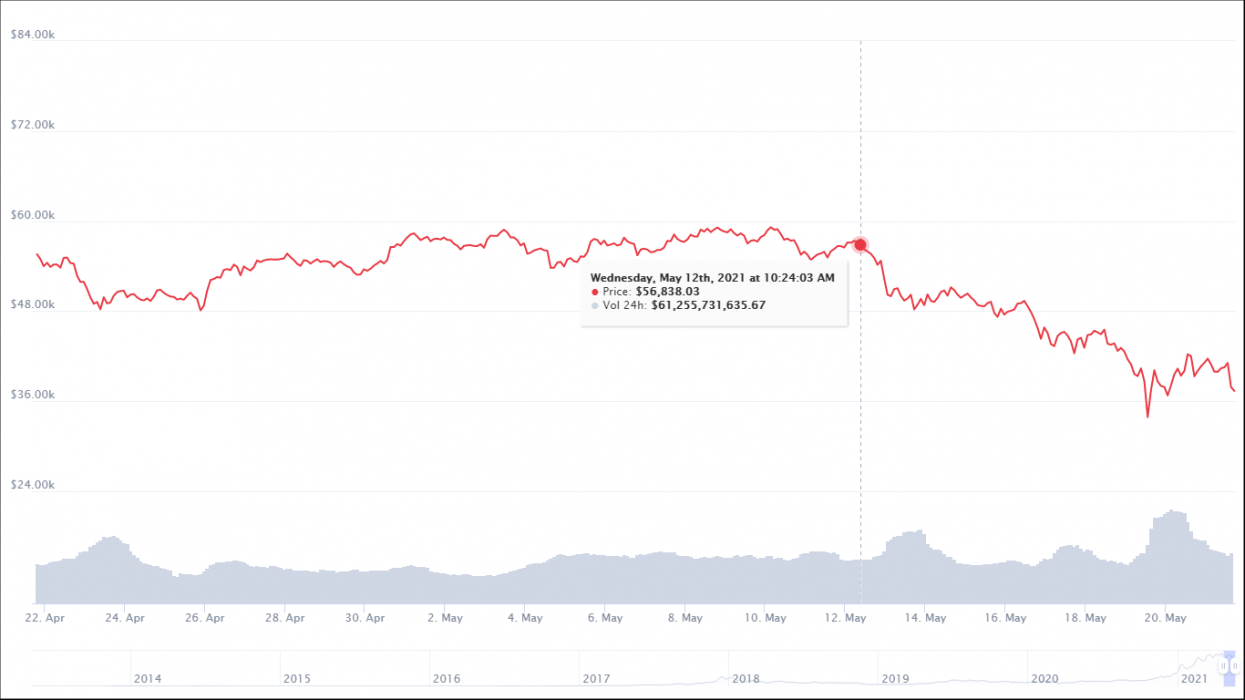

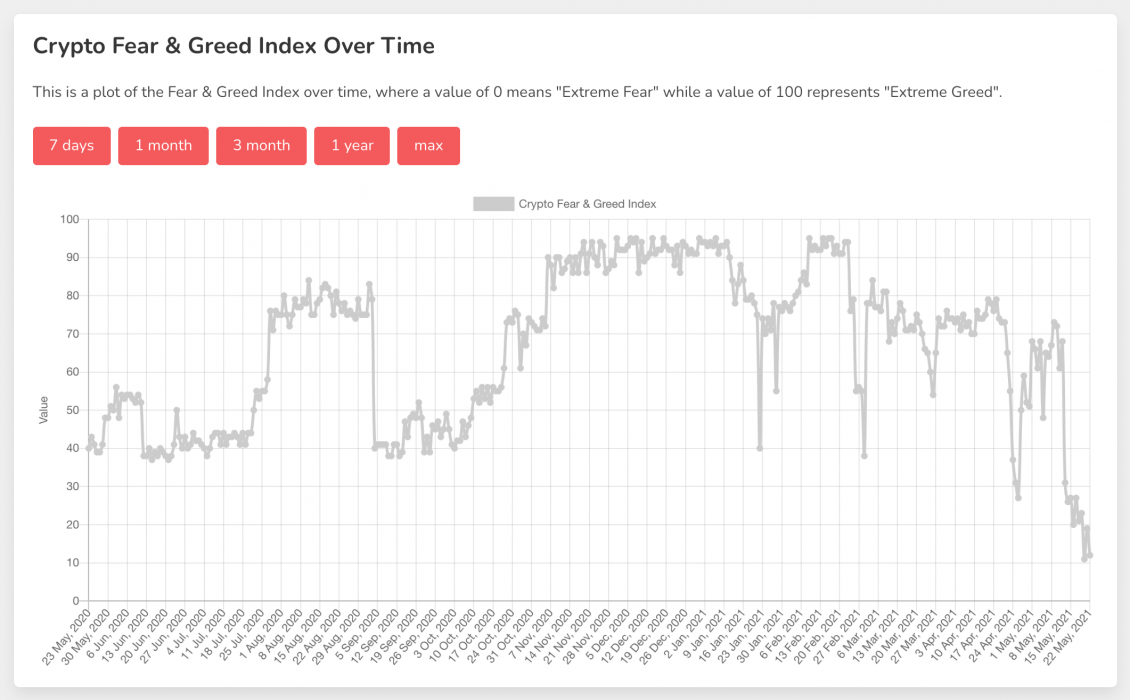

The Bitcoin Fear and Greed Index is the lowest that it has been for the past year – reaching a point of 10 indicating extreme fear in the market.

This indicator shows the current sentiment of the Bitcoin market into a simple meter from 0 to 100. Zero means ‘Extreme Fear’, while 100 means ‘Extreme Greed’.

From Greed To Fear

The lowest it has ever been was back in August 2019, hitting a point of 5. Just earlier this month however, it was at 73, indicating a rating of greed, coming down slightly from extreme greed highs of 95/100 earlier this year.

Tools like the Fear and Greed Index can help traders gauge market sentiment and react to ever-changing patterns and trends.

Triggering Trading Emotions

GREED – People tend to get greedy when the market is rising which results in huge FOMO (Fear Of Missing Out). The general pattern emerges as more and more buyers come into the market, it eventually tops out and a correction follows after a period of too much greed.

FEAR – When the market turns and more and more traders sell, FUD (Fear Uncertainty and Doubt) sets in and this cascades downwards. When this bottoms out, some traders then see this as a buying opportunity and the cycle changes and repeats.

Warren Buffet’s Famous Saying

The investment godfather Warren Buffet was famous for the following quote.

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

Warren Buffet

This advice from Warren Buffet suggests that we could use the Fear and Greed Index indicator as a tool to assist us when we are trading and investing cryptocurrencies.