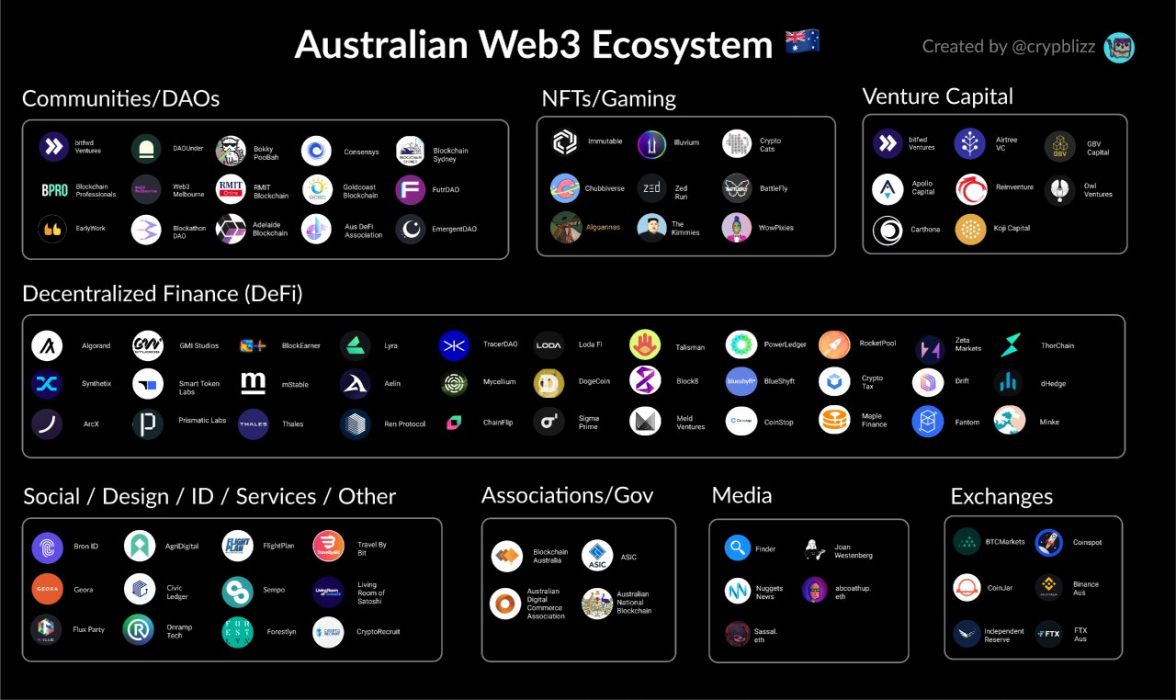

The Australian Securities and Investment Commission (ASIC) has released a document outlining which financial influencers may be in breach of the law. The move is being met with contention by many of these so-called “finfluencers”:

Digital Assets Are ‘Financial Products’: Senator

Finfluencers have the capability to offer incorrect, or unwise, financial information or products to their followers, either intentionally or accidentally. Some of the points on this guidance note include ensuring finfluencers are properly licensed to deal in a financial product or provide advice on a product, along with managing content to ensure it is accurate and balanced.

While the guide does not explicitly mention the crypto industry and its advisers and influencers, as crypto is counted as “investing services”, the rules still apply. This is backed up by pro-crypto NSW Senator Andrew Bragg.

ASIC’s current policy applies the law to crypto to the extent that digital assets fall within the definition of a financial product.

Australian NSW Liberal Senator Andrew Bragg

The move from ASIC is being heavily critiqued online by several financial influencers, with many suggesting the guide is all-encompassing in the sense that almost anything in the way of advice could still influence someone to invest.

The tighter regulations will come with penalties of up to five years’ jail for individuals and extreme fines for corporations.

ASIC Cautions Investors and Exchanges

ASIC has issued finfluencer warnings in the past, with the commission last year urging young investors in particular to be cautious. ASIC has stated that while using social media is a viable means of collecting background information on a topic, such info may be unlicensed and inaccurate.

More recently, ASIC has issued a warning aimed at crypto companies, informing them that they should expect tighter regulations in the future with the aim of pulling the crypto industry into line with traditional financial industries.