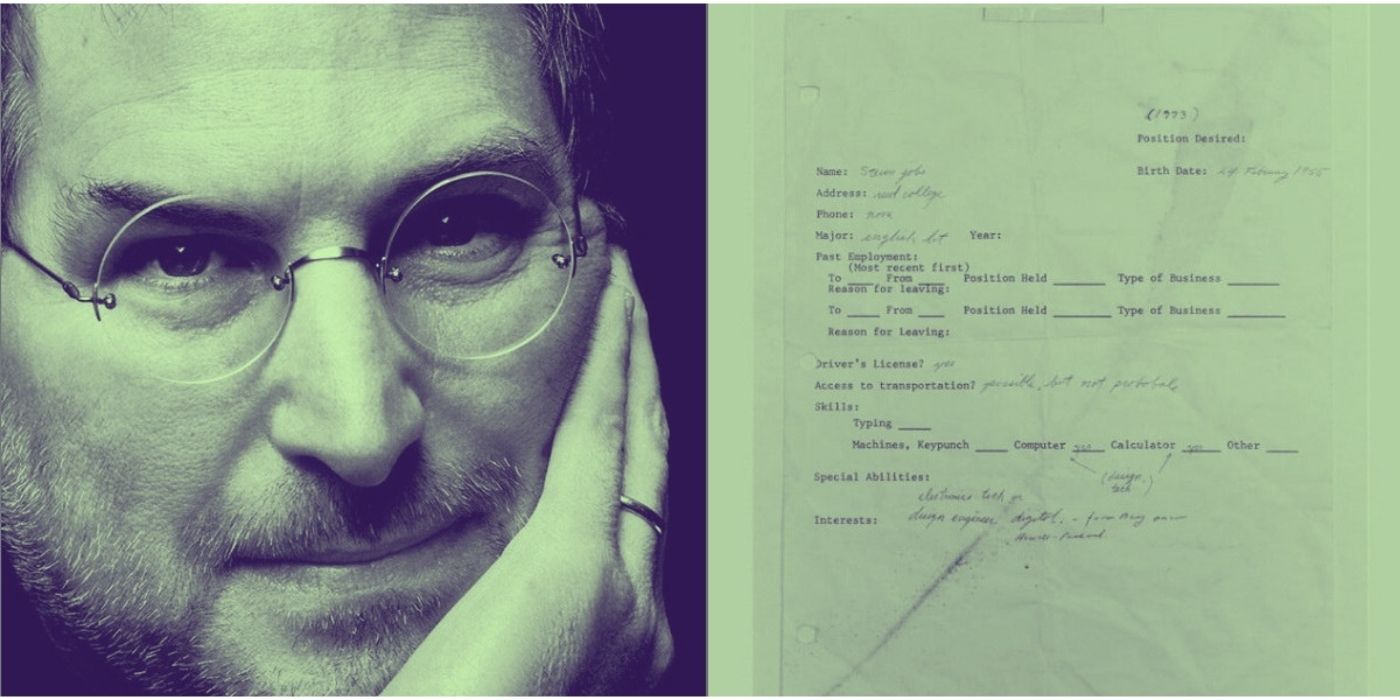

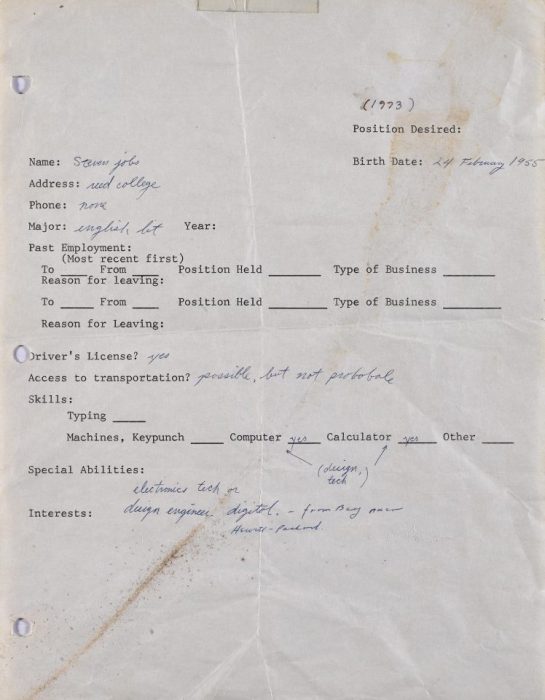

It’s an aged, yellowed piece of paper with printed text from an old typewriter and some scribbly, hard-to-read handwriting on it. But it isn’t just any piece of paper. The item in question is the first-ever job application of Steve Jobs, the man who built the Apple computer empire out of his family home garage in Los Altos, California.

As the worlds of finance and art combine, the demand for NFTs paired with the sale of real-world items is growing at a rapid rate, generating a lot of money and interest.

The physical item auction of the late Steve Jobs’ first job application was hosted on the stevejobsjobapplication.com website by internet entrepreneur Olly Joshi and closed on July 28. The NFT version went on sale separately, through NFT marketplace Rarible.

Physical Copy Achieved Higher Price Than NFT

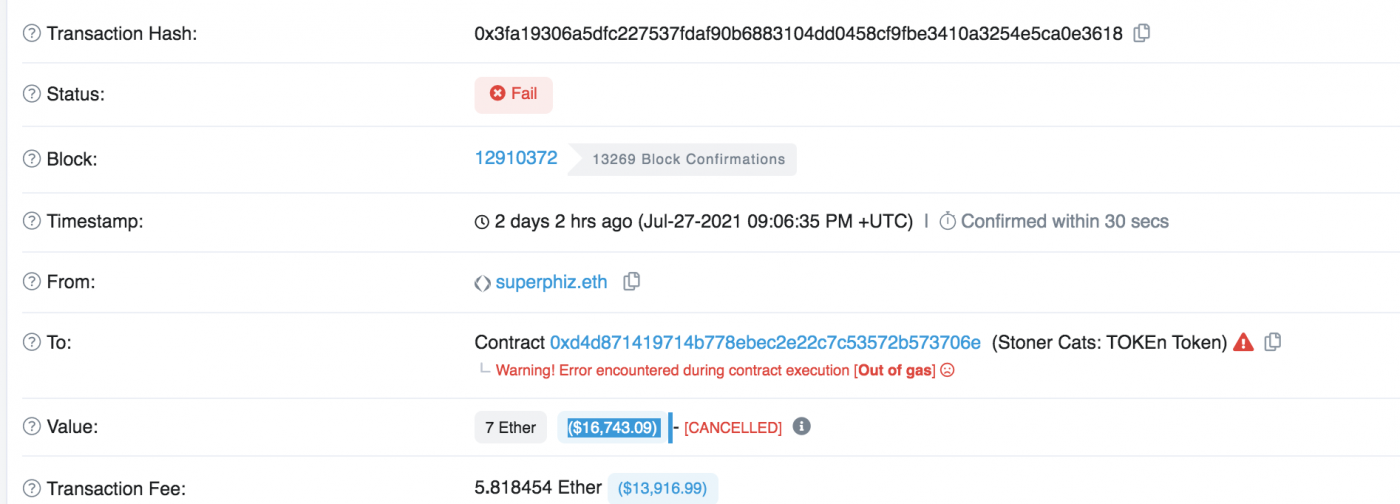

From a total of 43 bidders who took part in the auction, the winning bid was US$343,000, almost 15 times the sale price of the NFT version, which sold for just US$23,000.

The Steve Jobs’ Job Application from 1973 is a unique piece of history from the exact moment that a dreamer changed the world. It’s a snapshot into the mind of a future genius at a moment where any small deviation from the path ahead would have meant a very different world today. This NFT listing is part of the world’s first Physical vs NFT auction.

rarible.com

The item description for the Steve Jobs’ Job Application NFT listed on Rarible adds: “The motivation behind this auction is to gain a further understanding on where true ‘value’ sits in today’s world: the physical, the digital, or can value co-exist in both? This will be the first ever minted Steve Jobs’ Job Application NFT, created from the physical Steve Jobs’ job application.”

Physical Item Value Increased 1200% in Four Years

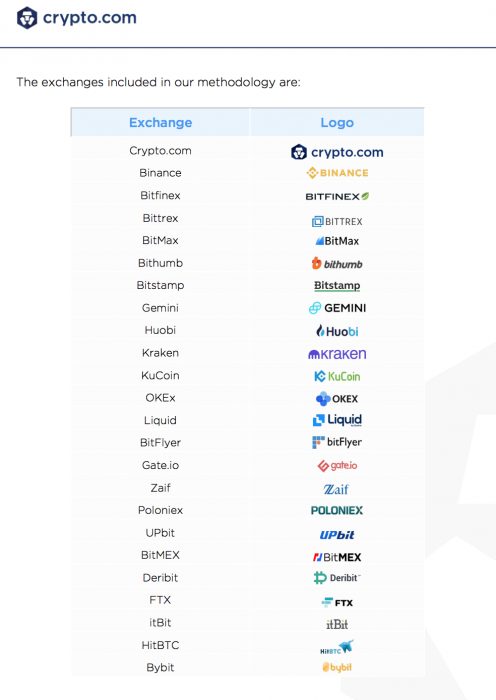

Auctioneers Winthorpe Ventures said it was decided to offer the document in two formats in two separate auctions “to test the appetite for digital assets in contrast with physical equivalents”.

Jobs’ application has gone under the hammer on three other occasions, selling for US$18,750 in 2017, $174,757 in 2018, and $222,400 in March. Prior to the latest auction, the physical item’s worth increased more than 1,200 percent over four years. The latest sale of $343,000 saw the value appreciate a further 55 percent in five months.

Crypto News Australia recently reported how Australian artists are creating their own NFT exhibitions, as NFT mania sweeps the country. In June, a highly valuable collection of historic Australian photographs was auctioned as NFTs.