Institutional investors have sold at least 236,000 bitcoin since the UST/LUNA collapse in early May, which roughly translates to over US$5.3 billion.

It All Started With Terra

According to Vetle Lunde, an analyst from Arcane Research, institutions have offloaded 236,237 BTC since May 10, most of it forced selling triggered by the Terraform Labs collapse, which caused contagion all over the crypto industry:

However, Lunde says it’s likely things are worse than what he’s reporting and the dollar value could be way higher than US$5.3 billion:

Most of the selling of the 236,237 BTC mentioned in this thread has been forced selling, and it’s likely been worse than what this thread covers with underwater retail and institutions capitulating.

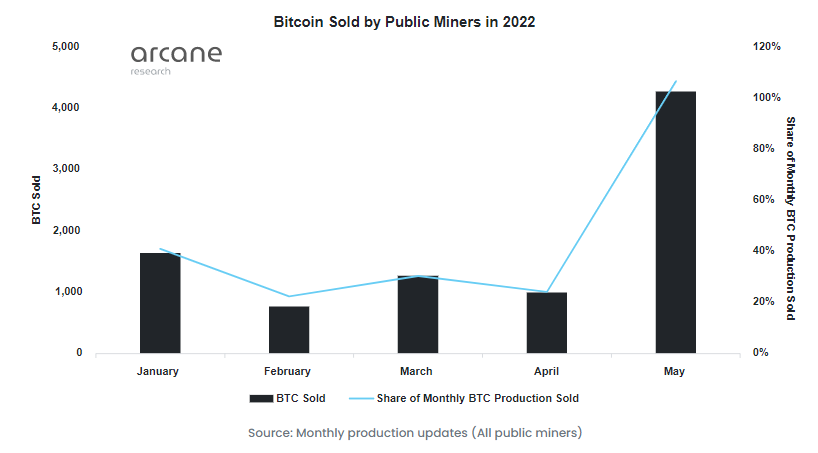

Forced Selling Infects Bitcoin Miners

At the same time, Lunde reports, Tesla sold 75 percent of its bitcoin holdings – around 29,060 BTC at an average price of US$23,209. Moreover, the forced selling spread to Bitcoin miners who reportedly had to dump all of their BTC holdings generated in May, an effective doubling of the usual 20 percent to 40 percent:

Shortly after the CPI (Consumer Price Index) sparked June’s broader market downturn, 3AC’s massive liquidation threw more fire into a market that was already burning. The infamous hedge fund now owes crypto lenders over US$3.5 billion.

Lunde ended his Twitter thread stating that the past two months’ capitulations, chapter 11 bankruptcies and July’s relief rally indicate contagion is getting resolved. “Less uncertain times ahead,” he concluded.