A new report from the Australian Competition and Consumer Commission (ACCC) published on June 7, 2021, shows scammers are now commonly receiving money from victims via crypto.

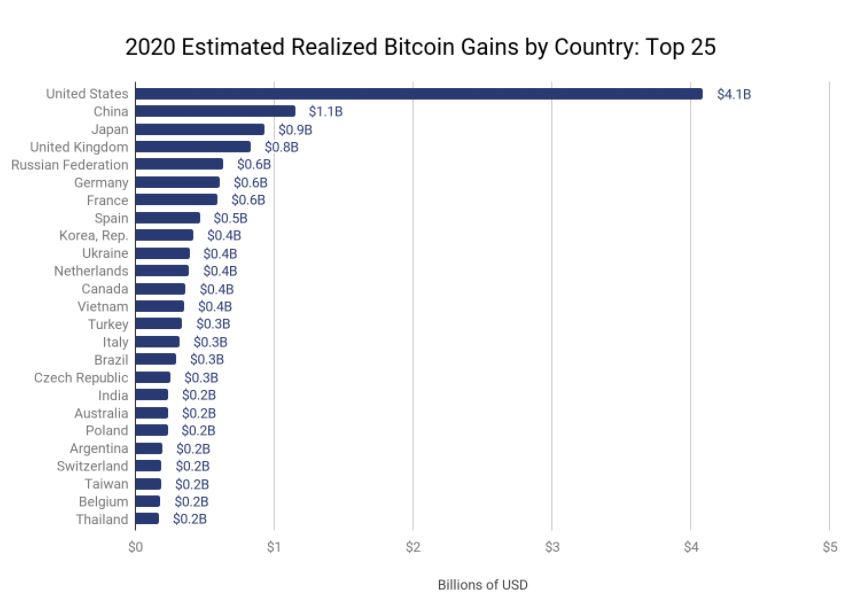

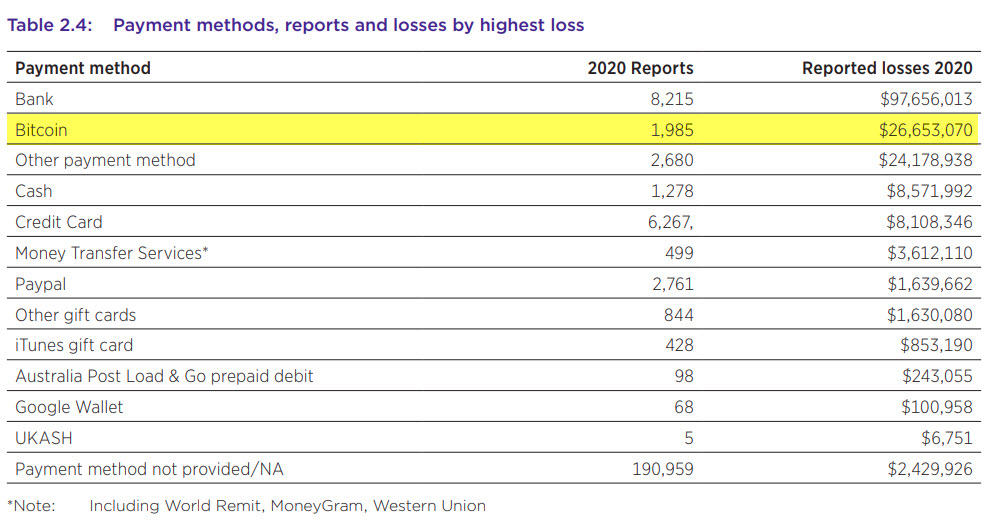

Bank transfer remained the most common payment method used in scams, with just over $97 million lost (a 40 percent increase). Bitcoin was the second-highest payment method, with $26.5 million lost.

Targeting Scams Report (page 14)

The Targeting Scams Report reveals that Australians lost over $850 million to scams in 2020. The figure is based on combined data from Scamwatch, ReportCyber, government agencies, banks, and payment platforms.

According to the report, it’s not surprising non-traditional payment methods are seen as ideal pickings by scammers. It states: “The perceived anonymity of unregulated cryptocurrencies can impede the ability to recover funds or identify scammers.”

Scammers Take Advantage of Rising Interest in Crypto

Scams resulting in the highest losses in 2020 included investment scams, romance scams, and business email compromises.

Many scammers used the COVID-19 pandemic as a ruse to separate people from their hard-earned cash. But Bitcoin and other cryptocurrencies were also a popular way to lure victims via various types of scams.

As financial analyst Martin North has previously warned crypto enthusiasts, the increasing value of crypto also brings out more ‘bad actors’ seeking naive investors.

Report Findings Explained

Scams relating to Bitcoin feature in multiple case studies included in the ACCC report, including:

- Investment scams: Featuring sophisticated fake trading sites. ACCC says it’s increasingly difficult for people to identify legitimate investment opportunities – this type of scam resulted in record losses of $328 million in 2020.

- Celebrity endorsements: Where images of public figures such as TV host David “Kochie” Koch promote fake websites and trading bots. For instance, Dick Smith’s likeness was used to defraud would-be cryptocurrency investors via ads on The Guardian website.

- Romance baiting scams: Striking up a connection via dating apps and then convincing the target to invest money, often in cryptocurrency. ACCC’s report found that people aged 25-34 lost the most money ($7.3 million) to romance baiting in 2020.

- Government impersonation scams: Where the scammer contacts a victim over the phone claiming to be from a government agency investigating fraud, and demanding victims deposit money via a Bitcoin ATM.

Bitcoin investment scams were also one of the most common types of scams reported that occurred on social media sites, according to the report, which shows losses to social networking scams increased more than 22 percent in 2020.

Other scams Crypto News Australia has reported on previously that investors should be wary of include fake invoice scams that targeted Tesla buyers, and dusting attacks – where very small amounts of crypto are added to a person’s wallet in an attempt to de-anonymise it.

If you spot a scam you can report it at www.scamwatch.gov.au.