Aussies lost more than A$2 billion to scams in 2021, including losses of A$84 million due to scammers seeking payment with cryptocurrency, according to an Australian Competition and Consumer Commission (ACCC) report.

The ACCC’s annual report on scams published on July 4 found that investment scams increased by 135 percent in 2021 and caused the most financial harm, resulting in A$701 million lost by Australians.

This spike was driven specifically by crypto investment scams, which led to Aussie investors reporting losses of A$99 million – 270 percent higher than the previous year.

The report tallies losses based on consumer reports shared with Scamwatch, ReportCyber, and 12 financial institutions and government agencies.

Common Types of Crypto Scams Aussies Fall For

Some of the most common ways scammers exploited Aussies’ interest in crypto to steal their hard-earned money include:

- fake investment and crypto trading platforms, which sometimes mimic legitimate, well-known websites;

- sales of fake crypto wallets;

- tricking people into revealing their seed phrase for an existing wallet; and

- offers to “help” people get set up on a crypto platform by remotely accessing their computer.

Scammers typically contacted victims by phone, or through social media and websites. Crypto investment scams affected all age groups but people aged 65 years and over lost the most money (A$26.5 million).

Combating Crypto Scams Requires ‘Urgent Work’

In her foreword to the report, ACCC deputy chair Delia Rickard suggests urgent work is needed to combat crypto investment scams:

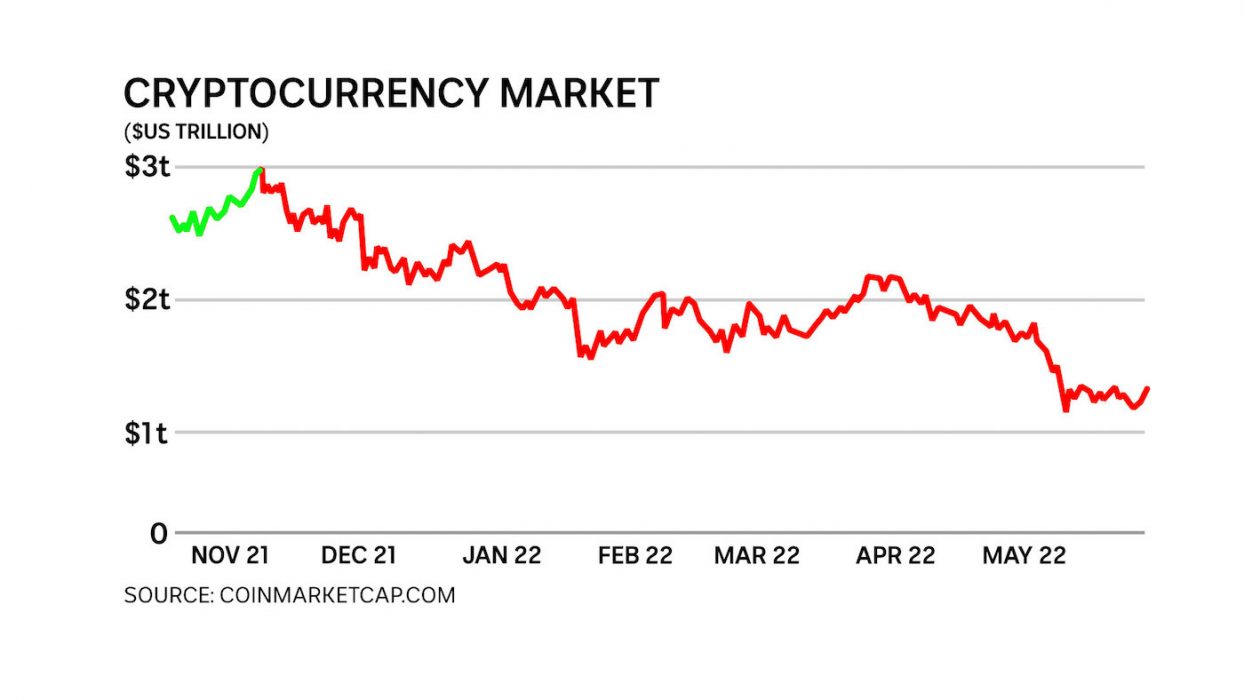

The popularity and hype of cryptocurrency has led to a surge in losses to investment scams with combined losses of $701 million. At the same time, it is also becoming the preferred method of payment across all types of scams.

Delia Rickard, deputy chair, ACCC

While bank transfers remained the most common way scammers requested payment from victims in 2021, requests for cryptocurrency increased dramatically – up 216 percent. Earlier this year, the ACCC revealed crypto had surpassed bank transfers as scammers’ preferred payment method.

Rickard also expressed her hope that government efforts towards licensing digital currency exchanges and custody requirements for crypto assets would slow the growth of crypto scams. Consumer groups have also called for Australia’s new Labor government to protect crypto investors through more stringent regulation.