Decentralised finance (DeFi) firm Aave liquidity protocol is working with Polygon (formerly known as MATIC) an Ethereum side-chain project to alleviate congestion and transaction fees on second-largest public blockchain.

In an announcement by Aave integration lead Marc Zeller, they will be exploring Ethereum sidechain technology for an increased user experience.

Block space supply today is scarce and limited, and since the “DeFi Summer” of 2020, demand for using Ethereum and DeFi has never slowed down […] High transaction fees are a feature of a successful public blockchain, as they define actors ready to pay the market price to use the decentralised services.

Marc Zeller, Integrations lead at Aave

One of the main assets of DeFi is the ability to build synergies with other projects, and by having an Aave Market in all the venues that matter, there’s no need for a “winner-takes-all” scalability solution and users can choose the solution they feel comfortable with.

Stani Kulechov, Aave founder

Polygon Sidechain Integration

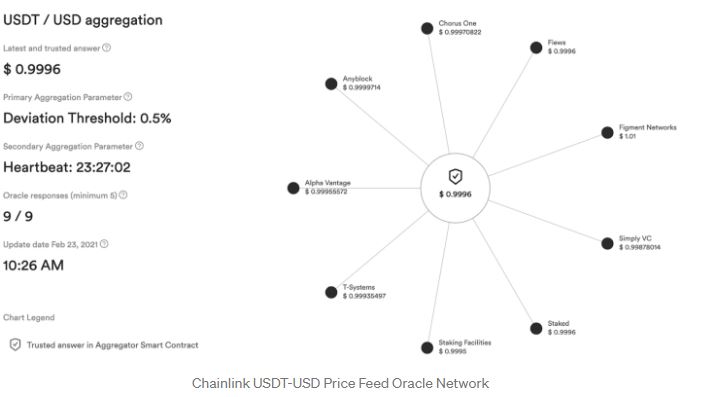

Polygon is a scalable sidechain of Ethereum and boasts a growing ecosystem, with some of the favourites being Aavegotchi and decentralised exchange Quickswap. Polygon is also powered by Chainlink oracles, benefiting Aave by gaining access to high quality and security price-data.

A sidechain on Ethereum refers to any mechanism that allows tokens from the layer 1 mainchain to be securely used within a completely separate blockchain but still moved back to the original chain if necessary.

Polygon will also be bringing in a smart-contract bridge to allow various other assets. Users of the bridge will receive part of the transaction fee used in MATIC tokens to cover most of their transaction fees on the Polygon blockchain.

A look at some of the fees:

- Deposit AAVE : $0.000061

- Borrow USDC : $0.000102

- Withdraw AAVE : $0.000109

- Repay USDC : $0.000072

At launch the following assets will be onboarded on the Polygon Aave Market :

- MATIC

- USDC

- USDT

- DAI

- WETH

- AAVE

- WBTC

With close to $43 billion currently locked within DeFi lending platforms. Built on Ethereum, Aave, a DeFi protocol aimed at both retail and institutional clients, has a market size of $6.48 billion, making it the third largest in the sector, according to DeFi Pulse. Aave has also integrated with Transak to enable the direct purchase of Polygon assets with fiat currencies.