Worldcoin is a newly launched cryptocurrency out of Silicon Valley that wants to get its coins into as many hands as possible, as quickly as possible. In exchange for your free share, you’ll only need to have your eyes scanned by their “Orb” as “proof-of-personhood”.

Let’s Talk About Worldcoin

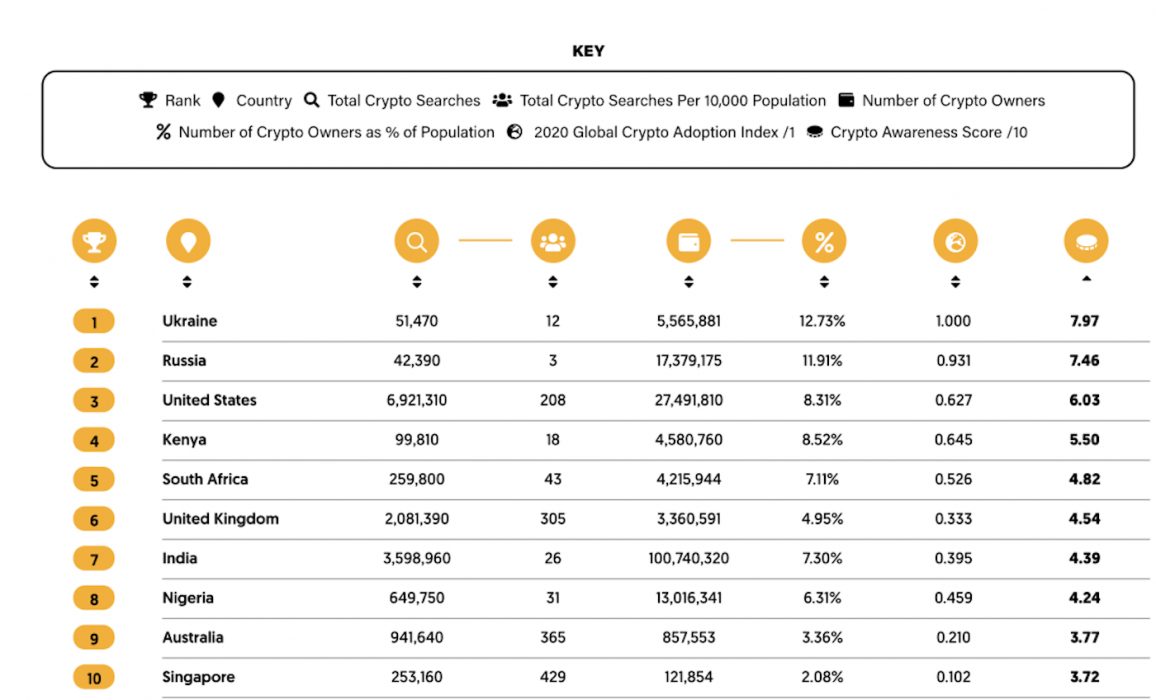

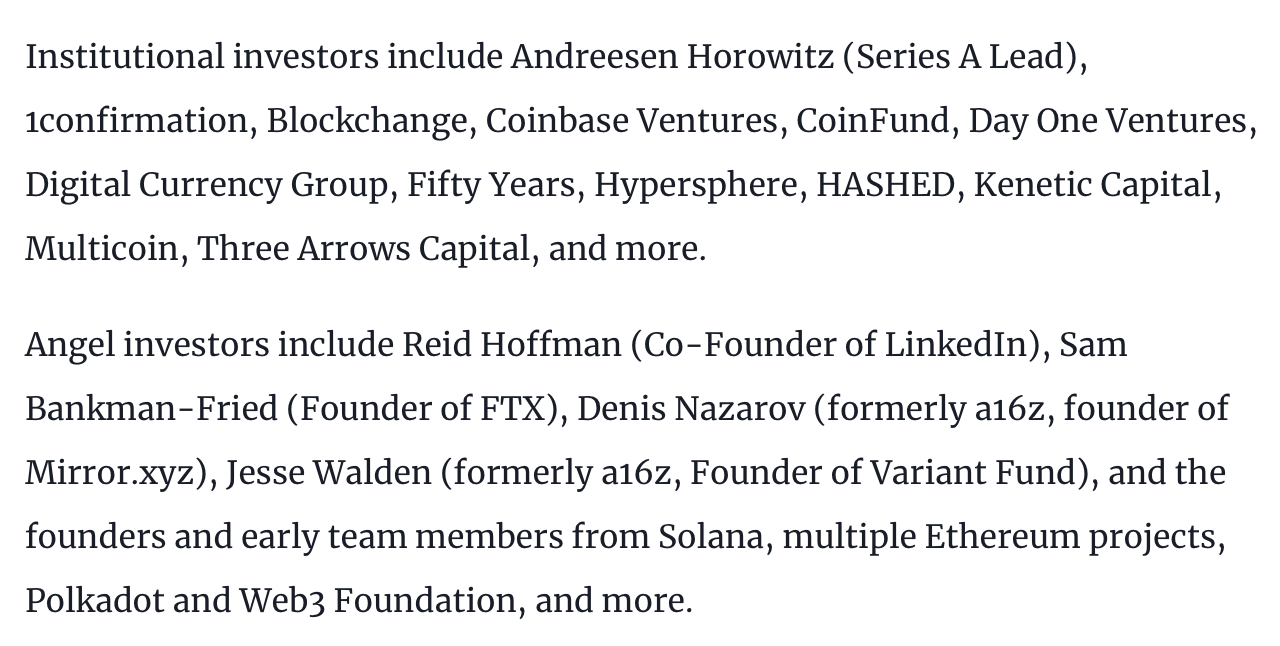

Worldcoin claims to be a “new, collectively owned global currency that will be distributed fairly to as many people as possible”. Unfortunately, a quick glance at the company’s investor base suggests that the distribution of coins is likely to be anything but “fair”. Willy Woo correctly pointed out: “How is it fairly distributed when it has primary round investments by the big name VCs and angels?”

False claims of fair distribution aside, you may still be wondering what Worldcoin is actually trying to do. What is their value proposition and what real-world problems are they looking to solve? These seemingly trivial details would appear to have been overlooked in their haste to outline how this coin will be readily adopted worldwide.

To rapidly get its new currency into the hands of as many people as possible, Worldcoin will allow everyone to claim a free share of it. For this to happen, we first had to solve one major challenge: ensuring that every person on Earth can prove that they are indeed human (not a bot) and that they have not received their free share of Worldcoin already. This challenge is the longstanding problem of ‘unique-humanness’: how can you prove you are you, without telling us anything about yourself?

Worldcoin website

The coin’s lack of utility isn’t apparently a problem when it comes to the company’s vision of having the entire planet collect their free share. Instead, the issue is proving your “unique-humanness”, otherwise users would be double-claiming.

Fortunately, to solve this issue Worldcoin has a new device called an “Orb”, which scans a person’s eyes and makes it possible to know if the person has already signed up for their free share. The plan is to manufacture and distribute Orbs around the world. Orb holders then grow the network by bringing on individuals and having their eyeballs scanned. It’s like Herbalife, but for crypto.

For users concerned about privacy, the company says they needn’t worry due to “modern cryptography”, but Edward Snowden remains unconvinced about this and CBDCs.

Silicon Valley Tone Deaf?

Silicon Valley is known for being in a bubble, and this uniquely invasive and dystopic effort would appear to support that view. Could it be that Silicon Valley is entirely disconnected from the ordinary person and their concerns? The founder himself even admitted that he “underestimated the visceral reaction to using biometrics”.

To anyone paying even a little attention, it was obvious that this would be the response.

Worldcoin is seemingly, on the face of it, a self-serving project lacking any utility or value for its users, but that alone is unlikely to prove enough of a deterrent for investors looking for the next big thing.