Blockchain research firm Chainalysis has announced the launch of a 24/7 hotline accessible to victims of crypto crime. The Crypto Incident Response hotline will work to support organisations under attack from ransomware demands or targeted by crypto cyber-attacks:

Hotline Independent of Chainalysis

With crypto hackers responsible for US$3 billion of lost crypto value via theft and ransom demands from just 251 attacks in 2021, Chainalysis’ announcement is a welcome one:

We’re investing in this service not just to assist organisations in their times of need, but also to help bring bad actors to justice and demonstrate that crypto is not the asset class of anonymity and crime.

Chainalysis blog post

The hotline will be independent of the analytics service and will not require victims to be existing Chainalysis customers. This rapid-response strategy aspires to turn up the heat on hackers, making it more difficult for them to cash out. The Chainalysis team has also indicated its willingness to liaise with law enforcement on victims’ behalf.

Despite many organisations having called for the implementation of the hotline, just as many voices on Twitter seem to be on edge about what this could mean for their money and their privacy:

Regardless, with time of the essence in these cases, Chainalysis is hoping that its strategy will decrease the quantity and severity of crypto crime in the industry.

Chainalysis Monitors Crypto Crime

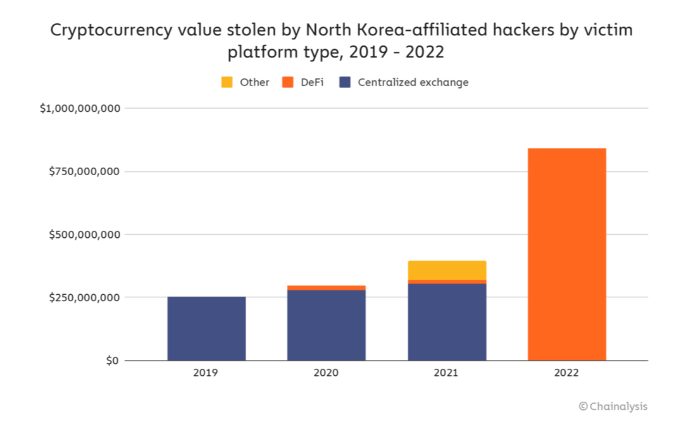

Earlier this month, Chainalysis published a report stating that DeFi projects were most often the target of crypto attacks. As many as 97 percent of all crypto attacks have been directed at DeFi projects since the beginning of 2020, with the biggest DeFi hack on record – in which Axie Infinity lost over US$600 million – happening on March 30 this year.

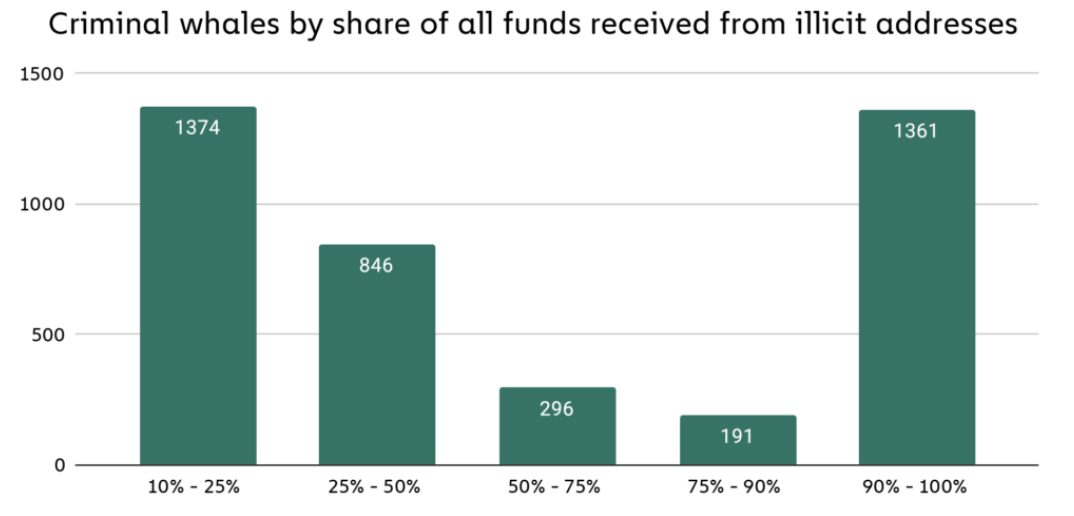

Chainalysis also announced in February that ‘criminal whales’ were holding US$25 billion in digital assets. Defined as private wallets holding over US$1 million of crypto, where a minimum of 10 percent of these funds are obtained from illicit addresses, criminal whales are commonly associated with fraud, malware, and scams.