Active types can now get paid to exercise and breathe in the fresh outdoor air with new Australian fitness app STEPN – an NFT-based play-to-move Web3 crypto “game” powered by the Solana blockchain.

Following in the footsteps of Genopets – the first move-to-earn NFT crypto game developed on Solana – STEPN is basically a mash-up of Apple’s step-counting Health app with Axie Infinity-style play-to-earn (P2E) tokenomics.

With over half a million downloads so far on Android alone, STEPN has taken off and so has its governance token, $GMT.

STEPN’s Green Metaverse Token (GMT) has sprinted upwards, increasing five-fold in value over the past month, from US$0.65 to an all-time high of US$3.79. $GMT is the token required for making upgrades to the App’s in-game NFT virtual sneakers. GMT’s market cap is now over US$2 billion and the token is currently ranked #60.

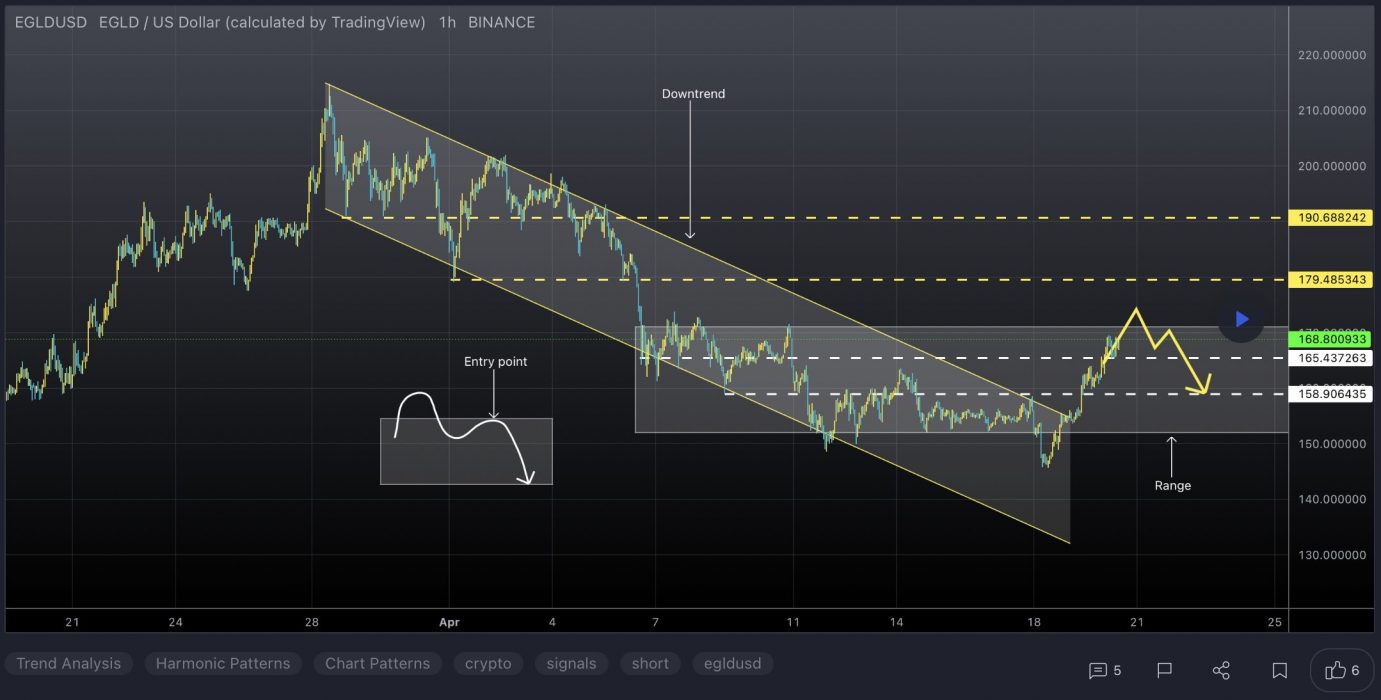

STEPN price chart (GMT). Source: CoinGecko.com

The most recent 26 percent spike came after STEPN announced a partnership with Japanese sports apparel giant Asics on April 18 via Twitter, launching a sneaker sale on the Binance NFT marketplace. Selected subscribers will be able to purchase the first STEPN sneakers on the BNB Chain version of the game:

Earn Crypto Exercising Outside

Users can earn crypto by walking or running with the STEPN App. The app tracks movement via your phone’s GPS and rewards are paid in STEPN’s game token: Green Satoshi Token (GST), which can be traded for USD Coin (USDC) or Solana (SOL).

Players begin by choosing a fitness level that suits their goals, which also determines how many tokens can be earned using the app. The four tiers are divided by different types of virtual sneakers: walker, jogger, runner or trainer. STEPN sneaker NFTs can be found and purchased from the in-app marketplace. Check the stepn.com website for full instructions on how to play.

Since the game has taken off, the price to get started playing has elevated accordingly. Currently the floor price for a pair of sneakers is 13.67 SOL (US$1,400+). Participants in the upcoming STEPN Shoebox sale on Binance will be offered mystery boxes containing a pair of NFT Sneakers of random quality and type, for 0.5 BNB (US$210).

STEPN plans to implement a sneaker-rental feature, coming soon to combat the high cost to entry.

How to Start STEPN

- Download the app from the App store (available for Android and Apple) and log in with your email address and verification code.

- Get verified. Join the official Discord and Telegram channels and get your activation code to enter the app on your phone. Note: due to popular demand, the development team is only releasing 1000 activation codes per day via Discord and 1000 per day via Telegram. You have to be quick, as codes refresh at midnight AEDT. You can also follow @Stepnofficial on Twitter for more activation code releases.

- Link your Solana wallet in the STEPN app and purchase your first pair of virtual sneakers from the STEPN marketplace. Sneakers can be customised and enhanced to increase token rewards.

STEPN buzz continues to gain traction amid rumours of further upcoming partnership announcements with other big shoe brands, including Nike and Adidas. Since the STEPN token sale in March, the app is off to a flying start, but it’s a marathon, not a sprint. Whether the move-to-earn model can prove sustainable over time will be the real test, but for now STEPN is showing no signs of slowing down.