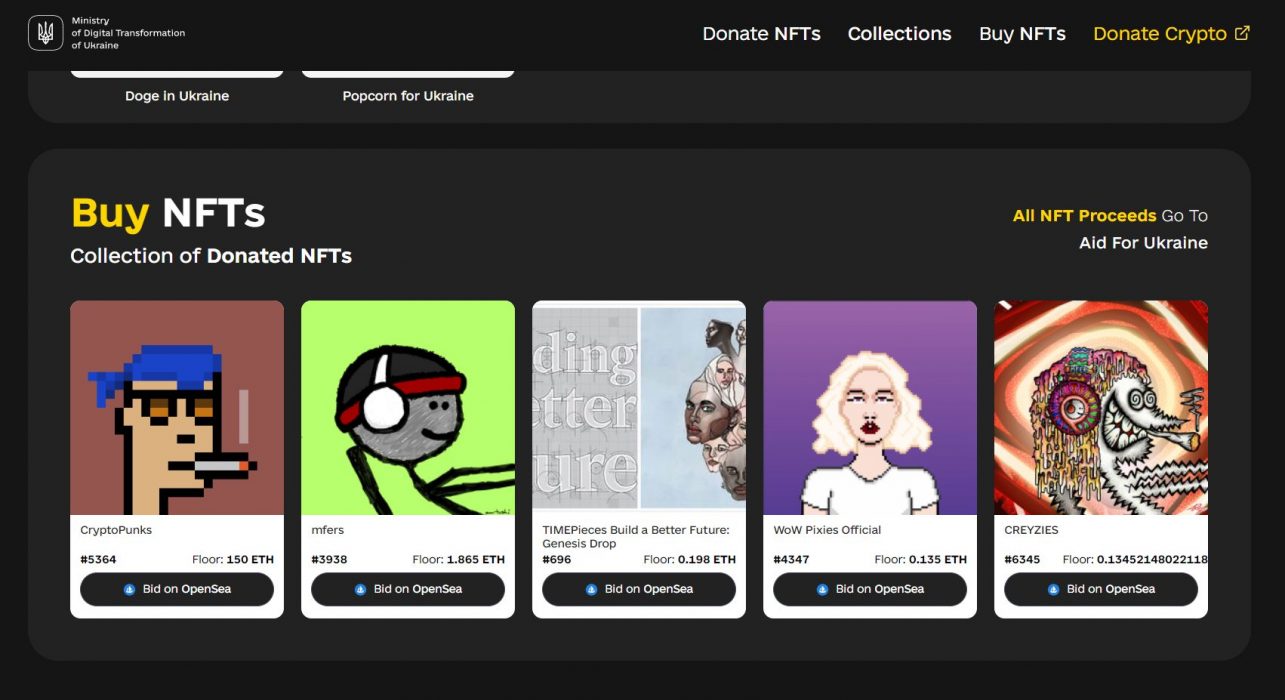

OpenSea has suffered a security breach on its main Discord channel, allowing hackers to promote a fake YouTube partnership with the NFT platform. OpenSea Support warned the community not to click on any links in its Discord channel, and that it would investigate the situation:

The scam was first pointed out by a Twitter user called Serpent, who shared a screenshot of the marketplace’s hacked Discord, showing the scammers promoting an NFT mint pass as part of a fake partnership with YouTube and a link to a phishing site:

Webhooks Used for Phishing

Apparently, the hacker(s) used webhooks – a technique used to augment or alter the behaviour of a web page in real-time – to access server controls.

The hacker(s) was able to stay on the server for a considerable amount of time before OpenSea staff were able to regain control. It appears that at least 13 wallets had fallen victim to the scam, as per on-chain data on Etherscan.

Another Discord Channel Hacked

Compromised Discord servers aren’t that uncommon, and more users are demanding better security protocols from the messaging platform.

It seems NFT channels are the biggest target for scammers. A month ago, Crypto News Australia reported how $APE dropped over 20 percent after the Bored Ape Yacht Club (BAYC) Discord channel got hacked.

Five months ago, blockchain gaming company Animoca had to repay users 265 ETH, or US$1.1 million, after several victims fell for fake NFTs, draining a considerable amount of money out of investors’ pockets.