Following last month’s record-breaking hack of the Ronin network, responsible for Axie Infinity transactions, Binance has led a funding round to help reimburse affected users.

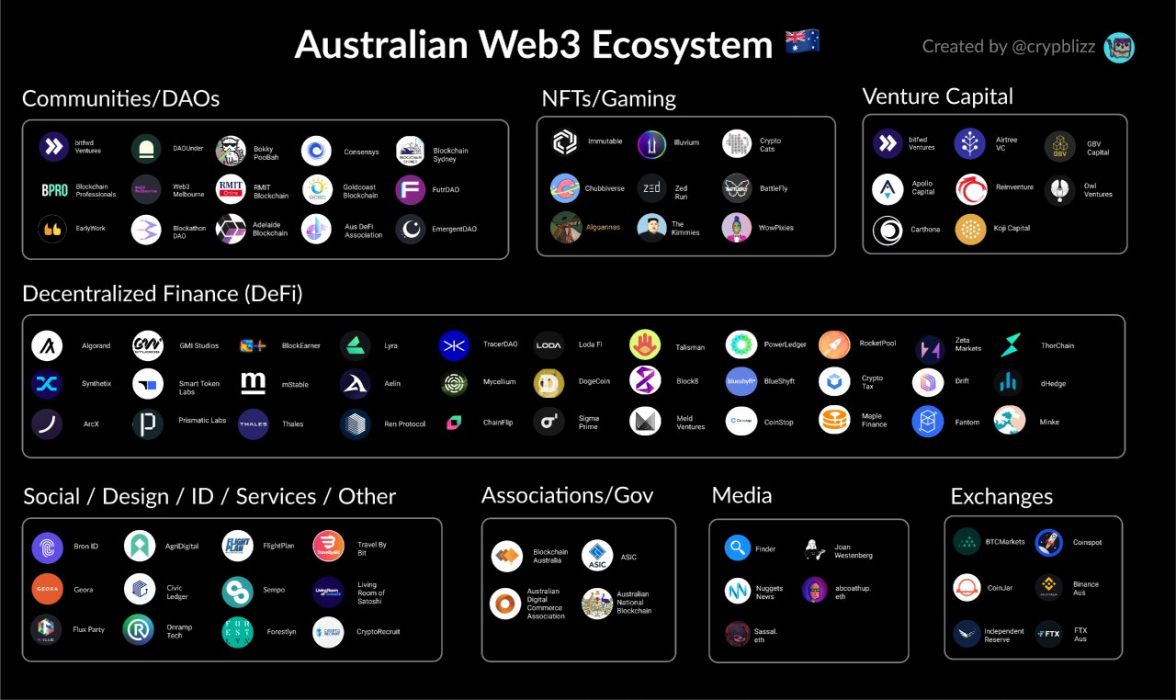

According to an announcement this week by Vietnamese gaming studio Sky Mavis, a funding round was led by Binance with other venture capital firms – including Animoca Brands, a16z, Dialectic, and Paradigm – to help reimburse funds lost in the US$625 million Axie Infinity hack.

Community to the Rescue

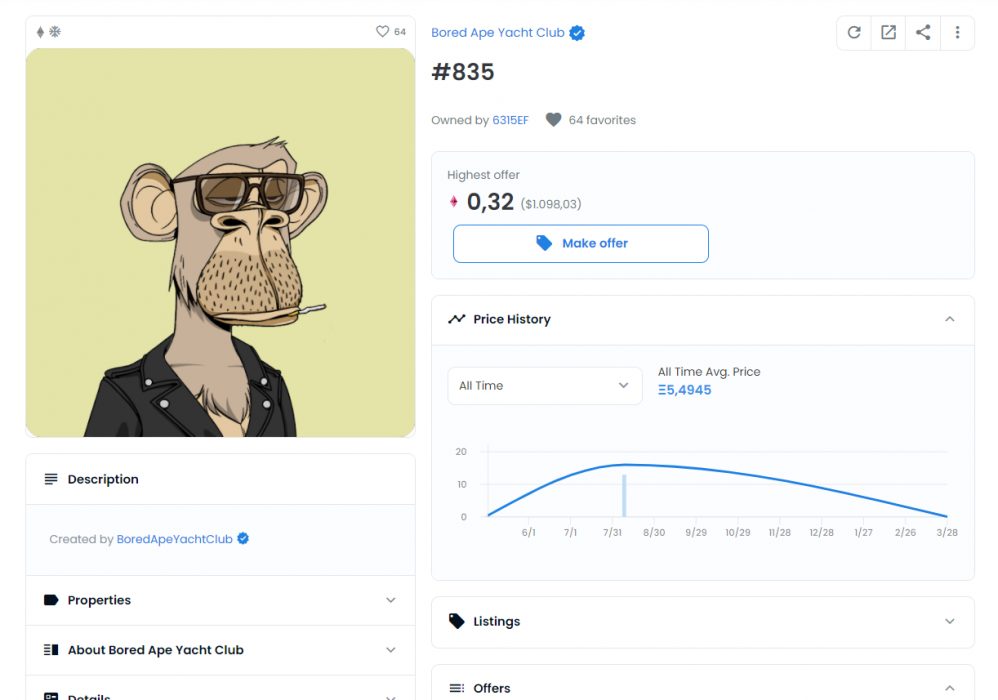

The hack is the biggest decentralised finance (DeFi) hack on record and has done a lot of damage to the Axie Infinity ecosystem Sky Mavis has created. Axie is the best performing blockchain game in the space, having processed 10 times more all-time volume than the next biggest NFT game.

We have seen the tremendous work and growth of the Sky Mavis team since working together on the Axie Infinity project on Binance Launchpad. We strongly believe Sky Mavis will bring a lot of value and growth for the larger industry and we believe it’s necessary to support them as they work hard to resolve the recent incident.

Changpeng “CZ” Zhao, CEO, Binance

Proceeds of the funding round along with funds on the Sky Mavis balance sheet will be used to ensure that all affected users are reimbursed. According to the post, “The Ronin Network bridge will open once it has undergone a security upgrade and several audits, which can take several weeks.”

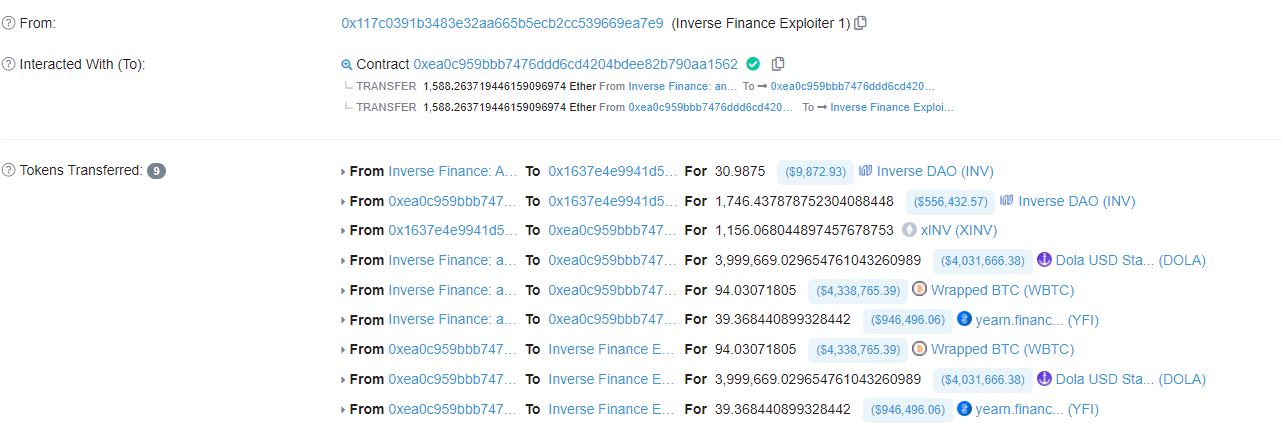

The post also stated that “the 56,000 ETH compromised from the Axie DAO treasury will remain undercollateralised as Sky Mavis continues to work with law enforcement to recover the funds”.

If the funds are not fully recovered within two years, it has been decided that the Axie DAO will vote on the next steps for the treasury.

Sky Mavis post

Increasing Ronin’s Security

Following the attack, Sky Mavis started the process of implementing rigorous internal security measures to prevent future attacks.

On March 23, Sky Mavis’s Ronin validator nodes and Axie DAO validator nodes were compromised, leading to the record-breaking hack. With the support of Binance, the Ronin chain has now been able to expand its validator set from 5 to 21 – increasing the security of the network – according to Sky Mavis CEO Trung Nguyen.

There have been only a few cases where affected users were reimbursed, especially in a case as large as this. With Axie being the biggest NFT game, major players have come together to help the project get back on its feet. Last year, Rari Capital also reimbursed up to US$25 million after being hacked.