Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Solana (SOL)

Solana SOL is a highly functional open source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

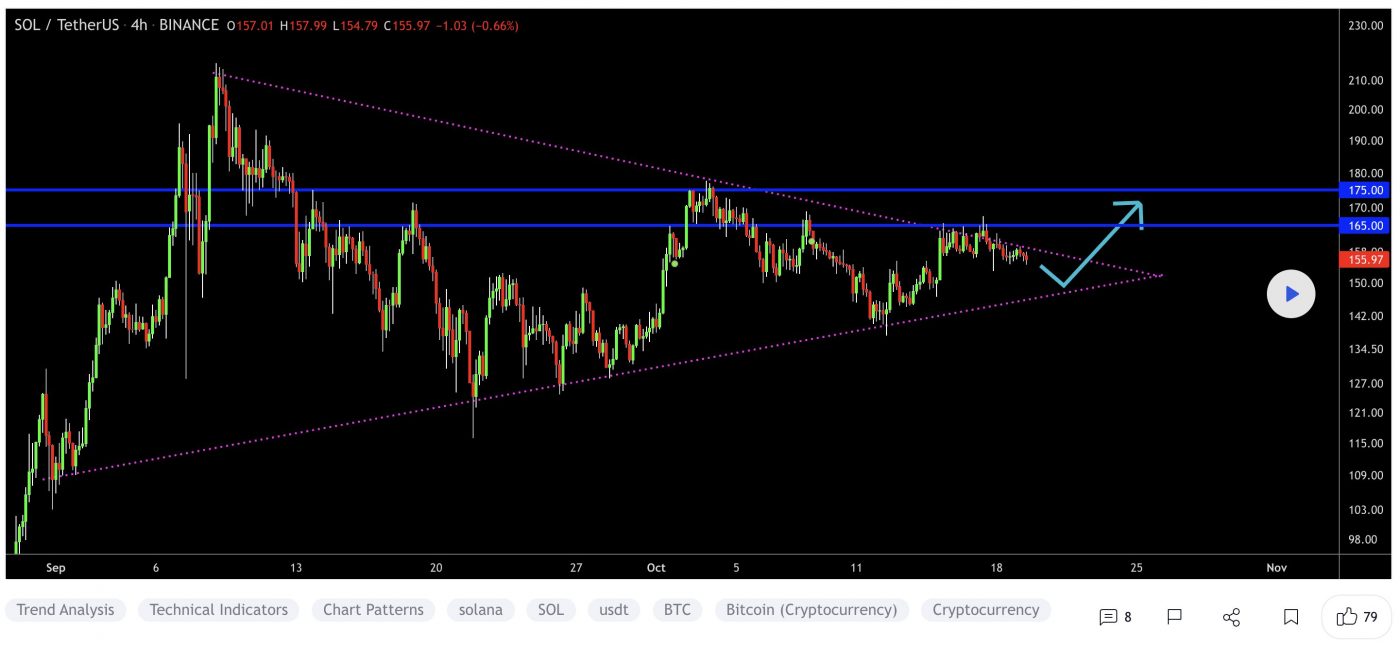

SOL Price Analysis

At the time of writing, SOL is ranked the 7th cryptocurrency globally and the current price is A$222.80. Let’s take a look at the chart below for price analysis:

SOL retraced nearly 63% from its high before finding a low in late September. Since then, the price has been sweeping stops on both sides of its local range as the current consolidation sets up the next move.

Aggressive bulls might bid near A$212, although a sweep of the stops near A$201 could reach below the next swing low into possible support near A$192. A continued downtrend might run into the weekly gap near A$179.

Some bears might add more shorts near A$229, although a push to A$237 is reasonable. A daily candle close over the swing high near A$245 could suggest that a longer-term trend reversal may be in play, with bulls possibly entering on a retracement near A$260.

2. Selfkey (KEY)

SelfKey KEY is a blockchain-based identity platform. The technology provides individuals, companies, exchanges, fintech startups and banks with a platform to manage identity data (often KYC). SelfKey aims to revolutionise the KYC on-boarding process and remain true to the ethos of Self-Sovereign Identity, where individuals should be able to own and control their identity.

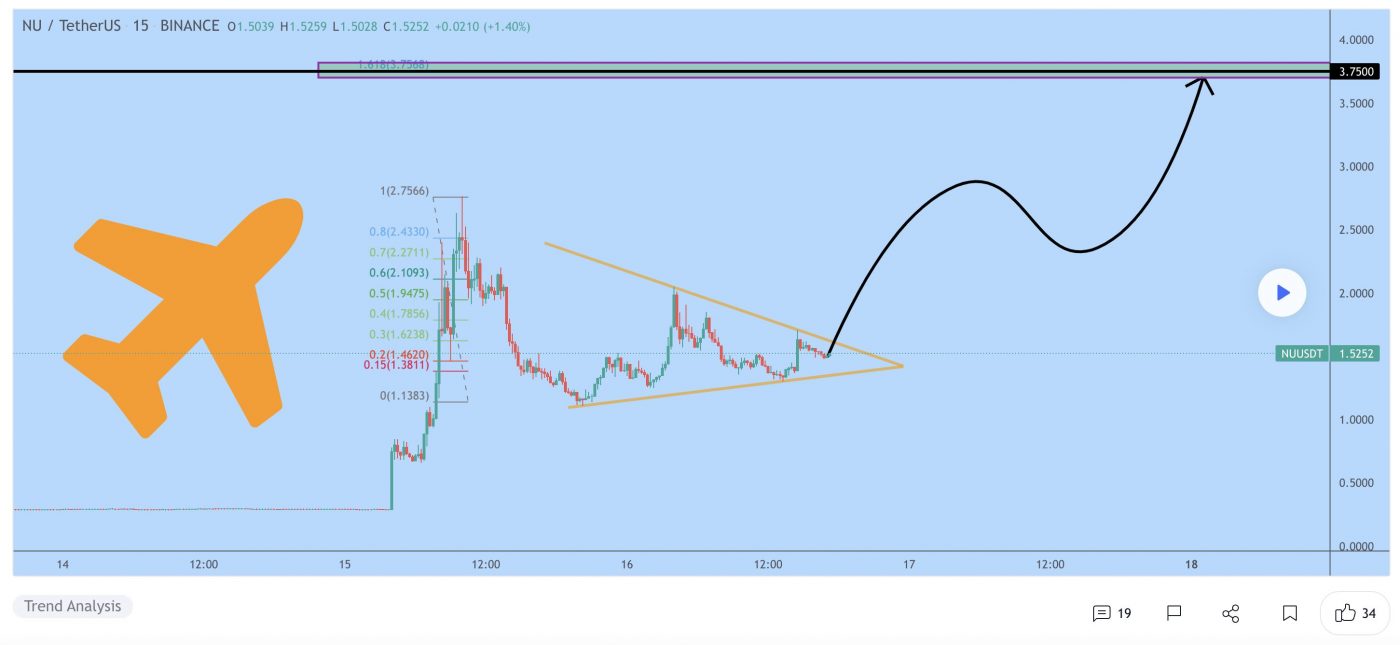

KEY Price Analysis

At the time of writing, KEY is ranked the 558th cryptocurrency globally and the current price is A$0.01506. Let’s take a look at the chart below for price analysis:

KEY‘s nearly 70% retracement continues to make lower lows while showing no definitive signs of bullish reversal.

Stops below the swing low near A$0.01433 mark the next likely bearish target, with the daily gap near A$0.01369 providing some chance of a short-term bounce. Swing lows near A$0.01245 and A$0.01187 are the next likely targets if this gap fails, with both lows marking areas of possible support.

A sweep of the most recent swing highs near A$0.01643 might find resistance beginning near A$0.01700, with a more substantial move reaching up to A$0.01839. Closing above this level could hint at a longer-term trend reversal and form the range high of any following consolidation.

3. Filecoin (FIL)

Filecoin FIL is a decentralised storage system that aims to “store humanity’s most important information”. The project was first described back in 2014 as an incentive layer for the Interplanetary File System (IPFS), a peer-to-peer storage network. Filecoin is an open protocol backed by a blockchain that records commitments made by the network’s participants, with transactions using FIL, the blockchain’s native currency. The blockchain is based on both proof-of-replication and proof-of-spacetime.

FIL Price Analysis

At the time of writing, FIL is ranked the 26th cryptocurrency globally and the current price is A$89.80. Let’s take a look at the chart below for price analysis:

After dropping almost 86% from its highs, FIL has been consolidating in a range for the second half of Q3.

The recent sweep of the lows near A$87.46 could set the stage for at least a short rally higher, with bulls possibly buying near A$90.13 for a move toward the relatively equal highs near $98.10. A close over these highs might hint at a longer-term move toward probable resistance near A$105.24, likely following a retracement.

Rejection from possible resistance near A$92.34, potentially including a sweep of the highs around A$115.34, could signal a run to the swing low near A$84.23. If this move occurs, bears might target the swing low and support near A$79.05.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.