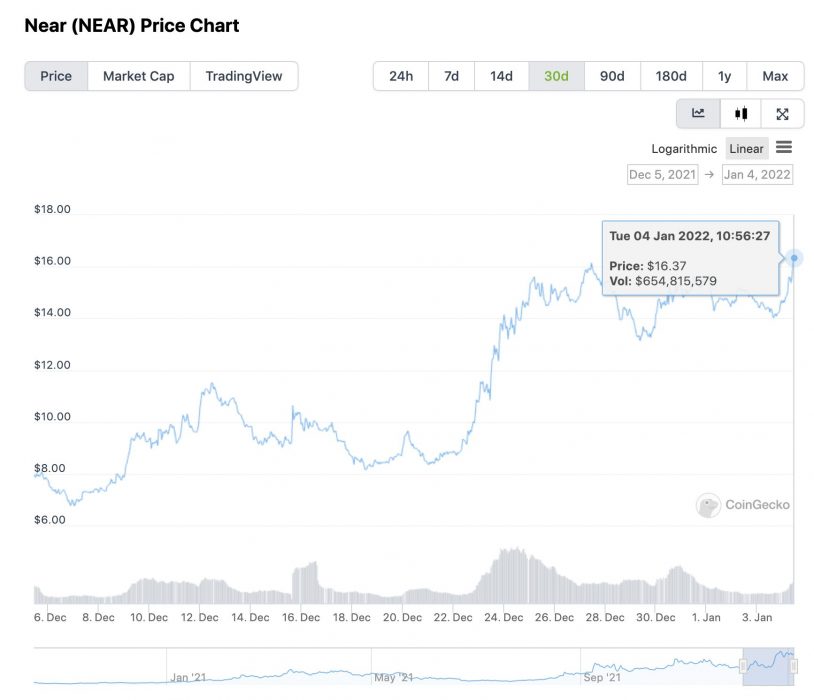

Instead, Sproule siphoned US$5.8 million into gold mining entities in South Africa, which was not disclosed to Crowd Machine token investors. None of the US$5.8 million has been recovered, and the South African gold mining operations “have returned no revenue”, according to the SEC’s statement of claim.

Along with Sproule and Crowd Machine, another entity registered in Australia, Metavine Pty Ltd, has committed to covering any future civil penalties relating to Crowd Machine. An application for voluntary deregistration of Metavine was filed with the Australian Securities and Investments Commission (ASIC) last month.

Sproule and Crowd Machine have neither admitted nor denied the allegations, although Sproule will be summarily banned from serving as an officer or director of a public company.

Shades of Last Year’s BitConnect Fiasco

The Sproule/Crowd Machine imbroglio echoes the circumstances of an SEC lawsuit filed last May against five individuals linked to BitConnect for promoting and selling unregistered securities. That case also shared a connection down under, with ASIC accusing a former BitConnect promoter of defrauding small investors in Australia in 2017-2018.