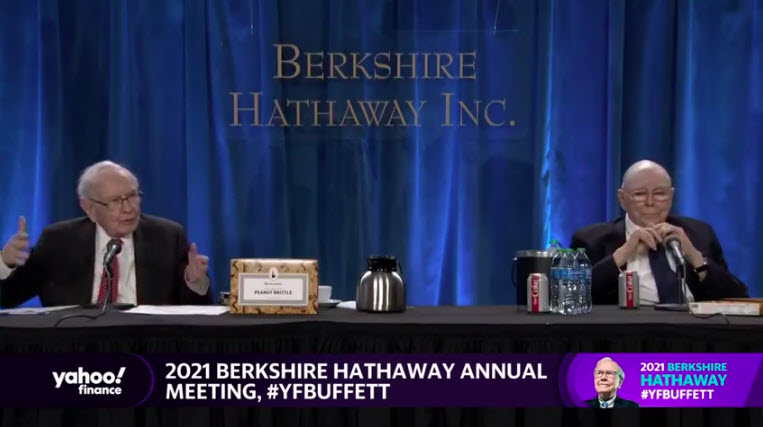

Warren Buffett’s American multinational holding company Berkshire Hathaway (one of the largest publicly held companies in the world) now has a US$500 million stake in Nubank, the world’s largest independent digital ‘Bitcoin-friendly’ bank, based in Brazil.

With 8.5 million customers, Nubank is the biggest online bank outside of Asia and has positioned itself as the most valuable financial institution in Latin America and the world. It was recently recognised as one of the most influential global companies by TIME magazine and one of the most innovative by CNBC. Launching its first product in Mexico just over a year ago, it has already received 1.5 million applications and is one of the largest issuers of new credit cards in that country.

The company is the largest digital bank in the world in terms of customer numbers – it has just reached the 40 million mark and, in the first five months of 2021, has grown at a pace of more than 45,000 new customers per day.

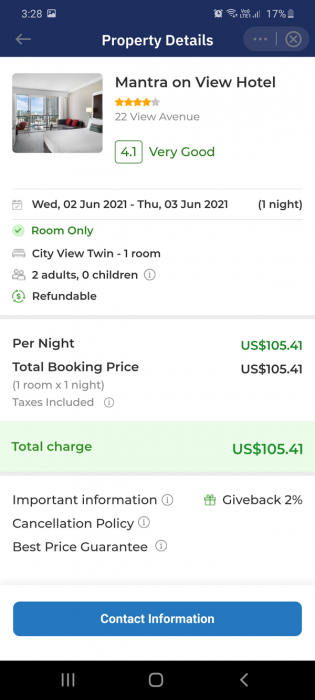

Nubank Blog

The company acquired Easynvest, a digital brokerage firm that offers a Bitcoin exchange-traded fund (ETF), in 2020 and is seriously challenging the global financial system by expanding its core credit card service to the unbanked to include personal lending and entrepreneurial investment loans.

On June 8, Nubank announced that it plans to use the money raised to fund its international expansion to Mexico and Colombia, launch new products and services, and hire more employees.

Superstar Executive Line-up

Nubank boasts an all-star team of brainiacs, including: Chief People Officer Renee Mauldin (Google, Twitter and Uber); Director of Operations Youssef Lahrech (MIT engineer and former senior vice-president at Capital One); and Product Director Jag Duggal (ex-Google and Facebook).

Although many Brazilians don’t have bank accounts, they do have mobiles and thus can use Nubank’s no-fee credit cards with a smartphone. The future we’ve been talking about is finally here. No wonder the banks and governments are FUDding. They are scared. Very scared – because the world is changing and they are being left in the dust.

Billionaire investor Charlie Munger‘s fear and negative sentiment towards Bitcoin and cryptocurrency in general will soon be a thing of the past. The old-school generation of corporate finance and Wall Street manipulation must die so the new generation of open source money, free from banks and institutional control, can live.