Australia’s first non-fungible token (NFT) gallery has opened at Baringa – a new suburb near Caloundra – on the Sunshine Coast, with the goal of making the Queensland holiday region a hub for digital artists and tech enthusiasts:

According to Kenny Lienhard, chief executive of the METACOLLECT Gallery, the global NFT community – now worth billions of dollars, although its total value has slipped amid the current bear market – is poised to extend across business, sport and the wider community once market conditions improve.

Ideal Timing for an NFT Gallery

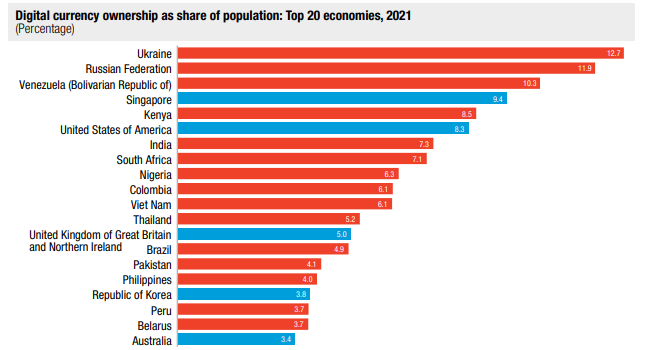

“Crypto artists now have the ability to sell their art and make a living via a global platform on their own terms,” Lienhard says. And with Australia ranking second in the world in terms of interest in NFTs, the timing of project makes perfect sense.

“We’ve developed our own NFT marketplace and publication, both focused on undiscovered Web3 artists while also providing the opportunity for the general public to easily mint NFTs and broadcast them directly onto gallery frames,” Lienhard adds.

METACOLLECT was co-founded by Lienhard and Sean Ballent, who in 2018 also jointly launched Cryptowriter, a blockchain-agnostic, community-driven crypto publication. “We decided our publication needed a brand mascot and our first NFT product was born.”

Two sold-out NFT collections later, the pair also designed an NFT art brand that would become UNDRGRND, formulated to discover and support underappreciated NFT artists.

Artist Publication Morphs into Gallery, Token and Marketplace

The UNDRGRND publication was launched in November 2021 and the next logical step for Lienhard and Ballent was to deliver their $COLLECT token, NFT marketplace and Web3 IRL gallery, under the collective banner of METACOLLECT.

The gallery is open to the public every Saturday from 10am-4pm. The address is Unit 11/9-13 Matheson St, Baringa.

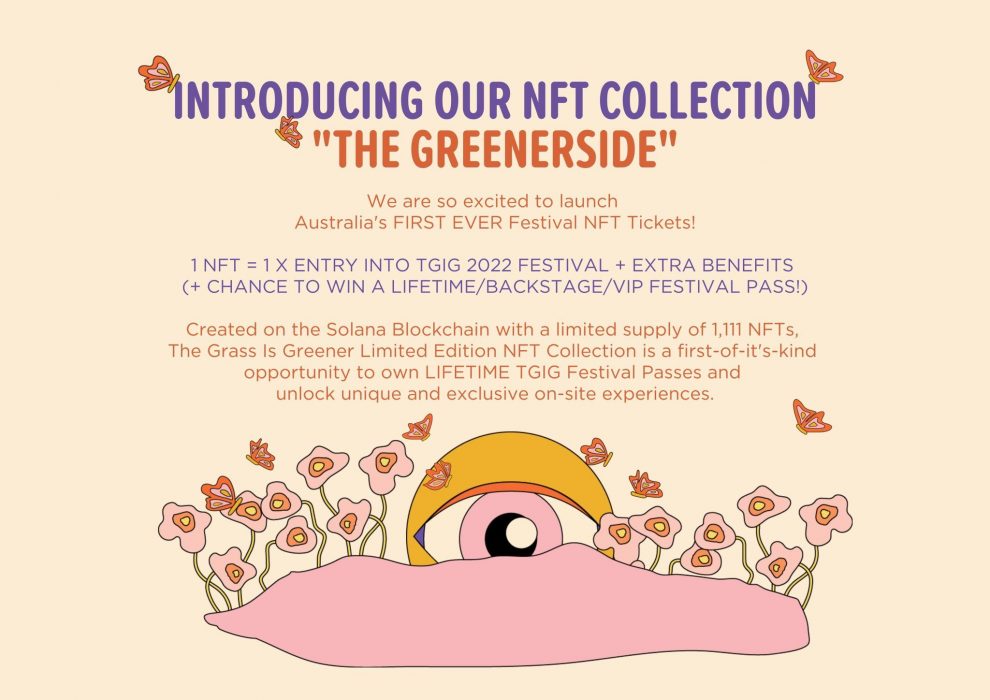

Hand in glove with the country’s inaugural NFT gallery, Australia’s first NFT-ticketed music festival, The Grass Is Greener, will also take place later this year in several east coast locations plus Canberra.