Do Kwon, the CEO of Terraform Labs and the man behind the collapsed LUNA ecosystem, has denied a report from South Korean news outlet News1 claiming local prosecutors have frozen some of his crypto assets valued at 56.2 billion won (US$39.6 million).

In response to the report, Kwon tweeted that it’s a ‘falsehood’ and that he doesn’t have time to trade crypto.

Mounting Reports Matched by Kwon Denials

In his tweet Kwon also denied having accounts on the crypto exchanges KuCoin and OKX — this was a reference to his earlier denial of a September report that South Korean authorities had asked these exchanges to freeze 3,313 Bitcoin (BTC) linked to Kwon held on their platforms.

Just a day earlier, Bloomberg had reported that South Korean prosecutors were claiming that Interpol had issued a red notice for Kwon, meaning law enforcement organisations globally had been asked to locate and apprehend him if he attempts to cross national borders.

Yet more claims against Kwon were reported back in July, when he was accused of rug pulling LUNA holders by quietly cashing out US$80 million per month in the lead-up to the blockchain’s collapse.

Despite these mounting reports against him and the fact he appears to have gone into hiding, Kwon maintains his innocence and claims to be cooperating with authorities.

I am not “on the run” or anything similar – for any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide

— Do Kwon 🌕 (@stablekwon) September 17, 2022

Kwon Wanted in Relation to May LUNA Collapse

The legal troubles for Kwon stem from the spectacular collapse of the LUNA ecosystem in May 2022 in which the algorithmic stablecoin UST lost its peg with the US dollar, falling to virtually zero and taking down its sister token LUNA with it.

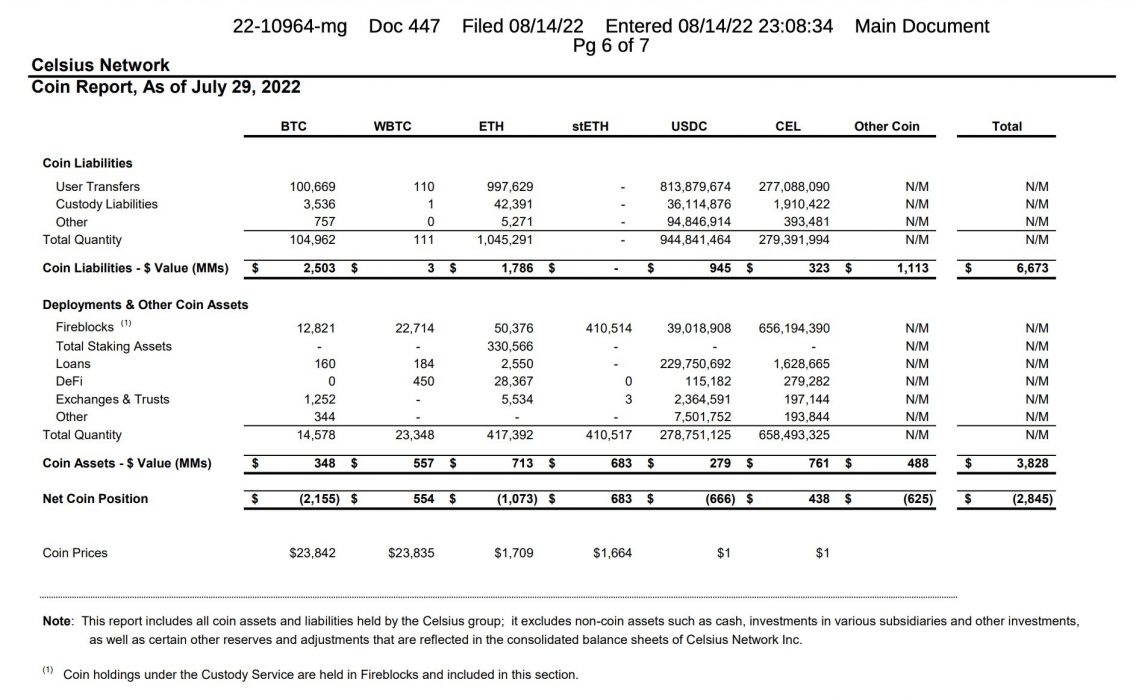

This collapse wiped out around US$26 billion of investor value, triggered the collapse of Three Arrows Capital, contributed to the bankruptcy of crypto lenders Voyager and Celsius, and plunged the entire crypto market into a deep winter from which it is yet to emerge.

For his part in LUNA’s collapse, Kwon is now wanted by South Korean authorities for numerous crimes, including breaching the country’s capital-market laws.