In a clear signal to younger ratepayers, former businessman and current mayor of Australia’s City of Gold Coast, Tom Tate, has suggested that in the future the municipality may consider the possibility of rates being paid with cryptocurrency:

The news may be somewhat bittersweet as council prepares to deliver its annual budget, where residents are expecting a rates rise of at least four percent, the highest increase in over a decade.

Speaking to ABC News about his plans, Mayor Tate commented: “It sends a signal that we’re innovative and bring[ing] in the younger generation … [but] I’m not saying we’re doing it, I’m just saying we’re always looking at the next level.”

Welcomed by Industry

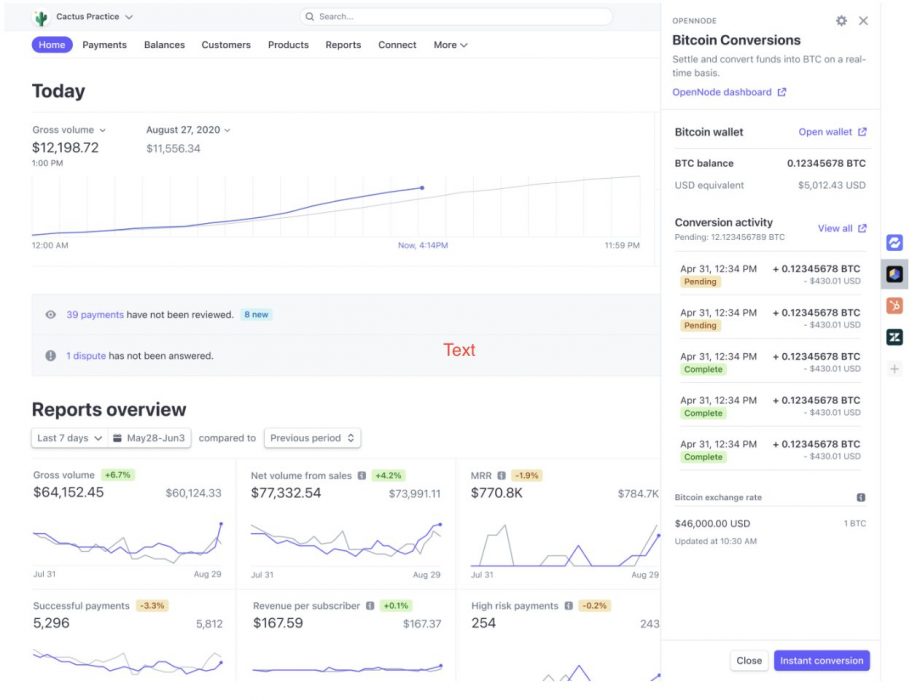

Blockchain Australia welcomed the news, with its chair Adam Poulton saying that crypto was “just another form of money” with an exchange rate linked to the Australian dollar. In outlining the mechanics, he added that with a “little bit of software, some applications, you can accept bitcoin as payment”.

Speaking to a possible implementation, Poulton commented:

They can choose to receive that bitcoin and hold it themselves, or they can actually exchange that bitcoin into Australian dollars, referencing that exchange rate, and have those Australian dollars turn up in their bank account.

Adam Poulton, chair, Blockchain Australia

However, he did add that, given the innate volatility of the asset class, “the council would need to look at [its] risk appetite”, adding “the last thing they’d want to do is accept A$2,000 worth of rates, hold it in bitcoin and for the bitcoin price to halve”. In addition, “the other risk is the bitcoin could go up in value and they’ll actually have three or four thousand dollars”.

One possible solution was that council could accept 95 percent of a rates bill in Australian dollars, with the balance in crypto. In this sense, the council could hold the crypto and in the future determine what use cases it may have.

‘Education Needed’

Not everyone was entirely enthusiastic. Associate Professor Vallipuram Muthukkumarasamy from Griffith University’s School of Information and Communication Technology said that despite crypto going mainstream, it remained a “speculative investment”.

Muthukkumarasamy suggested that more research and education would be required in order for crypto to reach the point of “taking over”, as has been envisioned since 2015: “A lot of learning needs to happen and the confidence building needs to happen with that.”

Even though it has “a lot of opportunity”, he added that the practicalities of implementing it were challenging, especially when it comes to large bureaucracies such as government. It would require, in his view, a “paradigm shift”.

Whatever one’s thoughts about Mayor Tate’s plans or intentions, one thing that can’t be disputed is that he appears to be making the types of noises younger Australian ratepayers want to hear.

While controversial to some, his plans are certainly not as radical as the city of Lugano in Switzerland where bitcoin is “de facto legal tender”, or in El Salvador, where Bitcoin bonds are being issued to build an entirely new city.