Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Cardano (ADA)

Cardano ADA is a proof-of-stake blockchain platform whose stated goal is to allow “changemakers, innovators, and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals”, helping to create a society that is more secure, transparent, and fair. Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

ADA Price Analysis

At the time of writing, ADA is ranked the 8th cryptocurrency globally and the current price is US$0.5085. Let’s take a look at the chart below for price analysis:

From its Q2 high, ADA dropped nearly 75% before finding support near $0.4269. The price has been consolidating since it set this low and is currently testing support near $0.4629. This level has held as support despite the larger market’s sharp downturn since mid-June.

It’s reasonable to expect the price to briefly drop through this level to run bulls’ stops below the swing lows at $0.4006 and $0.3950 before any potential rally. If so, an old accumulation and inefficiently traded area on the weekly chart near $0.3772 could provide support.

If this region holds as support, bulls might find the first resistance near $0.5710. Here, the 40 EMA and an inefficiently traded area converge in the upper half of the local range.

A break of this resistance may retest resistance just above the June monthly open, near $0.6590. This level holds many bears’ stops, is near old broken support, and is inefficiently traded on the monthly and daily charts.

However, bulls should be cautious of the bearish market conditions and a potential hardfork delay. A break of the two closest support levels could lead to a much more significant drop near $0.3588. This level, near the 2021 yearly open, is inefficiently traded on the monthly and weekly charts.

2. PancakeSwap (CAKE)

PancakeSwap CAKE is an automated market maker (AMM) – a decentralised finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. PancakeSwap uses an automated market maker model where users trade against a liquidity pool. These pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return. PancakeSwap allows users to trade BEP20 tokens, provide liquidity to the exchange and earn fees, stake LP tokens to earn CAKE, stake CAKE to earn more CAKE, and stake CAKE to earn tokens of other projects.

CAKE Price Analysis

At the time of writing, CAKE is ranked the 78th cryptocurrency globally and the current price is US$3.54. Let’s take a look at the chart below for price analysis:

CAKE‘s 79% decline after Q1 created relatively equal lows near $2.96 before bouncing over the local range’s midpoint near $3.60. A bullish altcoin market could help CAKE bulls regain a stronger bullish trend.

Aggressive bulls could look for entries in the daily gap starting near $3.36. The monthly open aligns with more probable support near $3.28.

A stop run below the monthly open near $3.10 might provide a more favourable entry. A more substantial bearish move – perhaps from a sharp drop in Bitcoin’s price – could challenge support near $2.90, just above the equal lows.

Resistance rests just above, with the zone from $3.95 to $4.27 likely to provide a short-term ceiling. A break through this level might target resistance just under the cluster of relatively equal highs near $4.77.

Beyond these highs, resistance near $4.98 provides a final challenge before attacking an old daily swing high near $5.42.

3. Solana (SOL)

Solana SOL is a highly functional open-source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

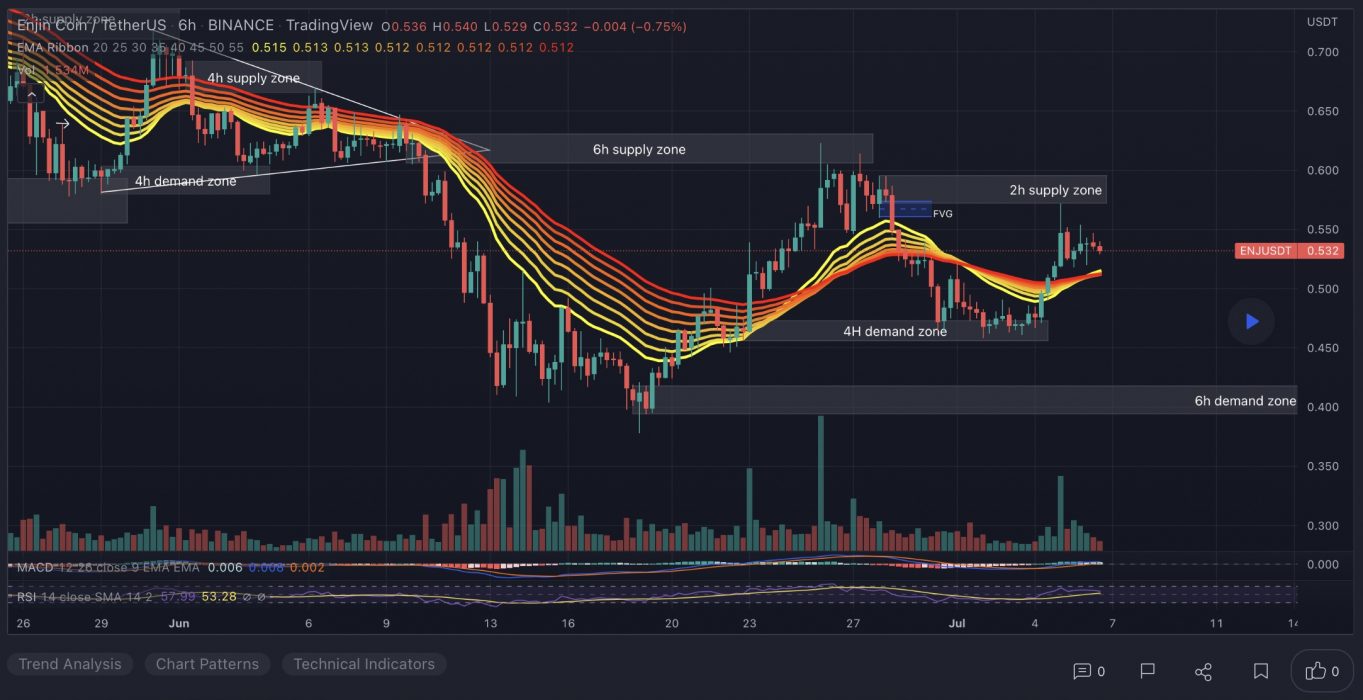

SOL Price Analysis

At the time of writing, SOL is ranked the 9th cryptocurrency globally and the current price is US$46.57. Let’s take a look at the chart below for price analysis:

SOL has retraced 89% from its Q2 highs and reached possible support last month near $27.34. Resistance might begin near $49.64, which has confluence with the 9 and 18 EMAs.

A more substantial rally might reach near the swing high at $58.23 and the 40 EMA. This high is less likely to break if bears plan to continue the downtrend without a lengthier consolidation.

While not highly probable in the current market conditions, a more animated move upward could reach a wide resistance area between $63.42 and $66.94. This zone is where the last movement down accumulated positions before breaking down.

Possible support rests near $41.34, which showed sensitivity on the last test. While it could provide support again, the higher-timeframe bearish trend is more likely to propel the price into an inefficient area between $37.10 and $33.54. If the price reaches this zone, the Q1 2021 swing high near $29.12 may mark a more sensitive level.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.