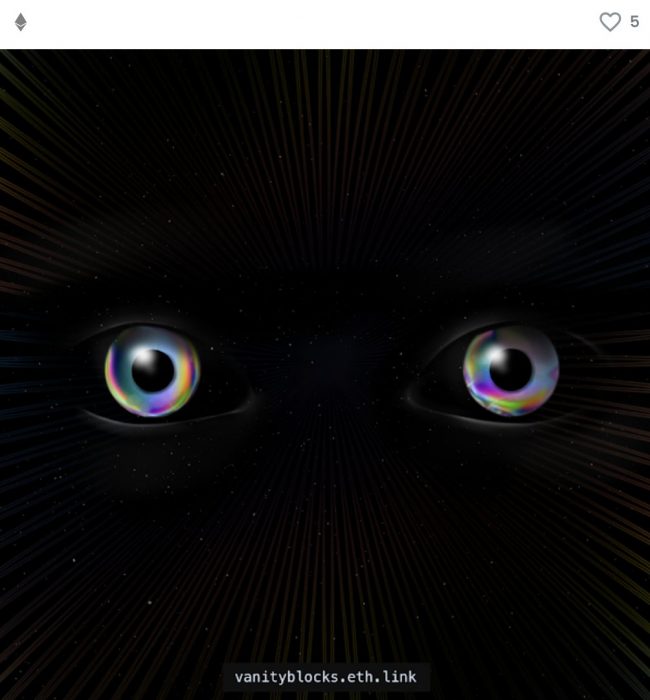

Following the lead of Twitter, Reddit and YouTube, racy online subscription service OnlyFans has announced that its users can now use verified Ethereum non-fungible tokens (NFTs) in their profile images.

Creators who choose to do so will receive an Ethereum symbol to show they own the asset. When users click on an NFT profile picture, they will see more information about the digital asset from OpenSea:

The idea of digital ownership is important to OnlyFans, a Web2 company whose business model has at times put it at odds with the traditional financial system.

Our mission is to empower creators to own their full potential. This feature is the first step in exploring the role that NFTs can play on our platform.

OnlyFans CEO Amrapali Gan

Launching in 2016, OnlyFans’ initial appeal was to amateur porn stars looking to take their “act” direct to audiences and cut out (at least some of) the middlemen. Similar to Patreon, OnlyFans takes a cut of the action in exchange for use of the platform.

New CEO Soft-Pedals OnlyFans Content

But the site has worked to temper its X-rated image, gradually replacing porn content with live music sessions, cosplay tutorials and fashion tips. Former chief marketing and communications officer (now CEO) Amrapali Gan took over the platform in December and says he has since shifted its emphasis to “non-nude” content.

Not that OnlyFans has dispensed with suggestive photos and videos entirely – that would serve to alienate much of its (hard) core audience.