The Australian Competition and Consumer Commission (ACCC) has announced it will be suing Meta over the company’s failure to block crypto scam advertisements involving Australian public figures that are in breach of Australian consumer law.

False Endorsements of Crypto Investments

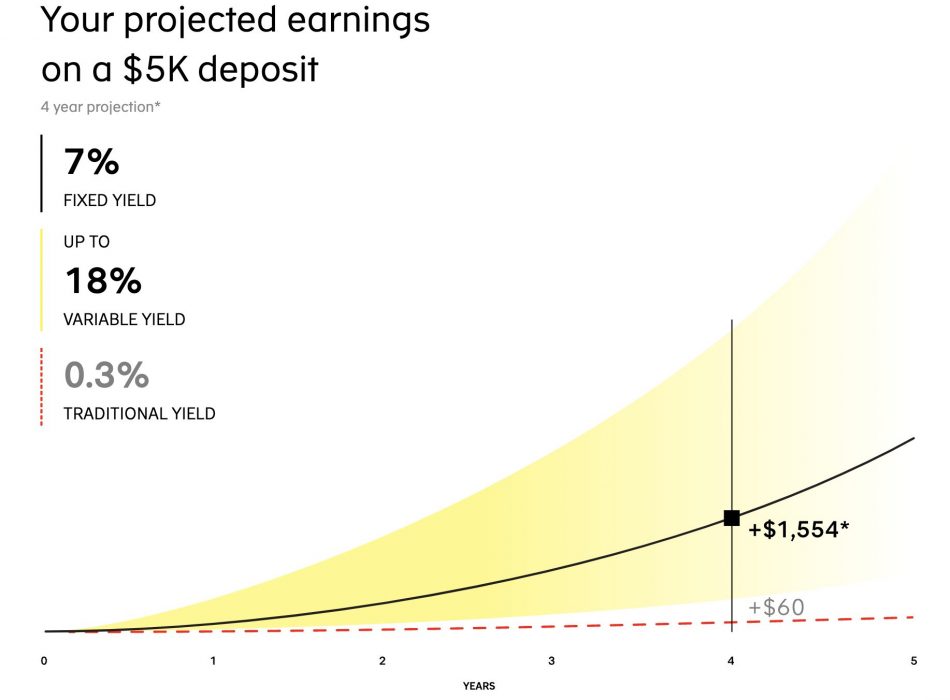

Dick Smith, David Koch and Andrew Forrest are some of the prominent Australian personalities unwittingly involved in a series of crypto scam ads circulating on Facebook. The ads claim that the featured celebrities have hugely benefited from cryptocurrency investments, then direct users to scam websites on the strength of these false endorsements.

The consumer watchdog believes that Meta is not doing enough to prevent the circulation of these ads on both Facebook and Instagram. The personalities in the ads have not given any permission for their names and faces to be used in the money-making schemes, and users who have engaged with this material have reportedly been the victims of intense pressure tactics, including phone calls asking for funds.

Rod Sims, the ACCC’s chair, outlined his disappointment with Meta’s lack of action and solutions in a March 18 media release:

Meta should have been doing more to detect and then remove false or misleading ads on Facebook, to prevent consumers from falling victim to ruthless scammers.

ACCC chair Rod Sims

Sims stated that in one circumstance an individual consumer lost A$650,000 to one of these scams. The ACCC will be seeking injunctions, penalties, declarations, costs, and other orders from Meta to ensure the practice does not continue.

Australia Cracks Down on Crypto Scams

News of the ACCC’s legal action against Meta follows an investigation into how Australians lost over A$70 million in 2021 through investment scams alone.

Scamwatch reported in July last year that investment scams involving cryptocurrency and other digital assets were on the rise. Other prominent fraud-related practices have included romance scams, personal identity theft and illegal crypto mining.