After staging a recovery following January’s sell-off, the cryptocurrency market has yet again felt the pain of a sharp decline after U$250 billion was erased from the sector’s market capitalisation (market cap).

A Sea of Red

Initial negative price action started over the weekend, which saw bitcoin drop below US$43,000, accelerated by US$152 million in leveraged long liquidations. In total, the market saw over US$439 million in liquidations within 24 hours.

It is, however, worth noting that these levels remain relatively mild compared to prior episodes, suggesting that further losses may be on the horizon.

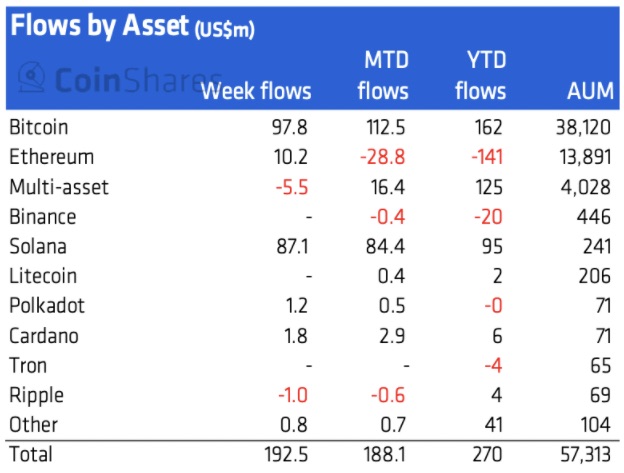

Bitcoin then continued its descent on Monday, dropping 15 percent in 24 hours, falling below US$40,000 for the first time since March 15. Meanwhile, Ethereum fell 14 percent, sinking below the US$3,000 mark for the first time since March 23. Across the board, with the exception of Monero (XMR), all major cryptocurrencies are significantly down over the past week:

Fear and Uncertainty

Digital assets form part of the broader investment universe, and due to their speculative nature tend to get hit hardest when sentiment shifts risk-off. Risk-on assets, such as equities and crypto, generally decline when market fear takes hold as investors seek safety in less risky assets.

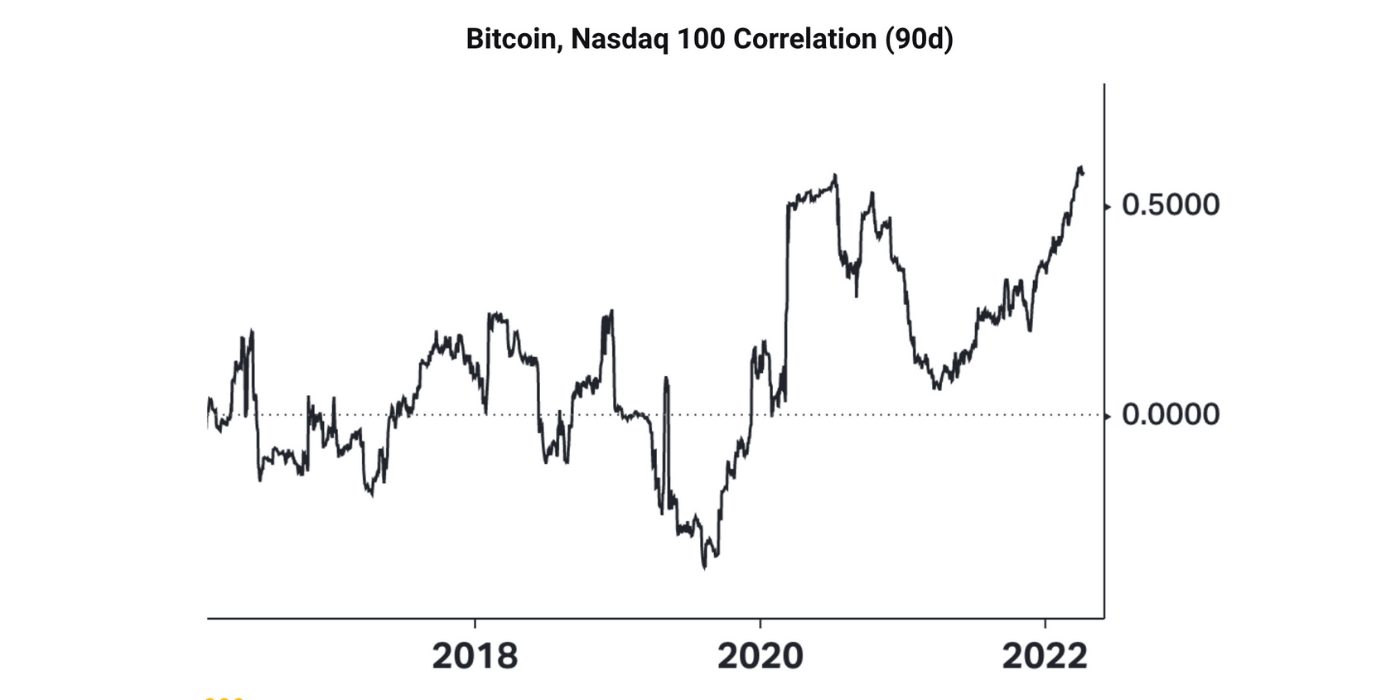

For these reasons, bitcoin (and other digital assets) tend to mirror the performance of the equity market in the short term, specifically the higher volatility tech sector.

Since March 2020, Bitcoin’s correlation with the tech-heavy Nasdaq 100 has increased significantly:

It’s therefore not surprising that all major global equities indices are down amid growing inflation and slower economic growth, resulting in many investors reducing exposure to higher volatility growth assets.

This follows news of the 10-year US Treasury yield rising to a three-year high, making tech stocks significantly less attractive, and cryptocurrencies even less so. In addition, there’s an ongoing war in Ukraine and the Federal Reserve is posturing to aggressively raise interest rates.

For these reasons, macro sentiment is negative and fear is widespread, resulting in a flight to safety away from assets such as cryptocurrencies. With US inflation figures due to be released this week, the market remains on edge, and as Bitcoin analyst Will Clemente recently opined on Twitter: