Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ankr (ANKR)

ANKR originated as a solution that utilises shared resources in order to provide easy and affordable blockchain node hosting solutions, and has since built a marketplace for container-based cloud services through the usage of shared resources. It is a platform that enables the sharing economy, where any customer can access resources at a more affordable rate while also providing enterprises with the ability to monetise their spare computing power. It is unique in the way that it is the first to use trusted hardware, and this ensures a high level of security.

ANKR Price Analysis

At the time of writing, ANKR is ranked the 90th cryptocurrency globally and the current price is US$0.04992. Let’s take a look at the chart below for price analysis:

ANKR continues to set monthly lows in its downward trend. Support might be found in the daily gap above the monthly open near $0.04295, though a deeper retracement is likely to target the relatively equal lows into support near $0.03925.

The daily gap near $0.03766 could also provide support. However, another gap inside the down candles, around $0.03421, provides the highest chances of solid support while offering a high risk-reward entry.

There is currently no resistance overhead since the price is in discovery. Extensions hint at the areas around $0.05932 and $0.06570 as reasonable take-profit zones.

2. The Graph (GRT)

The Graph GRT is an indexing protocol for querying data for networks like Ethereum and IPFS, powering many applications in both DeFi and the broader Web3 ecosystem. Anyone can build and publish open APIs, called subgraphs, that applications can query using GraphQL to retrieve blockchain data. GRT is a work token that is locked up by Indexers, Curators and Delegators in order to provide indexing and curating services to the network.

GRT Price Analysis

At the time of writing, GRT is ranked the 55th cryptocurrency globally and the current price is US$0.1415. Let’s take a look at the chart below for price analysis:

GRT‘s 80% retracement during Q2 set a low near $0.09547 during its consolidation that began in early June.

Relatively equal highs near $0.1635 could be the current target if the price breaks through resistance beginning near $0.1858. Bullish continuation may reach through the next significant swing high near $0.2038 into the daily gap near $0.2473. If bullish strength continues, the zones just below the previous monthly highs near $0.2643 and $0.2712 could halt any retracement.

A bearish shift in the market may seek the relatively equal lows near $0.1236 into possible support near $0.1187. If this down move occurs, the swing low near $0.09742 and possible support near $0.09124 may be the primary objective.

3. Neo (NEO)

NEO bills itself as a “rapidly growing and developing” ecosystem with the goal of becoming the foundation for the next generation of the internet – a new economy where digitised payments, identities and assets come together. As well as drawing a worldwide community of developers who create new infrastructure for the network and lower barriers to entry, the team behind this project operates an EcoBoost initiative that’s designed to encourage people to build decentralised apps and smart contracts on its blockchain.

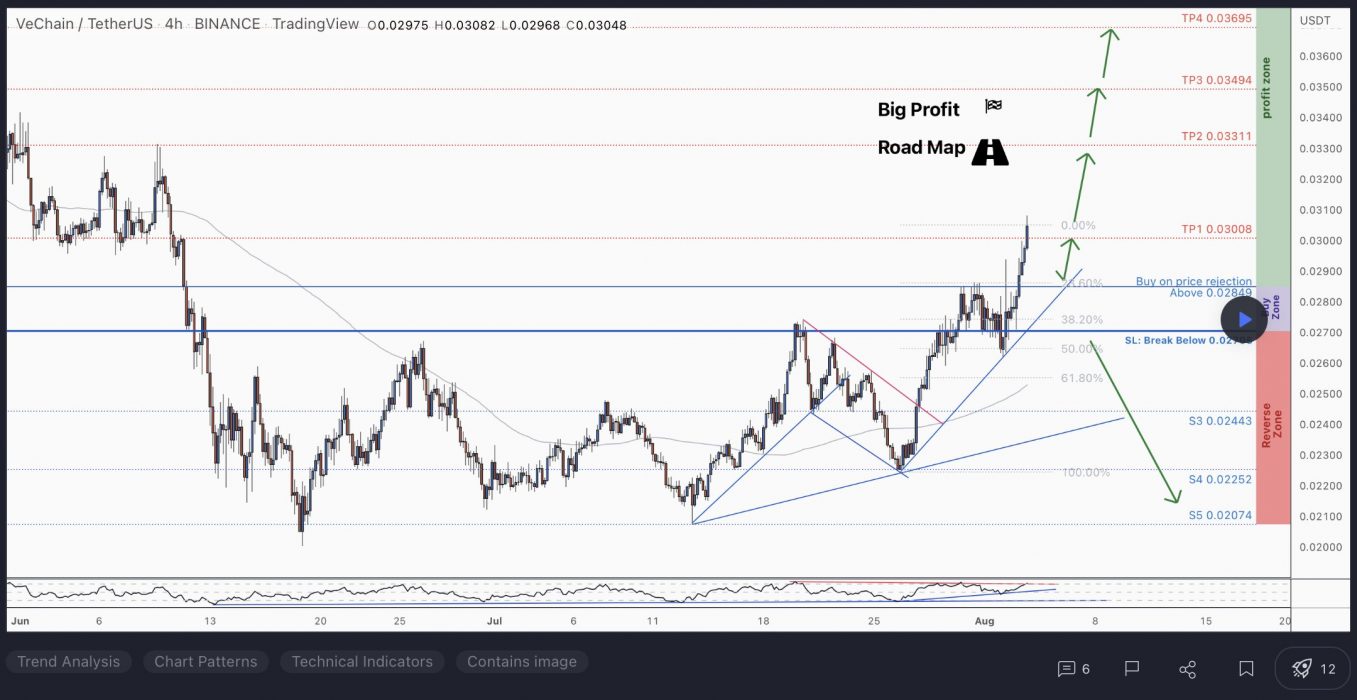

NEO Price Analysis

At the time of writing, NEO is ranked the 63rd cryptocurrency globally and the current price is US$11.93. Let’s take a look at the chart below for price analysis:

After creating a second equal low during Q2, NEO has gained nearly 25% into resistance that starts near $14.24.

Aggressive bulls looking for a continuation to the nearest cluster of relatively equal highs around $15.33 might look for bids near $12.86. More significant resistance rests above, near $16.00. A group of significant swing highs at $16.76 and $17.49 give possible targets if this resistance breaks.

A stop run on the recent low at $10.09 into possible support beginning near $9.63 may see stronger bidding. This area also has a confluence with the previous monthly low.

A bearish market shift could reach the swing low at $8.30 into possible support beginning near $7.84.

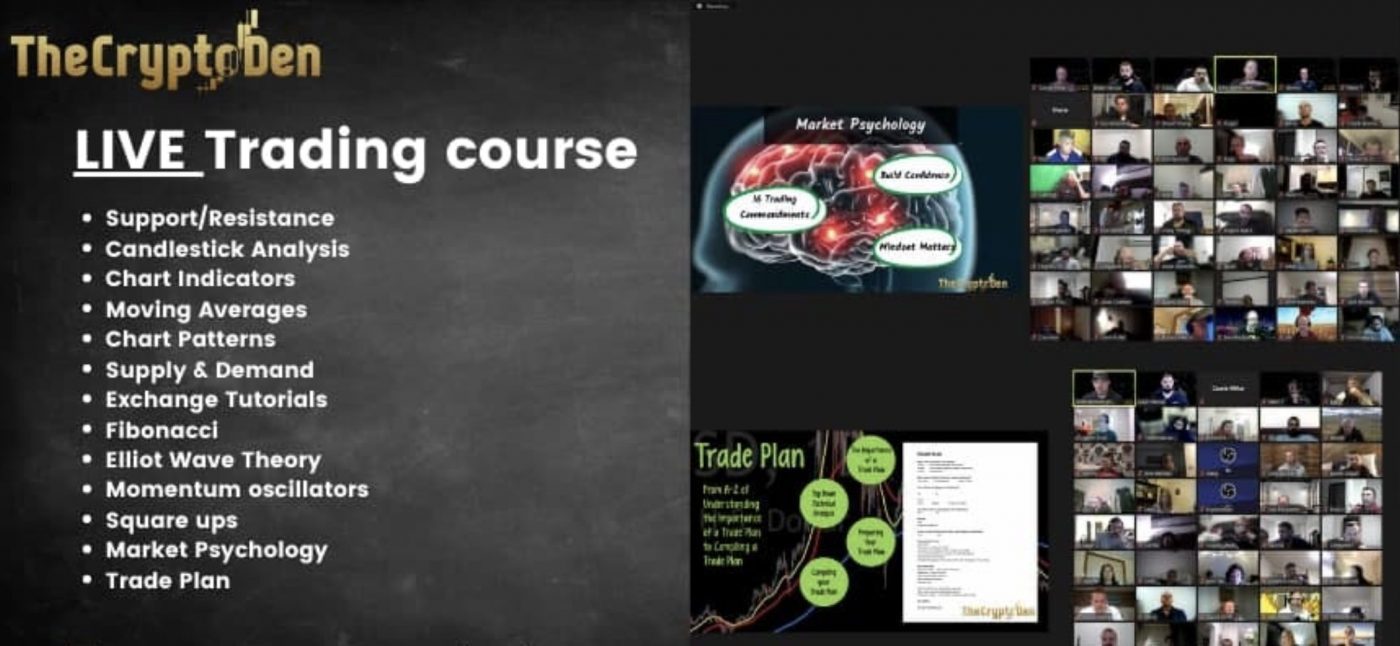

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.