Ever since its founder went to ground nine weeks ago amid wild rumours of fraud, scams, misappropriated funds and leveraged loans, Alex Saunders’ crypto media channel Nugget’s News has also gone quiet. Turns out there’s been a discreet rebranding, with a new title reflecting exactly how that happened: by means of a collective shift.

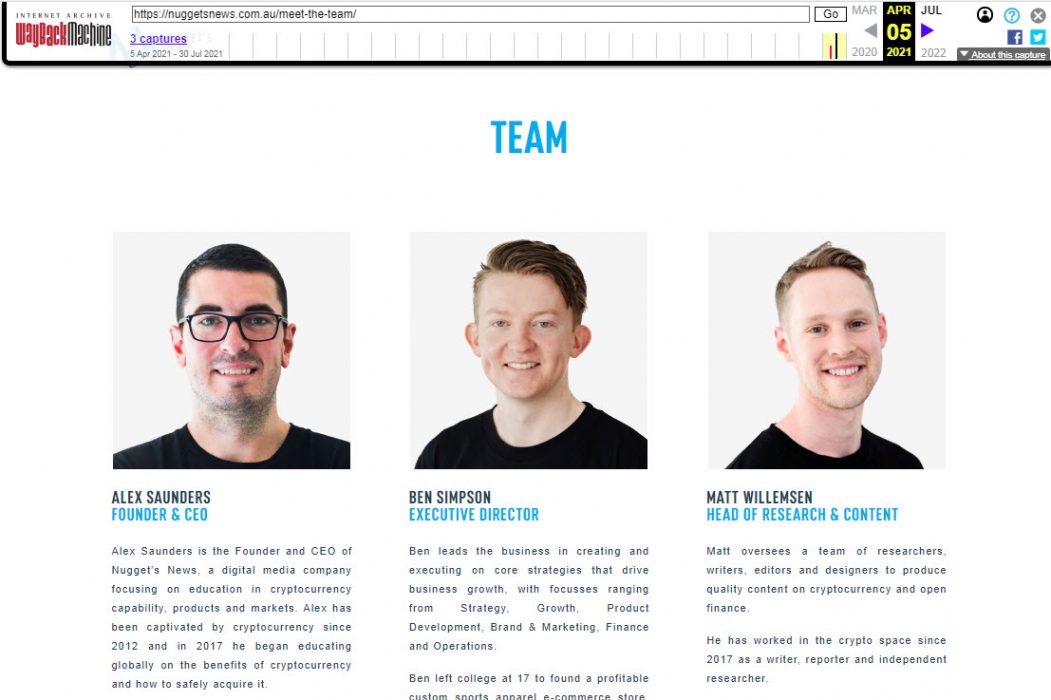

The staff of so-named “global news platform” Collective Shift, headed up by 22-year-old Tasmanian Ben Simpson, is essentially the same team behind Nugget’s News. Simpson himself is the former executive director of Nugget’s News, Matt Willemsen reprises his role as head of content, while fellow Collective Shift staffers Megan Steicke (marketing), Nicholas Sciberras (research), Mark Drever (design) and Sarah Petty (editor) are also ex-Nugget’s team members.

Conspicuous in his absence, of course, is Alex Saunders, who in July figuratively vanished in the face of a Twitter storm alleging he had defaulted on personal loans extended to him by crypto investors, with the amount subsequently lost said to run “to eight figures”.

A Tale of Two Tasmanians

Like Saunders, Simpson is a relentless self-promoter. And in contrast to the recent low profile of his fellow Tasmanian, the former high-school dropout has made a point of thrusting himself into the public eye. Just this week, Simpson was the subject of a news.com.au report in which he boasted of making A$2 million a year in revenue from “a lucrative business idea that provides real-time research analysis and market updates on cryptocurrency”.

In the article Simpson claims “more than 3500 members” have signed up to Collective Shift, and that he employs “25 full-time and part-time staff”, many of whom formerly worked at Nugget’s News.

Reaction from the crypto community to the news.com.au report was swift, with many in the Twittersphere making pointed allegations to its author, Alex Turner-Cohen, regarding Simpson’s former colleague. Here’s one example:

ASIC Investigation Confirms Link

Australian Securities and Investments Commission (ASIC) documents show that up until June 22, Simpson was a director and shareholder in Nugget’s News before resigning and selling his shares to Saunders. On June 11 Simpson had registered his own company, Collective Shift, which took over the Nugget’s News business assets and intellectual property, including team, content, branding and communications. Subscribers were not advised of the change in ownership, though the Nugget’s branding had already begun to transition to Collective Shift.

ASIC frowns on the practice of companies re-branding under a new name, claiming ownership of assets of the prior company but not its creditors and liabilities. Directors have a responsibility to know what is going on within a company and can be held personally liable for any unlawful behaviour. Even claiming to have no knowledge does not absolve them from liability.

Simpson Downplays Saunders Connection

Simpson has distanced himself from his former close colleague, saying he confronted Saunders about the public allegations against him. “He looked at me straight in the eye and said, ‘don’t worry about, like, you know, there’s a couple of people I owe money [to], I am on repayment plans, don’t worry about it’,” Simpson said in a video statement to subscribers in his new venture.

Collective Shift is an independent entity and has had no involvement with any projects undertaken by Alex Saunders.

Ben Simpson, managing director, Collective Shift

Simpson has told the ABC that Saunders was not a shareholder in Collective Shift and was “no longer” a content contributor. He also told the Australian Financial Review that Collective Shift staff had no part in any of Saunders’ personal affairs. Saunders, however, openly stated in a YouTube interview in June with Uncommon’s Jordan Michaelides that “all of our research can be found at collectiveshift.com.au”.

Saunders has maintained his silence about all allegations of fraud and failure to repay loans. In August, New Zealand investor Ziv Himmelfarb filed a lawsuit against Saunders for defaulted loans totalling almost half a million dollars.

Crypto News Australia approached Simpson for comment regarding this story but he declined.

Investors Should Proceed with Caution

With claims that millions have been lost through the Nugget’s News fiasco, investors should proceed with caution when investing with largely unregulated crypto projects.