Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Binance Coin (BNB)

Binance BNB is the biggest cryptocurrency exchange globally, based on daily trading volume. Binance aims to bring cryptocurrency exchanges to the forefront of world financial activity. Aside from being the largest cryptocurrency exchange, Binance has launched a whole ecosystem of functionalities for its users. The Binance network includes the Binance Chain, Binance Smart Chain, Binance Academy, Trust Wallet, and Research projects, which all employ the powers of blockchain technology to bring new-age finance to the world. Binance Coin is an integral part of the successful functioning of many of the Binance sub-projects.

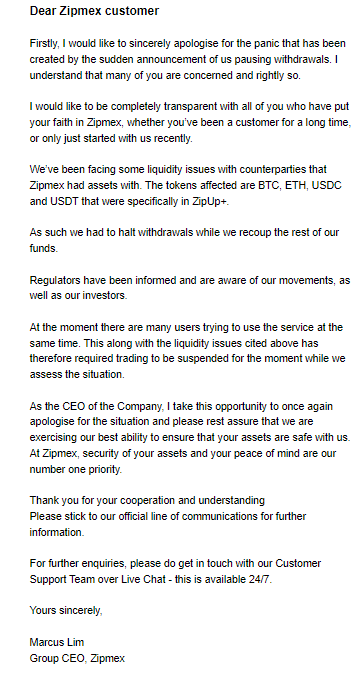

BNB Price Analysis

At the time of writing, BNB is ranked the 5th cryptocurrency globally and the current price is US$263.18. Let’s take a look at the chart below for price analysis:

After a 55% decline from Q2, BNB has ranged between $198 and $270. The recent price recovery was approaching probable resistance near $296 but could be aiming for stops above the relatively equal highs near $326. Continuation of the trend could target the daily gap near $354.

Aggressive bulls might add to positions near $260 and $254. Price action near $240 – if it gets there – may be more likely to provide support during any retracements.

Relatively equal lows clustered around $235 seem likely to be swept if the bearish trend resumes. If this move occurs, the price might find support at the significant higher-timeframe level near $219.

2. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

At the time of writing, LTC is ranked the 20th cryptocurrency globally and the current price is US$58.90. Let’s take a look at the chart below for price analysis:

After setting a low last week, LTC kicked off a with recovery trend to break the weekly highs. The following 75% plummet found support near $42.36, sweeping under the 40 EMA into the 63.8% retracement level before bouncing to resistance beginning at $60.73.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $64.12, where aggressive bulls might begin bidding. The level near $70.18, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $78.13.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $50.18 could provide at least a short-term bounce. If this level fails, the old monthly lows near $43.65 may also give support and see the start of a new bullish cycle after retesting these support levels.

3. Axie Infinity (AXS)

Axie Infinity AXS is a blockchain-based trading and battling game that is partially owned and operated by its players. The Axie Infinity ecosystem has its own unique governance token, known as Axie Infinity Shards AXS. These are used to participate in key governance votes and give holders a say in how funds in the Axie Community Treasury are spent.

AXS Price Analysis

At the time of writing, AXS is ranked the 39th cryptocurrency globally and the current price is US$17.30. Let’s take a look at the chart below for price analysis:

AXS‘s relatively small 23% range could suggest that a recovery is setting up in July.

Aggressive bulls could look for entries at the most recent area of support formed near $15.34. However, equal lows near $14.32 make a tempting target for a stop run into this support. This move could reach support near $12.90.

A decisive move to the downside could run stops below the second set of relatively equal lows near $11.80, possibly reaching support at an old swing high and a daily gap near $11.00.

A recent level near $19.84 provided resistance and caused a swing high to form near $21.88, offering first targets. A move through this high may arrive at new monthly high levels near $23.40 and $25.13.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.