As newly minted Prime Minister Anthony Albanese settles in to his role after the Australian Labor Party’s victory in last weekend’s federal election, emphasis is being placed on crypto regulation as one of the new government’s top priorities.

Albanese Prioritises Crypto

Labor has a lot of priority policies to install as it gets stuck into its term and, notably, crypto is a highlight on the list. Alongside its plans to tackle the cost of living and more urgently address the issue of climate change, Albanese’s government will be continuing the outgoing Liberal Party’s work towards regulating the industry as efficiently as possible.

Caroline Bowler, CEO of BTC Markets, has weighed in on the subject, stating that Labor will be looking to create a digital assets-focused regulatory bill. However, it will be a priority to avoid the restriction of future innovation while developing such a bill:

The primary concern would be to put together the appropriate regulatory regime for the marketplace, but also to leave room for innovation.

Caroline Bowler, CEO, BTC Markets

As Labor has inherited an increasingly difficult economic situation, crypto is unlikely to be the only financial sector up for examination.

Roadmap to Regulation

Crypto regulation had been a hot topic in government prior to Labor’s electoral win. April 23 saw the Australian Prudential Regulation Authority (APRA) produce a regulatory roadmap for the crypto industry. The roadmap outlined APRA’s preliminary risk management expectations for “regulated entities dealing with digital assets”.

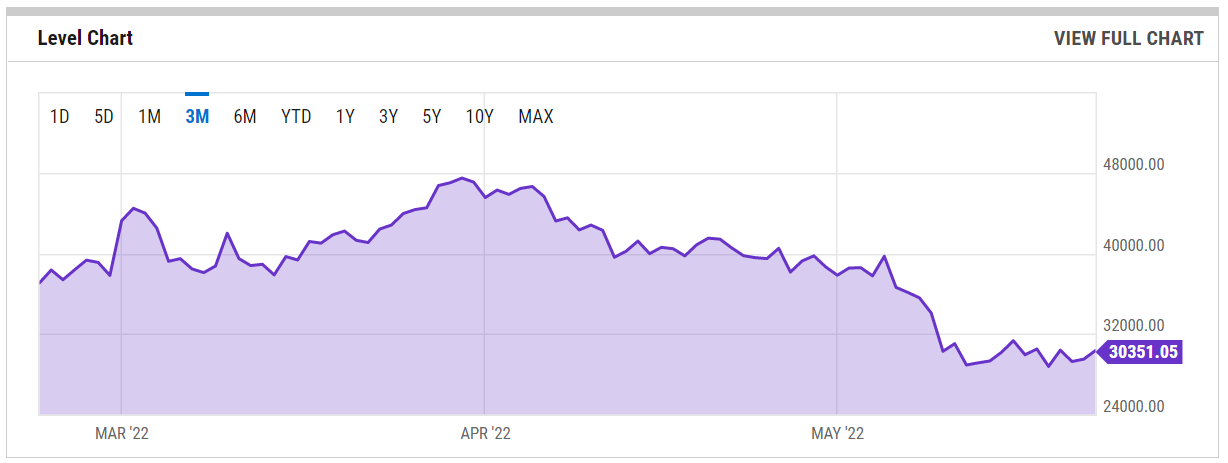

More recently, the Commonwealth Bank of Australia was forced to halt trading on its pilot crypto app amid market turmoil. The decision was justified by stating that CBA’s focus was on ensuring the endeavour was aligned with the required regulations.

Conversations surrounding the regulation of crypto really picked up in late 2021 as billions of dollars of investors’ money caused an industry boom, with the associated risks noticeably high for both investors and businesses.