A new game being developed on Solana called ‘MonkeyBall’ has caused mayhem as angry investors take to Twitter to voice their concerns about the project.

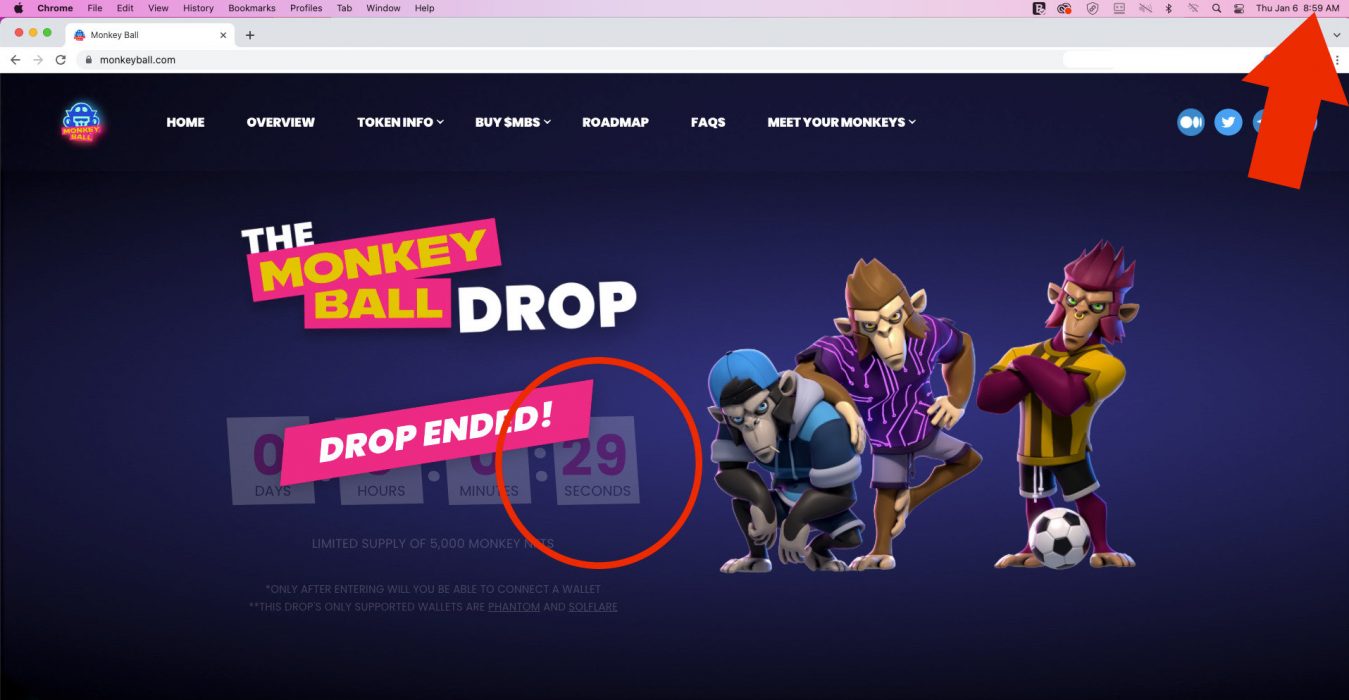

The project was aiming to drop 5,000 Monkey NFTs on its website on January 7 at 12am AEST. But the launch countdown timer on the website didn’t even finish before a message popped up saying “drop ended”, leaving many users disappointed and angry.

Some users were persistently refreshing the web page, even hundreds of times, and a few were able to create a 2 SOL transaction to mint an NFT. However, the SOL was sent to MonkeyBall but no NFT was returned appearing in the wallet, leaving investors out of pocket.

The subdomain used for the drop (monkeydrop2022.monkeyball.com) did appear in the DNS a few minutes before the official countdown ended, which hackers could have used to exploit the drop and execute mint transactions to chew up the supply.

Failed Token Launch, Failed NFT Drop and Broken Promises

The MonkeyBall team also muted the Discord and Telegram communities throughout the drop, leaving users in the dark as to what was actually going on.

Some YouTubers did some investigative work to try to find out what happened. They revealed several flaws in the drop, including coding errors, bot prevention flaws and whitelist logic ambiguities.

Token Launch IDO Mayhem

This failed NFT drop comes after the project had previously promised the $MBS token launch on Starlaunch IDO, which after investors had put their money in was suddenly delayed without notice, leaving unanswered questions about the project’s integrity.

Starlaunch used Fractal to process the KYC for the MonkeyBall IDO, which experienced some problems, allowing investors to put money into the launchpad – even though they were not eligible to participate from their location – leaving a lot of investors angry and out of pocket.

Was Solana to Blame for the Failed Drop?

The MonkeyBall team has blamed Solana for the failed drop but investors are not buying it, as it appears the Solana blockchain was working fine at the time of mint:

That said, there have been some problems with the network lately after Solana suffered DDOS attacks on January 4, and it did have some downtime.

SOL users have expressed their outrage on Twitter and Reddit. One Redditor, angry for the constant delay, claimed that Solana Status was lying to its users, insisting the network had been working “completely fine” and that the delay problems might be related to slow internet connections.

Is MonkeyBall a Rug Pull?

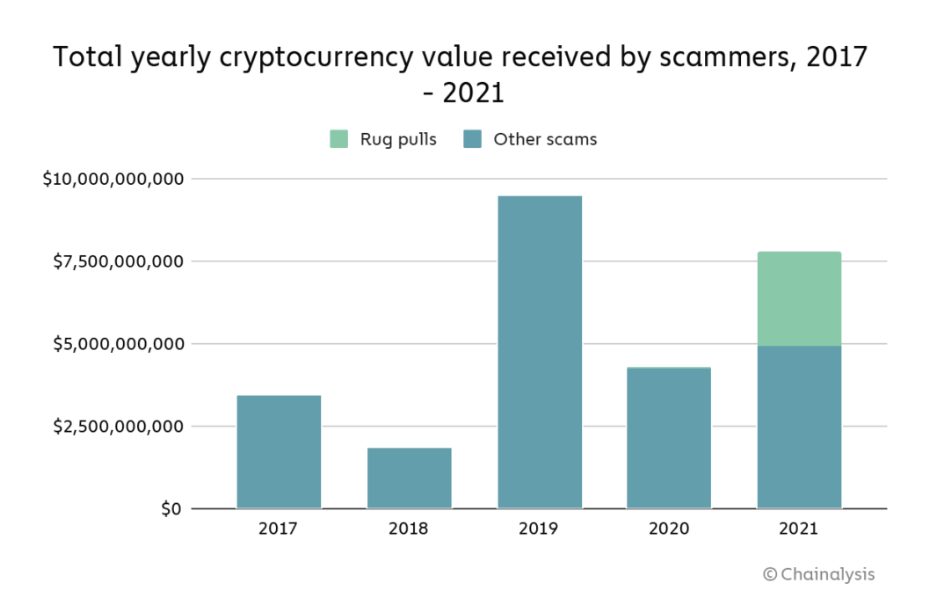

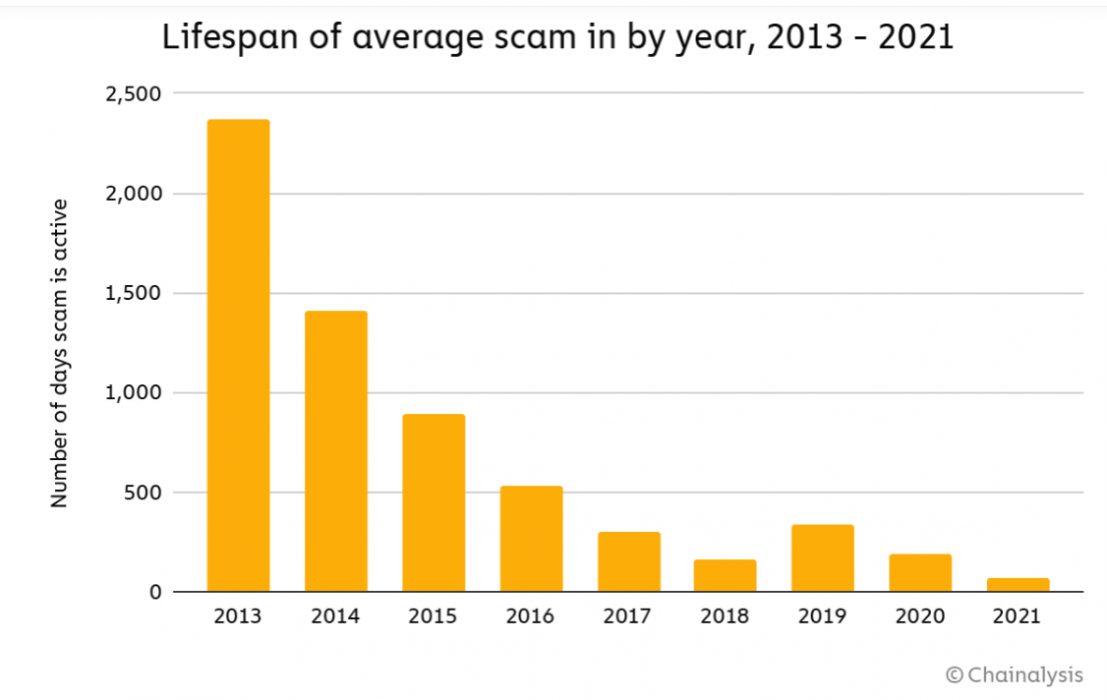

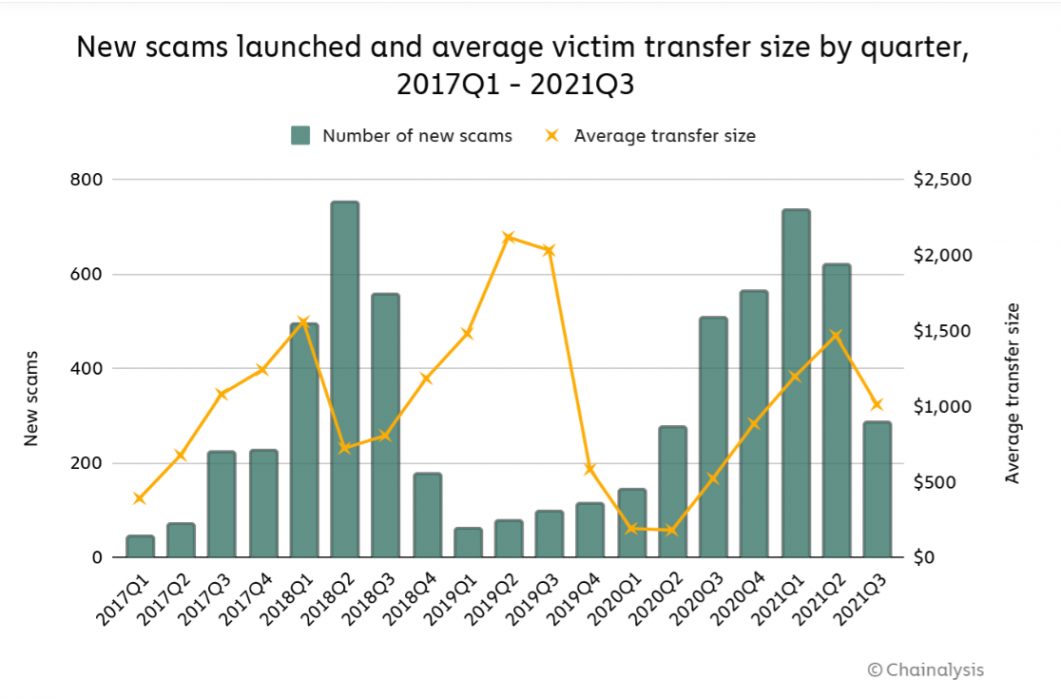

Crypto News Australia has reported on a lot of scams in 2021 including countless rug pulls from NFT projects, to mention but a few recent Solana-related examples:

- SolGame NFT Rug Pull, Website and Social Media Shut Down

- Rug Pull: ‘Monkey Jizz’ DeFi Token Founders’ Alleged Exit with $300,000 of BNB

- Solana NFT Project Accused of Rug Pull After Lil Uzi Deletes Tweets

While it cannot be proved that MonkeyBall is a rug pull, we encourage investors to be cautious and take note of the red flags that have appeared. We’ve reached out to the MonkeyBall team to get some comments on this.

If you want to find out more, check out these resources: