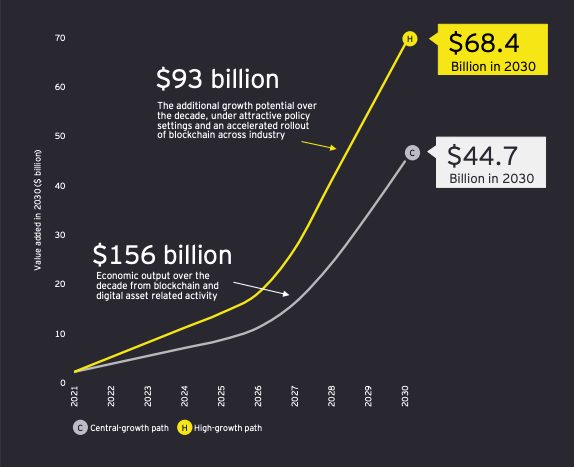

An analysis by global consulting firm EY (formerly Ernst & Young), commissioned by digital asset management company Mawson, has found the economic value of Australia’s cryptocurrency ecosystem could grow to A$68.4 billion by 2030 and employ around 206,000 workers.

The Cryptocurrency and the distributed digital economy in Australia report, released on December 10, says that unlocking the value of the digital assets market – which covers crypto, stablecoins, NFTs, DeFi, Web 3.0 and DAOs – requires “attractive” policy settings to be put in place to drive innovation.

“The magnitude of the economic benefits will depend on the speed and scale of uptake and the transformational potential of technology across different industries,” the report states.

Digital Asset Ecosystem Set For 30x Expansion

The report puts the current value of Australia’s digital asset ecosystem at A$2.1 billion. It argues that enabling an increase of more than 30 times the sector’s value in the next decade rests on:

- fit-for-purpose regulatory systems that provide greater business certainty;

- upskilling the nation’s workforce, including skilled migration; and

- more certainty around tax settings related to digital assets and the way they are transacted.

Under the right reform and growth conditions, the report predicts the cryptocurrency and digital asset economy could:

- grow in value by more than 50 percent each year;

- add up to A$250 billion to the national economy over the next decade, reaching a value of A$68.4 billion in 2030;

- eclipse the economic contribution of Australia’s tourism, agriculture and energy industries;

- generate more than A$2.8 billion in high-value exports by 2030 and

- create thousands of digital jobs across various industries, including more than 200,000 employed in 2030 and cumulatively more than 765,000 full-time roles over the next decade.

Report Responds to Australian Senate’s Crypto Recommendations

In a statement announcing the report’s release, CEO and founder of Mawson, James Manning, said the analysis was commissioned in response to the Senate Committee report, Australia as a Financial and Technology Centre Final Report.

“We are at a crossroads. As an industry, we desperately need a fit-for-purpose policy and regulatory framework to provide greater security and certainty to consumers and the crypto industry,” Manning said. He added:

The Bragg Report recommendations, in particular, represent a significant coming together of industry, regulators and government. [Those] recommendations, if adopted, will revolutionise the Australian crypto sector and improve consumer protection, therefore driving innovation, confidence and growth in the sector.

James Manning, CEO and founder of Mawson

Capitalising on the booming sector is clearly of interest to the Australian government. In November, in an address at the Australian Financial Review Super & Wealth Summit, Liberal Senator Jane Hume, the Minister for Superannuation, Financial Services and the Digital Economy, noted the importance of crypto and stressed the role of government in encouraging innovation.