A Terra whistleblower has taken to Twitter to rubbish claims by founder Do Kwon that the newly launched Terra 2.0 network is “community-owned”, accusing Kwon and his company, Terraform Labs (TFL), of holding substantial amounts of LUNA 2.0 in what he (the whistleblower) calls “shadow wallets”:

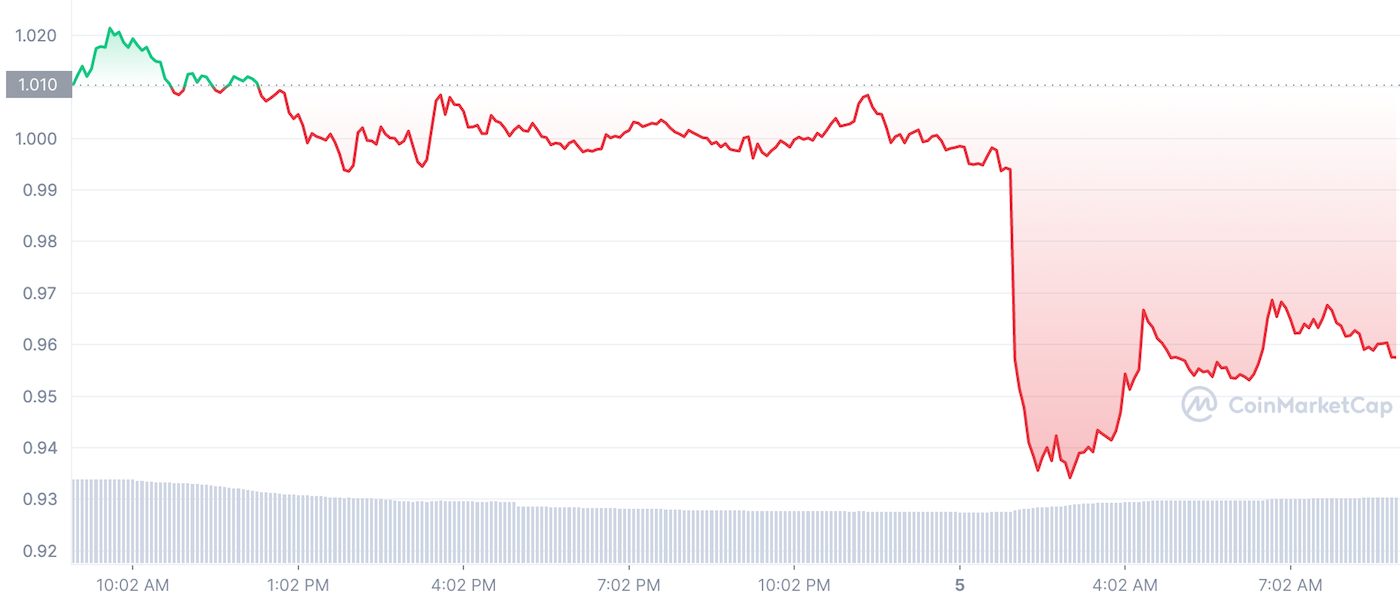

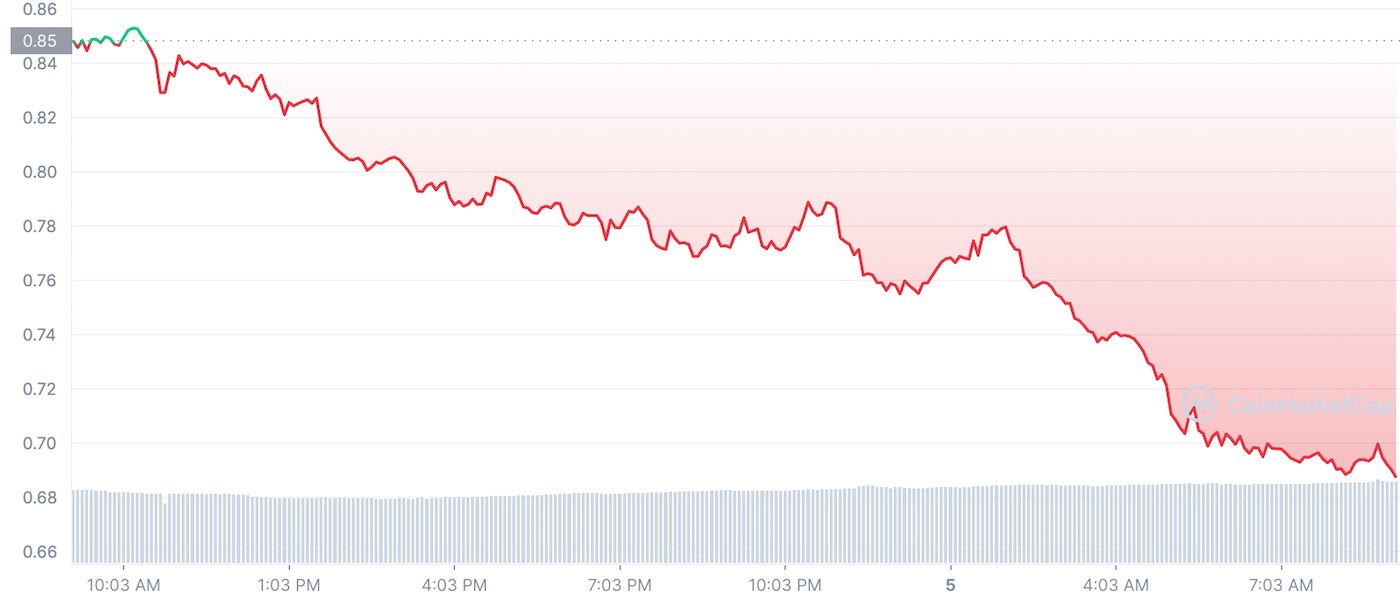

These accusations follow a rough week for LUNA 2.0 in which it lost over 50 percent of its value. At the time of writing, CoinGecko shows LUNA 2.0 valued at US$4.59, down from its recent high on May 31 of US$10.24, a drop of 56 percent in seven days.

Accusation of Shadow Wallets

The accusations of TFL holding secret stashes of LUNA come from Twitter user and prominent Terra critic FatMan. On June 6, FatMan posted a Twitter thread laying out his evidence that TFL and Kwon secretly hold large quantities of LUNA. FatMan listed several Terra accounts linked to TFL and Kwon which collectively hold approximately 42 million LUNA, currently valued at around US$200 million:

TFL Dawn (11.28M): https://t.co/67XVH8t50D

— FatMan (@FatManTerra) June 6, 2022

TFL shadow wallet (2.01M): https://t.co/k5k3g02LP2

TFL MM (0.72M): https://t.co/16CqyPcUL4

Do Kwon shadow wallet #1 (19.69M): https://t.co/kfFx1ck8gR

Do Kwon shadow wallet #2 (9.11M): https://t.co/pevv1xT0yR

Total: 42.81M LUNA (2/6)

This is a serious accusation as Kwon has repeatedly insisted the newly launched Terra blockchain is community owned and controlled. According to FatMan, his evidence shows this claim is not true, tweeting:

“Do Kwon has stated numerous times that TFL has zero new LUNA tokens, making Terra 2 ‘community-owned’. This is an outright lie that nobody seems to be talking about. In fact, TFL owns 42M LUNA, worth over $200m, and they’re lying through their teeth.”

Claims Secret Holdings Used to Manipulate Governance

FatMan further claimed that Kwon used his LUNA holdings to influence governance of the new blockchain and approve his own proposal, claiming in another tweet:

“Do [Kwon] used his shadow wallet to approve *his own proposal* through governance manipulation (TFL is not supposed to vote), told everyone it would be a community-owned chain, and then gave himself a nine-figure score. These are just the verified wallets – there are many others.”

Terra 2.0 Dogged by Issues

Most responses to FatMan’s thread expressed concern about the alleged dishonesty and called for Kwon to be held accountable:

And the man hides his tweets. Cannot make this up. Git em!!!

— CryptoEdgeHunter (@CryptoEdgeHuntr) June 6, 2022

@stablekwon wen jail

— ihor.eth 🇺🇦 (@ihorbond) June 6, 2022

However, some users also questioned the significance of these allegations and accused FatMan of conspiratorial thinking:

I already replied to this. But to let your followers know you’re a conspiracy theorist: Do and other ppl owned Luna in personal wallets. Do stated that TFL is here only to develop Terra and employees should have their own personal wallet if they want. 1/2

— REX 🌕 (@REX_LUNATIC_) June 6, 2022

Terra 2.0 was launched in late May following the collapse of the original Terra ecosystem. Since its launch the new blockchain has struggled, losing almost 80 percent of its value immediately after going live and continuing to be dogged by accusations of shady practices.