After declining more than 15 percent over the past week, the value of Bitcoin has slipped below US$30,000 for the first time since July 2021 – creating a new market cap of US$588 billion, down from US$900 billion.

Interest Rate Rise to Blame

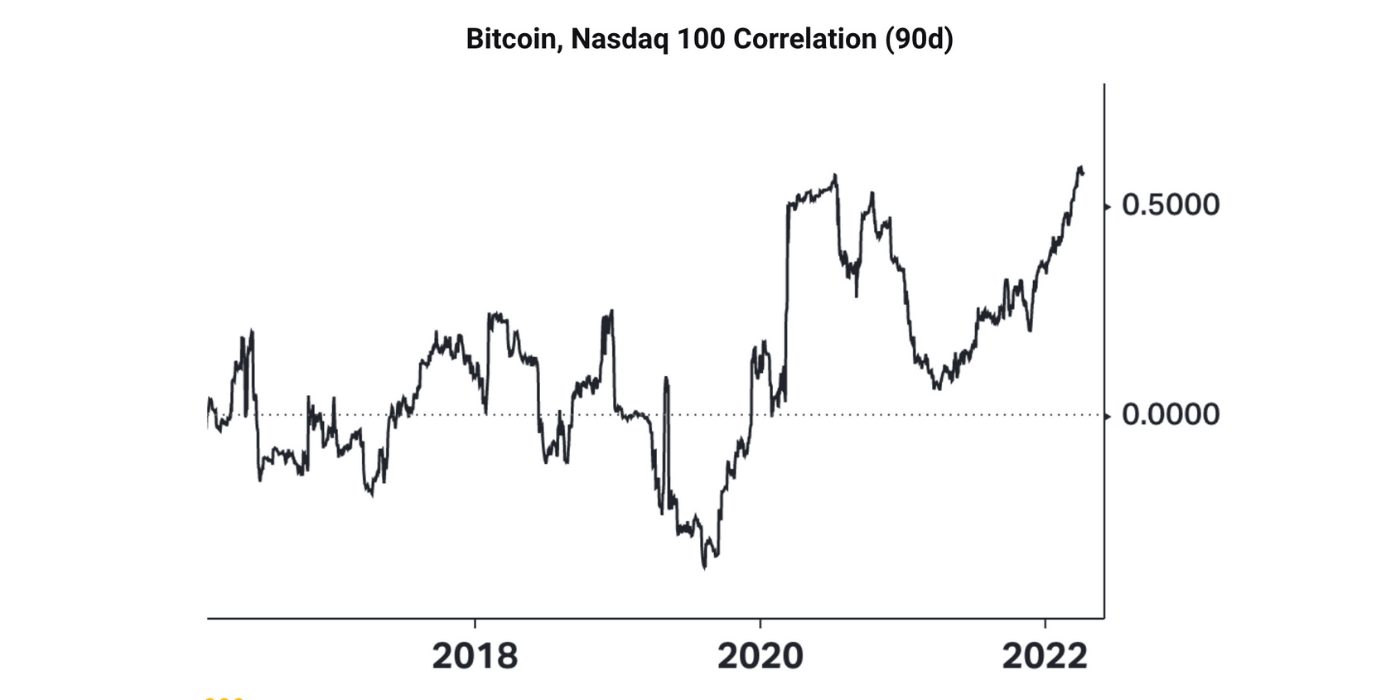

The drop, likely a result of the US Federal Reserve’s announcement to increase interest rates by 50 basis points, has undone the brief rebound period Bitcoin experienced after January’s dip.

Bitcoin’s outflow from the week prior has been the highest since June 2021, totalling over US$133 million. This seemed to be the result of institutional investors pulling their assets from the Bitcoin ETF, thus pushing BTC down 50 percent from its 2021 all-time high and causing panic globally:

However, the panic isn’t all doom and gloom, with experts suggesting the industry bubble is finally ready to pop and that there is room for optimism in the reboot. Crypto is prone to macroeconomic shock, and these strong crashes and booms are nothing the industry hasn’t encountered before.

Crypto Market Plunge

Bitcoin isn’t the only player in the industry that’s seen large decreases in value since January’s stock market sell-off. Last month saw US$250 billion wiped from the crypto market as a whole, due to leveraged liquidations and market fear. At the time Bitcoin dropped below US$40,000, and the overall crypto market tumble marked the industry’s worst day of trade since March 2020.