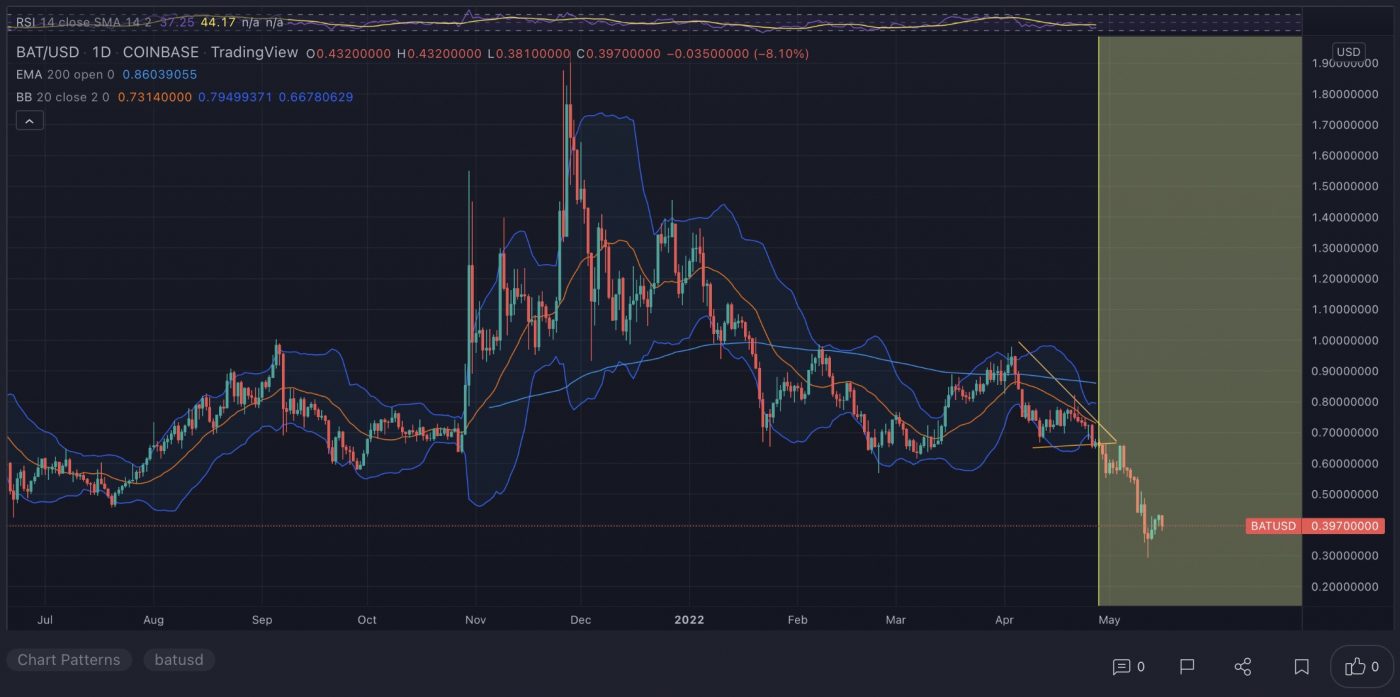

Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. SushiSwap (SUSHI)

SushiSwap SUSHI is an example of an automated market maker (AMM). An increasingly popular tool among cryptocurrency users, AMMs are decentralised exchanges that use smart contracts to create markets for any given pair of tokens. SushiSwap aims to diversify the AMM market and also add features not previously present on Uniswap, such as increased rewards for network participants via its in-house token, SUSHI.

SUSHI Price Analysis

At the time of writing, SUSHI is ranked the 155th cryptocurrency globally and the current price is US$1.34. Let’s take a look at the chart below for price analysis:

After retracing nearly 75% from its Q1 highs, SUSHI set a low near $1.22 as it formed its current range.

Last week, the price swept highs near $1.53, which now also marks the previous monthly high. Relatively equal daily highs near $1.60 provide a reasonable target, although resistance beginning near $1.64 could cap the move. A break of this resistance is likely to target the swing high near $1.77 into higher-timeframe resistance beginning near $1.90.

The current area near $1.30 could provide support, although bulls may be more likely to buy near the price fractal near $1.24 if a retracement reaches this level. A break of this area could continue down to sweep the low near $1.13 into possible support beginning near $1.02.

2. Axie Infinity (AXS)

Axie Infinity AXS is a blockchain-based trading and battling game that is partially owned and operated by its players. The Axie Infinity ecosystem has its own unique governance token, known as Axie Infinity Shards AXS. These are used to participate in key governance votes and give holders a say in how funds in the Axie Community Treasury are spent.

AXS Price Analysis

At the time of writing, AXS is ranked the 48th cryptocurrency globally and the current price is US$21.21. Let’s take a look at the chart below for price analysis:

AXS‘s relatively small 25% range could suggest that a recovery is setting up in May.

Aggressive bulls could look for entries at the most recent area of support formed near $20.34. However, equal lows near $19.42 make a tempting target for a stop run into this support. This move could reach support near $18.90.

A decisive move to the downside could run stops below the second set of relatively equal lows near $17.23, possibly reaching support at an old swing high and a daily gap near $15.58.

A recent level near $27.84 provided resistance and caused a swing high to form near $30.88, offering first targets. A move through this high may arrive at new monthly high levels near $33.31 and $35.30.

3. PancakeSwap (CAKE)

PancakeSwap CAKE is an automated market maker (AMM) – a decentralised finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. PancakeSwap uses an automated market maker model where users trade against a liquidity pool. These pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return. PancakeSwap allows users to trade BEP20 tokens, provide liquidity to the exchange and earn fees, stake LP tokens to earn CAKE, stake CAKE to earn more CAKE, and stake CAKE to earn tokens of other projects.

CAKE Price Analysis

At the time of writing, CAKE is ranked the 44th cryptocurrency globally and the current price is US$4.63. Let’s take a look at the chart below for price analysis:

CAKE‘s 75% decline after Q1 created relatively equal lows near $3.56 before bouncing over the local range’s midpoint near $4.60. A bullish altcoin market could help CAKE bulls regain a stronger bullish trend.

Aggressive bulls could look for entries in the daily gap starting near 4.46. The monthly open aligns with more probable support near $4.28.

A stop run below the monthly open near $4.10 might provide a more favourable entry. A more substantial bearish move – perhaps from a sharp drop in Bitcoin’s price – could challenge support near $3.90, just above the equal lows.

Resistance rests just above, with the zone from $4.95 to $5.37 likely to provide a short-term ceiling. A break through this level might target resistance just under the cluster of relatively equal highs near $5.77.

Beyond these highs, resistance near $5.89 provides a final challenge before attacking an old daily swing high near $6.52.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.