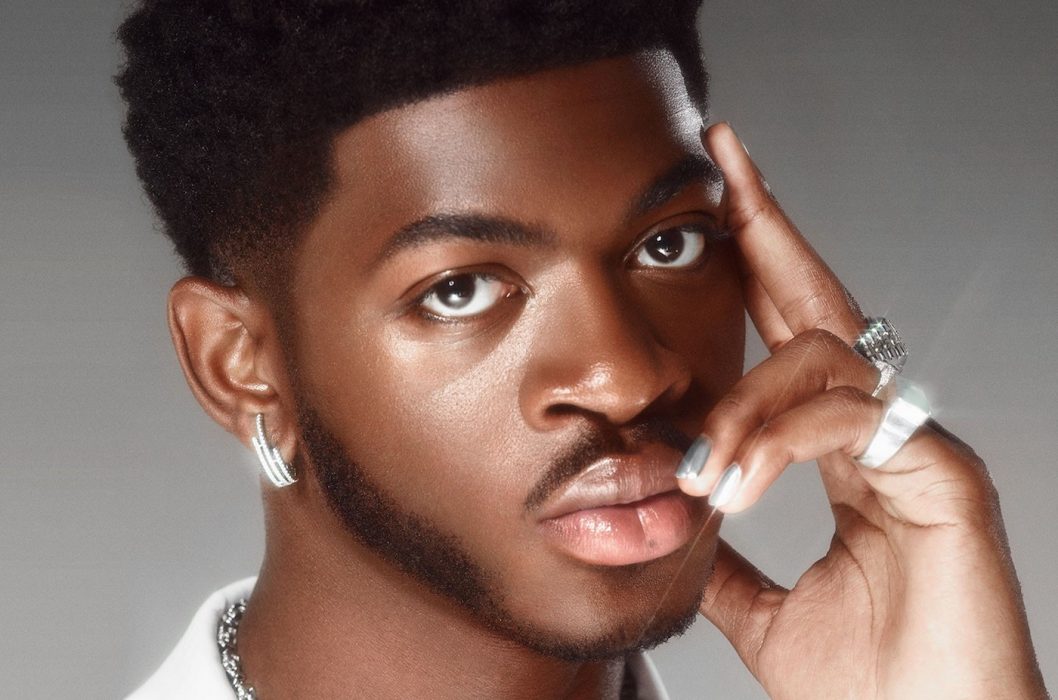

TikTok is set to release a series of NFT collectibles with celebrity partners including American rapper Lil Nas X, Canadian musician/producer Grimes and NFT entrepreneur Gary ‘Vee’ Vaynerchuk.

TikTok Passes One Billion Active Users

The hugely popular Chinese video-sharing and social media app, which now boasts more than one billion monthly active users worldwide, will issue six different NFT drops based on what it terms “culturally significant” videos shared on the service.

The TikTok Top Moments collection kicks off on October 6 with Lil Nas X as the subject of the first drop, with an NFT based on a TikTok video by Seattle-based artist Rudy Willingham. The video, a stop-motion tribute to the rapper’s Montero (Call Me By Your Name) music video, has already garnered millions of interactions via the service.

Subsequent ‘Moments’ in the collection will feature Gary Vee, social media personality Bella Poarch, and musician Grimes, who in March this year sold her crypto art NFT collection for US$6 million.

TikTok will offer both one-off and larger “limited edition” runs of its NFT collectibles. Other artists in the pipeline include Brittany Broski (aka Kombucha Girl), rappers Curtis Roach and FNMeka, and TikTok video regular Jess Marciante.

TikTok plans to showcase all six of its one-off videos at the Museum of the Moving Image in Queens, New York, this month.

NFTs Minted on Immutable X

The NFTs will be minted on Immutable X, a layer-2 scaling solution that runs on top of Ethereum. Immutable X attracts lower transaction fees and faster completion times than Ethereum’s mainnet, plus it uses significantly less energy than Ethereum’s proof-of-work consensus model.

The first six months of 2021 have seen some US$2.5 billion worth of trading volume across the top NFT marketplaces. Since then, however, leading marketplace OpenSea has recorded more than US$3.4 billion in volume in August alone.

That same month, Audius, a music streaming platform on the Ethereum and Solana blockchains, partnered with TikTok to create TikTok Sounds. As a result, the $AUDIO token surged 200 percent.

All very ironic when you consider that just a month earlier, TikTok banned its users from promoting crypto-related financial products and services and also prohibited ads relating to crypto.