It’s official, Elon Musk has bought Twitter for US$44 billion and will be taking the social media giant private. Despite various blue check Twitter accounts decrying the move as “dangerous for democracy”, Musk himself has signalled that freedom of speech will reign supreme in the online town square:

An Offer Too Good to Refuse

Under the agreement, shareholders will receive US$54.20 per share, a 38 percent premium on the company’s closing share price as of April 1, which was the last trading day before Musk disclosed his approximately 9 percent stake in Twitter.

The transaction, expected to close later this year, was financed with both debt (US$25.5 billion) and equity (US$21 billion). After initially electing to invoke a “poison pill”, thereby diluting his holdings, Musk responded with a new filing with the Securities and Exchange Commission (SEC).

At the time, Musk said:

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy. However, since making my investment I now realise the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

Elon Musk

Recognising their responsibility to shareholders, the board of directors was ultimately left with little choice but to accept the offer. Bret Taylor, Twitter’s independent board chair, said:

The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.

Bret Taylor, independent board chair, Twitter

Musk’s Priorities

While some users will be pleased to hear that Musk intends to introduce a much-needed edit button, much of the focus was on freedom of speech: “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” Musk said.

He added: “I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it.”

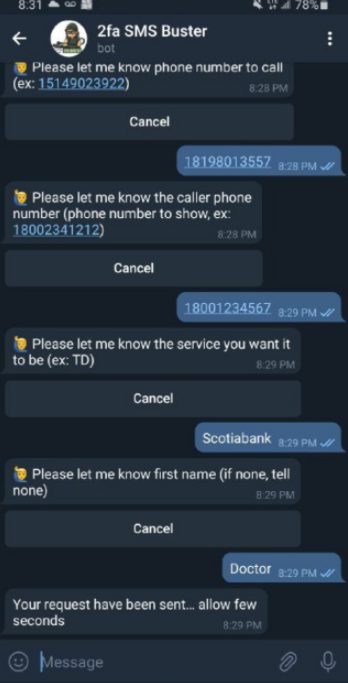

Musk provided some additional context at TED 2022, highlighting it was a priority to eliminate the spam bots, which are particularly rife in the crypto industry:

One potential avenue for doing so could be to implement Michael Saylor’s suggestion of integrating the Lightning Network to make the cost of spam and scams economically unfeasible.

In order to engage, users would require an “orange tick”, which they could obtain by posting satoshis as collateral. Any breach of the rules would then result in a ban and loss of the collateral. Saylor outlined this in a recent interview, saying it could put an end to cyber attacks:

The Twitter user experience has undoubtedly been negatively impacted through censorship and the proliferation of spam bots. Hopefully, Musk will be a better custodian of the digital town square than his Silicon Valley predecessors. Initial signs are good.