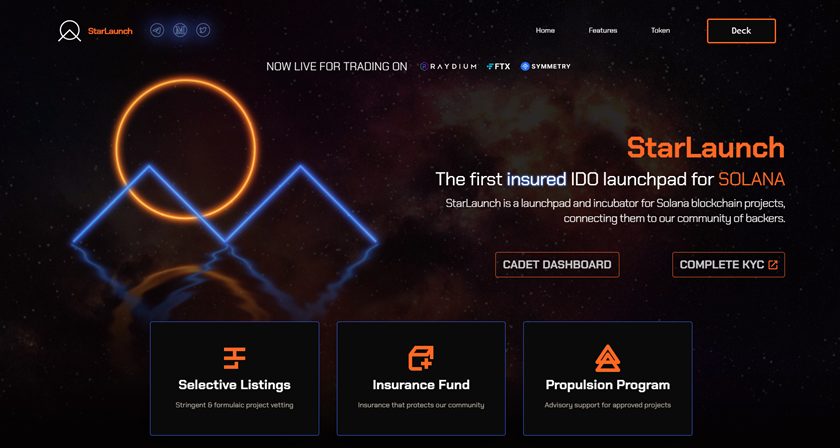

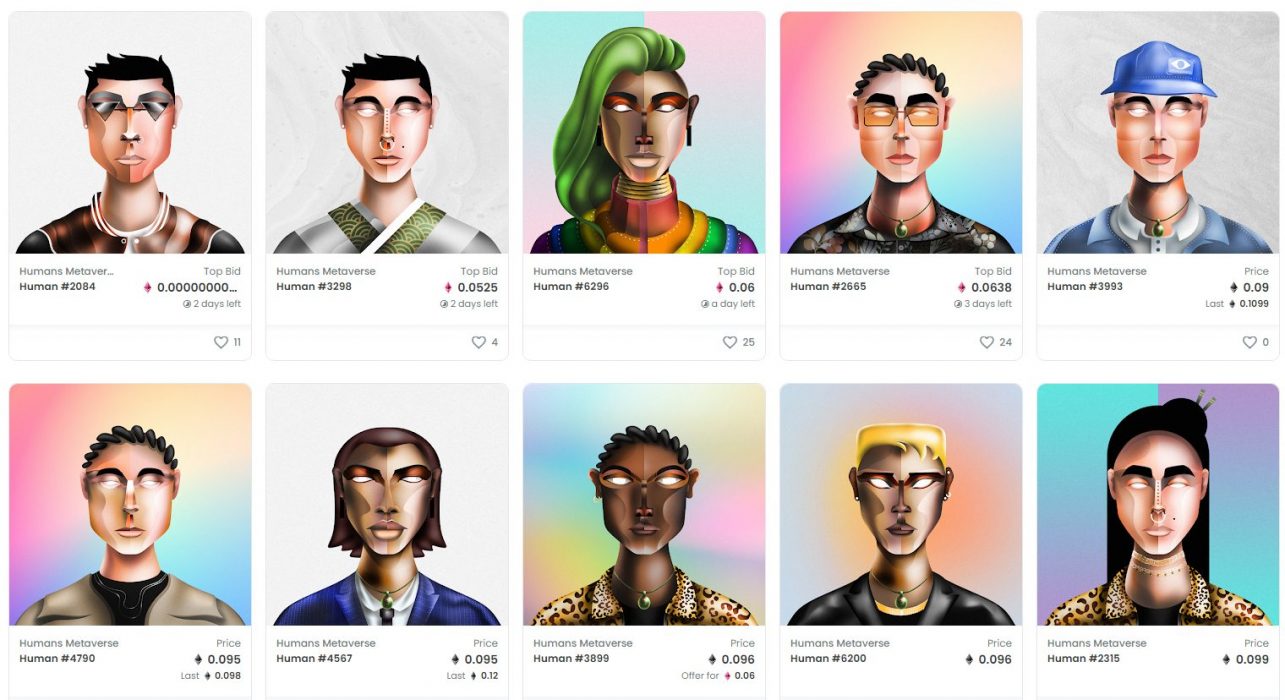

Humans of the Metaverse, a new and unique collection of Meta-Human NFTs, is launching in-game virtual NFT art auctions. In Q1 of 2022, users will be able to access one-for-one artwork NFTs, all using the project’s native token, $HOTM.

Humans of the Metaverse (HOTM token) has exciting prospects amid the metaverse boom. The project comprises a collective of 6,500 unique Meta-Human NFTs, stored as ERC-721 tokens on the Ethereum blockchain and hosted on the InterPlanetary File System (IPFS), which is essentially a distributed system for storing and accessing files, websites, applications and data.

Residents of the Metaverse are represented by a unique composition from 200 traits collected from the most notable and influential personalities, taken from all temporal spaces. The project is on the road to creating the “MetaCity” – a fully integrated Web3 ecosystem where HOTM token holders will reside and be able to spend the project’s native token, $HOTM, in an increasing number of ways, giving long-term value and utility to holders as the city grows.

Holders of Humans NFTs will be able to perform various activities and “interact” with a range of buildings within the HOTM ecosystem via the $HOTM token.

Humans of the Metaverse Roadmap

Within the MetaCity, Humans will be able to generate tokens via ‘jobs’ – another trait conferred on the NFTs. Each job determines the specific NFT’s $HOTM generation rate, and ‘salaries’ will range between 10-30 $HOTM/day. Along with token generation, holders will be able to invest in real estate by buying land and city essentials, along with buildings, each of which is upgradeable to allow evolution and expansion.

Within the metaverse will be a museum where Human NFT holders will be able to spend $HOTM on 1/1 artworks, personalised Humans tailored to their holders’ likeness, along with NFTs from other projects. The project, however, wants to make it clear that 1 $HOTM = 1 $HOTM, which means these tokens do not have a monetary value.

Initial Humans NFTs Sold Out But More Available on Secondary Market

According to the HOTM website, the initial set of Humans NFTs sold out within 15 minutes on the OpenSea marketplace, and over 100 ether (ETH) was traded in the first hours of the sale. Do not fear, however – Humans NFTs are available for purchase on the secondary market to all those who missed out during the initial sale.

The Metaverse: The Next Big Thing

The term “metaverse” is relatively new to the world of cryptos, but that has not stopped the concept booming. Exhilarating projects are on the rise and it is fast becoming the next big investment theme, according to financial powerhouse Morgan Stanley.

Last month, the global banking giant issued a statement to its investors in which it notes the metaverse is garnering much attention, with both Meta (formerly Facebook) and Microsoft venturing into the space. Accordingly, Morgan Stanley said, “it can fundamentally change the medium through which we socialise with others”.