In response to a rash of recent stolen and plagiarised NFTs implicating its platform, OpenSea has announced the launch of a new feature that will automatically hide suspicious NFT transfers from view on its marketplace.

Fresh Investments in Safety Measures

Just last month, OpenSea suffered a security breach on its main Discord channel that allowed hackers to promote a fake YouTube partnership with the NFT platform. As a result, OpenSea has announced investments in theft prevention, IP infringement, scaling review and moderation. It also intends to reduce critical response times in high-touch settings, as foreshadowed by the project’s co-founder and CEO, Devin Finzer:

Self-Detection Technologies to Combat Fraud

OpenSea will use “critical auto-detection” technologies for copyright breaches and other instances of fraud. According to Finzer, removing such elements from the platform will improve its overall performance and will also prevent unsolicited advertisements and potential frauds on open blockchains being seen on OpenSea.

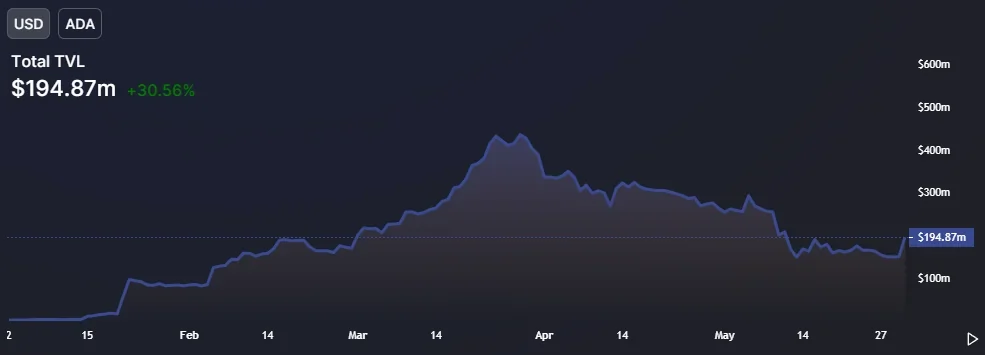

As the NFT boom broke out last year, business at OpenSea increased accordingly until frequent hacks and frauds left many investors dissatisfied with the platform’s efforts to compensate victims and combat theft. Last month, OpenSea rolled out measures to reduce fraud while improving authenticity.

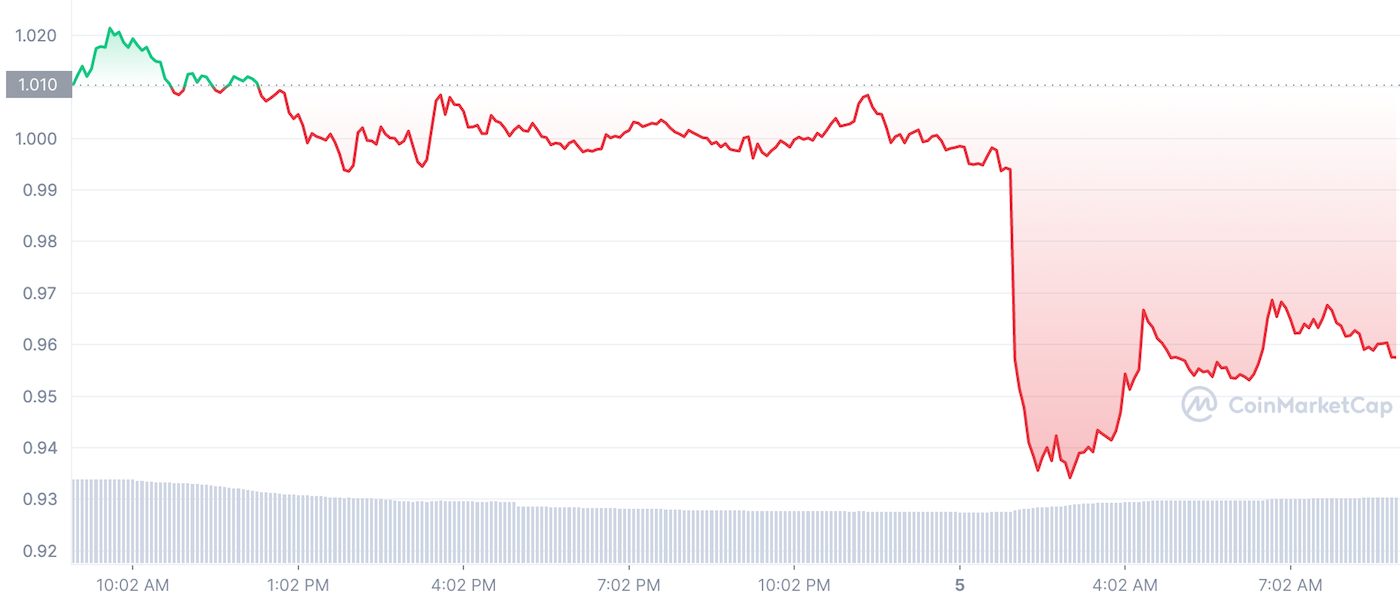

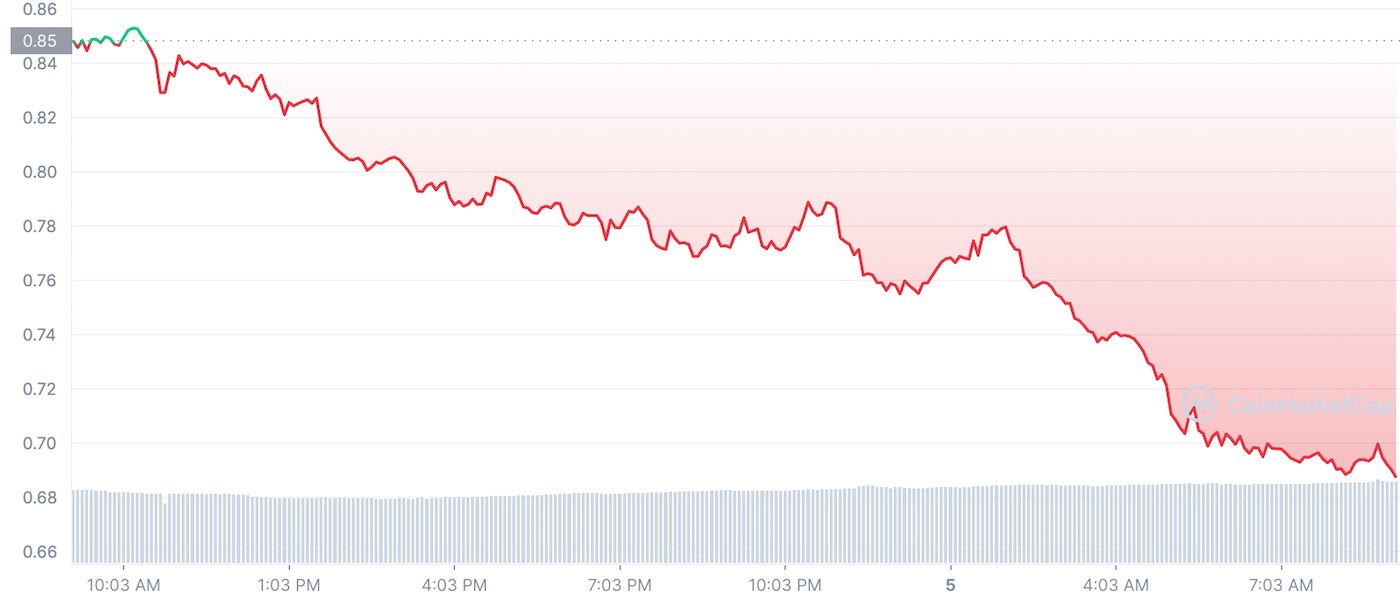

This latest round of safety measures arrives just as demand for NFTs is dropping off and the cryptocurrency market in general is in a downward spiral, though they will be nonetheless welcome.