American multinational Mastercard has acquired blockchain forensic firm CipherTrace in an attempt to enhance its operations in the cryptocurrency industry.

According to a September 9 press release, the deal would enable both companies to combine their technologies, from AI to cyber capabilities, to differentiate card and real-time payments architecture. Mastercard hopes to close the acquisition by the end of the year, giving the company insight into more than 900 cryptocurrencies.

[The acquisition] follows a number of investments the company has made, including partnerships with Uphold, Gemini and BitPay to create crypto cards, the creation of new platforms to test and support Central Bank Digital Currencies, programs to support the broader use of blockchain technology and NFTs, and the potential to support select stablecoins directly on its network.

Mastercard press release

Mastercard’s Multiple Plans for the Crypto Industry

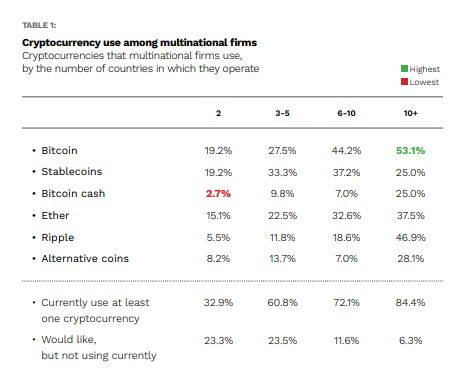

Six months ago, Mastercard announced support for cryptocurrencies, prioritising stablecoins and popular tokens like Ethereum and Bitcoin. With this acquisition, Mastercard dives deeper into the digital assets space and brings a solution to protect its customers and merchants, also allowing global businesses and stakeholders to build upon and comply with regulations for their digital assets services.

We help companies – whether they are banks or cryptocurrency exchanges, government regulators or law enforcement – to keep the crypto economy safe. Our two companies share this vision to provide security and trust throughout the ecosystem. We are thrilled to join the Mastercard family to scale CipherTrace’s reach across the globe.

Dave Jevans, CEO, CipherTrace

Mastercard added it’s joining forces with a broad set of partners, including fintech companies, crypto-wallet providers, and governments, to further drive innovation in the digital assets space. A year ago, the credit card giant teamed up with Blockchain Australia and VeChain to track Aussie food and wine exports with blockchain technology.